PREC14A: Preliminary proxy statement in connection with contested solicitations

Published on May 2, 2018

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant o | ||

|

Filed by a Party other than the Registrant ý |

||

Check the appropriate box: |

||

|

ý |

Preliminary Proxy Statement |

|

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

o |

Definitive Proxy Statement |

|

|

o |

Definitive Additional Materials |

|

|

o |

Soliciting Material under §240.14a-12 |

|

| SJW Group | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

California Water Service Group |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

|

ý |

No fee required. |

|||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) |

Title of each class of securities to which transaction applies: |

|||

| (2) |

Aggregate number of securities to which transaction applies: |

|||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) |

Proposed maximum aggregate value of transaction: |

|||

| (5) |

Total fee paid: |

|||

|

o |

Fee paid previously with preliminary materials. |

|||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

| (2) |

Form, Schedule or Registration Statement No.: |

|||

| (3) |

Filing Party: |

|||

| (4) |

Date Filed: |

|||

PRELIMINARY COPYSUBJECT TO COMPLETION, DATED MAY 2, 2018

SPECIAL MEETING OF STOCKHOLDERS

OF

SJW GROUP

TO BE HELD ON · , 2018

PROXY STATEMENT

OF

CALIFORNIA WATER SERVICE GROUP

SOLICITATION OF PROXIES IN OPPOSITION TO THE PROPOSED

MERGER OF SJW GROUP AND CONNECTICUT WATER SERVICE, INC.

This Proxy Statement (this "Proxy Statement") and the enclosed WHITE proxy card are furnished by California Water Service Group, a Delaware corporation ("California Water," "we" or "us") in connection with California Water's solicitation of proxies to be used at the special meeting of stockholders of SJW Group, a Delaware corporation ("SJW"), to be held on · , 2018, at · at · , and at any adjournments or postponements thereof (the "Special Meeting"). SJW has set · , 2018 as the record date for determining those SJW stockholders who will be entitled to vote at the Special Meeting (the "Record Date").

On March 14, 2018, SJW entered into a merger agreement (the "CTWS Merger Agreement") with Connecticut Water Service, Inc. ("CTWS"), pursuant to which SJW would acquire CTWS in an all-stock transaction (the "Proposed CTWS Merger"). Completion of the Proposed CTWS Merger requires that SJW stockholders approve (1) a proposal to issue shares of SJW common stock to CTWS shareholders pursuant to the Proposed CTWS Merger (the "Share Issuance Proposal") and (2) a proposal to adopt an amendment to the SJW certificate of incorporation in connection with the closing of the Proposed CTWS Merger (the "Certificate Amendment Proposal"). SJW intends to submit each of the two proposals to an SJW stockholder vote at the Special Meeting. Also at the Special Meeting, SJW will submit to a stockholder vote a proposal to adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve the Share Issuance Proposal or the Certificate Amendment Proposal (the "Adjournment Proposal"). The Share Issuance Proposal, the Certificate Amendment Proposal and the Adjournment Proposal are intended to facilitate completion of the Proposed CTWS Merger, and in this Proxy Statement we refer to all three proposals collectively as the "SJW Proposals."

As further described in this Proxy Statement, California Water has submitted an all-cash proposal to acquire SJW for $68.25 per share, conditioned on termination of the Proposed CTWS Merger (the "California Water Acquisition Proposal"). The Board of Directors and management of SJW have failed to engage with us regarding our acquisition proposal. Therefore, we are soliciting proxies from SJW stockholders to vote "AGAINST" the SJW Proposals.

WE ARE NOT ASKING YOU TO VOTE ON OR APPROVE THE CALIFORNIA WATER ACQUISITION PROPOSAL AT THIS TIME. HOWEVER, WE BELIEVE THAT A VOTE "AGAINST" THE SJW PROPOSALS WILL SEND A MESSAGE TO THE SJW BOARD THAT THE SJW BOARD SHOULD GIVE PROPER CONSIDERATION TO OTHER OFFERS THAT IT RECEIVES, INCLUDING THE CALIFORNIA WATER ACQUISITION PROPOSAL. A VOTE AGAINST THE SJW PROPOSALS WILL NOT OBLIGATE YOU TO VOTE FOR THE CALIFORNIA WATER ACQUISITION PROPOSAL IN THE FUTURE. THERE CAN BE NO ASSURANCE THAT THE CALIFORNIA WATER ACQUISITION PROPOSAL WILL BE CONSUMMATED IF THE SJW PROPOSALS ARE REJECTED BY SJW STOCKHOLDERS.

The principal executive offices of SJW are located at 110 West Taylor Street, San Jose, California 95110, United States. This Proxy Statement and the enclosed WHITE proxy card are first being mailed to SJW stockholders on or about · , 2018.

If you need assistance in voting your shares, please contact the firm assisting California Water in this solicitation:

Innisfree

M&A Incorporated

Stockholders May Call Toll Free: (888) 750-5834

Banks and Brokers May Call Collect: (212) 750-5833

REASONS TO VOTE "AGAINST" THE SJW PROPOSALS

California Water urges all SJW stockholders to vote "AGAINST" each of the Share Issuance Proposal, the Certificate Amendment Proposal and the Adjournment Proposal for the following reasons:

-

- A rejection of the SJW Proposals by SJW stockholders at the Special Meeting preserves their opportunity to receive the consideration contemplated by the California Water Acquisition Proposal which, if consummated, in our view provides superior economics to SJW stockholders as compared to the Proposed CTWS Merger.

We believe that the California Water Acquisition Proposal, if consummated, would be economically superior to the Proposed CTWS Merger for SJW stockholders because it would provide SJW stockholders an opportunity to receive a significant premium for their shares of common stock of SJW ("SJW Shares"). In that regard, the California Water Acquisition Proposal to acquire SJW for $68.25 per SJW Share in cash:

-

-

exceeds SJW's all-time high closing price of $68.13 as of November 30, 2017;

-

-

represents a 30% premium to the $52.41 closing price of the SJW Shares on April 3, 2018, the day prior to California Water's

April 4, 2018 proposal; and

-

- represents a 20% premium to the $56.90 closing price of the SJW Shares on April 25, 2018, the last trading day prior to the public announcement of the California Water Acquisition Proposal.

In contrast, if the Proposed CTWS Merger is completed, the SJW stockholders will retain their SJW Shares and receive no premium, while paying CTWS shareholders a premium of 18% (based on the relative closing price of SJW and CTWS shares on the last trading day prior to the announcement of the Proposed CTWS Merger).

Information with respect to the range of closing prices for the SJW Shares, which are traded on the New York Stock Exchange ("NYSE"), for certain dates and periods is set forth in the preliminary joint proxy statement/prospectus included in the registration statement on Form S-4 filed by SJW (the "SJW/CTWS Proxy Statement") with the United States Securities and Exchange Commission (the "SEC") on April 25, 2018. California Water urges SJW stockholders to obtain a current market quotation for the SJW Shares.

-

- Rejection of the SJW Proposals by SJW stockholders at the Special Meeting stops the SJW Board's attempt to proceed with a transaction that California Water believes is an inferior transaction.

We believe that the Proposed CTWS Merger is an inferior transaction, as compared to the California Acquisition Proposal, because among other things:

-

-

If the Proposed CTWS Merger is completed, SJW stockholders would be forced to wait for uncertain economic benefits that

would not fully accrue until the long term, while bearing the substantial execution risks associated with operating two separate businesses located 3,000 miles apart in

different regulatory environments.

-

- Following completion of the Proposed CTWS Merger, SJW would be led by a Board and CEO who in our view are largely unfamiliar with the San Jose community and the unique challenges of running a California-based water utility. Six out of 12 directors for the new SJW/CTWS Board would come from CTWSfive are current CTWS directors and the sixth is SJW's Chief Executive Officer, Eric Thornburg, who ran CTWS for more than 11 years, until last September 2017.

1

-

-

The path to completion is uncertain given that a third party, Eversource Energy, has submitted

a proposal to acquire CTWS and is soliciting proxies from CTWS shareholders to vote against the Proposed CTWS Merger. Since the Proposed CTWS Merger requires the approval of holders of two-thirds of

the outstanding CTWS common shares, we believe that the Eversource Energy proposal and solicitation creates a high degree of uncertainty around the completion of the Proposed CTWS Merger.

-

- The Proposed CTWS Merger requires regulatory approvals in both Connecticut and Maine. We believe that regulators in these two states have no formal relationships with SJW given SJW's lack of operations in either state, which could delay the timely receipt of requisite approvals in one or both jurisdictions.

USE YOUR WHITE PROXY CARD TO VOTE "AGAINST" EACH OF THE SHARE ISSUANCE PROPOSAL, THE CERTIFICATE AMENDMENT PROPOSAL AND THE ADJOURNMENT PROPOSAL TODAY BY INTERNET OR TELEPHONE OR BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED. A VOTE AGAINST THE SHARE ISSUANCE PROPOSAL, THE CERTIFICATE AMENDMENT PROPOSAL AND THE ADJOURNMENT PROPOSAL WILL NOT OBLIGATE YOU TO VOTE FOR THE CALIFORNIA WATER ACQUISITION PROPOSAL IN THE FUTURE. THERE CAN BE NO ASSURANCE THAT THE CALIFORNIA WATER ACQUISITION PROPOSAL WILL BE CONSUMMATED IF THE SJW PROPOSALS ARE REJECTED BY SJW STOCKHOLDERS.

IF YOUR SJW SHARES ARE HELD IN "STREET-NAME," DELIVER THE ENCLOSED WHITE VOTING INSTRUCTION FORM TO YOUR BROKER OR BANK OR CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT TO VOTE ON YOUR BEHALF AND TO ENSURE THAT A WHITE PROXY CARD IS SUBMITTED ON YOUR BEHALF. IF YOUR BROKER OR BANK OR CONTACT PERSON RESPONSIBLE FOR YOUR ACCOUNT PROVIDES FOR VOTING INSTRUCTIONS TO BE DELIVERED TO THEM BY INTERNET OR TELEPHONE, INSTRUCTIONS WILL BE INCLUDED ON THE ENCLOSED WHITE VOTING INSTRUCTION FORM.

DO NOT RETURN ANY PROXY CARD THAT YOU RECEIVE FROM SJWEVEN AS A PROTEST VOTE AGAINST THE PROPOSED CTWS MERGER. EVEN IF YOU HAVE PREVIOUSLY SUBMITTED A PROXY CARD FURNISHED BY SJW, IT IS NOT TOO LATE TO CHANGE YOUR VOTE BY INTERNET OR TELEPHONE OR BY SIMPLY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD TODAY.

VOTE "AGAINST" THE SHARE ISSUANCE PROPOSAL, THE ADJOURNMENT PROPOSAL AND THE CERTIFICATE AMENDMENT PROPOSAL TODAY.

2

BACKGROUND OF THE SOLICITATION

California Water's Board of Directors continuously explores all available avenues for profitable growth, including evaluating opportunities for strategic acquisitions. In connection with such strategic evaluation, California Water has numerous times over many years proposed to SJW that SJW and California Water engage in discussions regarding a potential business combination transaction. SJW has declined to engage in such discussions.

During August 2017, Martin Kropelnicki, the CEO of California Water, talked with W. Richard Roth, the then-President, Chief Executive Officer ("CEO") and Chairman of the Board of SJW, to discuss a possible merger of the companies. Mr. Roth advised California Water to direct its inquiries to Daniel More of the SJW Board of Directors.

On September 18, 2017, California Water privately submitted a written non-binding proposal to the SJW Board of Directors (the "SJW Board") to acquire 100% of the issued and outstanding SJW Shares for a 25% to 30% premium to SJW's then-current share price in cash and/or California Water common shares, at the election of SJW stockholders. At the close of business on September 18, 2017, the closing price of SJW Shares was $56.54 per share.

On September 28, 2017, SJW announced that it had appointed Eric Thornburg, the then-CEO of CTWS, to serve as president and CEO of SJW, effective as of November 6, 2017.

On October 26, 2017, Mr. More sent a response e-mail to a representative of California Water's financial advisor that indicated that the SJW Board had unanimously decided that California Water's September 18, 2017 proposal was not in the best interests of SJW's stockholders, and the SJW Board was not going to pursue California Water's proposal at that time.

On March 15, 2018, SJW and CTWS announced that they had entered into the CTWS Merger Agreement.

On April 4, 2018, California Water privately submitted a written all-cash proposal to the SJW Board to acquire 100% of the issued and outstanding SJW Shares for $68.25 per share.

On April 16, 2018, Peter Nelson, Chairman of the Board of Directors of California Water, called Robert Van Valer, lead independent director of SJW, to follow up regarding California Water's April 4, 2018 proposal. Mr. Nelson left a message at Mr. Van Valer's office requesting a call back.

On April 17, 2018, California Water delivered a private letter to SJW that noted California Water's surprise that it had not received a response from the SJW Board to California Water's April 4, 2018 proposal.

On April 18, 2018, Mr. Van Valer sent an e-mail to Mr. Nelson assuring Mr. Nelson that SJW Group would be back in touch regarding California Water's proposal "in due course."

On the morning of April 25, 2018, SJW held its annual meeting of stockholders to elect all eight members of its Board of Directors. Later that day after the close of business, SJW filed the SJW/CTWS Proxy Statement with the SEC. The SJW/CTWS Proxy Statement disclosed for the first time that the SJW Board had already met on April 13, 2018 and voted at that time to reject California Water's April 4, 2018 all-cash proposal and had also determined that it neither constituted nor was reasonably likely to lead to a superior proposal as defined in the CTWS Merger Agreement. The SJW/CTWS Proxy Statement referred to California Water as "Company X.".

Concurrent with the filing of the SJW/CTWS Proxy Statement, SJW delivered to California Water a private letter communicating the SJW Board's April 13, 2018 determinations. Shortly thereafter, on the evening of April 25, 2018, press reports surfaced indicating that California Water was "Company X."

3

On the morning of April 26, 2018, before the opening of the market, California Water issued a press release confirming that it had previously delivered to SJW an all-cash proposal to acquire SJW for $68.25 per share. Concurrent with the issuance of the press release, California Water delivered to SJW a letter reiterating its $68.25 all-cash proposal. A copy of the letter was included in California Water's press release.

Later in the morning of April 26, 2018, SJW issued a press release reaffirming its rejection of California Water's $68.25 per share all-cash proposal. The press release included a copy of the letter delivered by SJW to California Water the prior evening.

On May 2, 2018, California Water filed this Proxy Statement with the SEC with respect to soliciting votes against the Share Issuance Proposal, the Certificate Amendment Proposal and the Adjournment Proposal.

4

CERTAIN INFORMATION CONCERNING THE CALIFORNIA WATER ACQUISITION PROPOSAL

California Water has proposed to acquire SJW for $68.25 per share in an all-cash transaction. The proposal, which we refer to in this Proxy Statement as the California Water Acquisition Proposal, is conditioned on termination of the existing merger transaction with CTWS, completion by California Water of confirmatory due diligence of SJW, and finalizing definitive transaction documents between California Water and SJW. We believe that with the cooperation of the SJW Board, we can complete such confirmatory due diligence and the negotiation of definitive transaction documents within two weeks. We are confident in our ability to finance this transaction, and any definitive transaction documentation will not include a financing condition.

The SJW Board has taken the position that the California Water Acquisition Proposal does not constitute a superior proposal and is not reasonably likely to lead to a superior proposal under the terms of its existing merger agreement with CTWS, such that SJW purports to be contractually constrained from engaging in discussions with California Water. We disagree with that conclusion given the economic terms of our proposal, which represented a 30% premium to SJW's share price at the time of California Water's April 4, 2018 proposal, and represents a 20% premium to SJW's closing stock price the day prior to our public announcement of our proposal. In that regard, we believe that the SJW Board has sufficient flexibility under the terms of its merger agreement with CTWS to immediately engage with us in good faith discussions regarding the merits of our proposal.

If the SJW Board concludes our proposal is a "superior proposal" and it then proceeds to terminate the CTWS Merger Agreement to enter into a definitive transaction agreement with California Water, CTWS may be entitled to a termination fee from SJW in an amount of $42.5 million.

Required Regulatory Approvals

Completion of the acquisition of SJW by California Water would be subject to the following regulatory approvals, which we believe we can timely obtain:

-

-

The California Public Utilities Code requires California Public Utilities Commission ("CPUC")

approval before a utility may sell the whole of its system, and before any person shall "merge, acquire, or control either directly or indirectly any public utility organized and doing business" in

California. Both California Water and SJW would jointly file an application for the acquisition. The CPUC will review the transaction to determine whether the transaction will be "adverse to the

public interest."

-

-

Because SJW is the parent of a Texas water utility ("SJWTX"), approval of the Texas Public

Utilities Commission ("TPUC")will also be required . The Texas Codes require TPUC approval of any "sale, transfer, merger, consolidation, acquisition,

lease, or rental" of a water utility.

-

-

Under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the "HSR Act"),

California Water and SJW would need to file notifications with the United States Federal Trade Commission and the Antitrust Division of the United States Department of Justice and observe a mandatory

pre-acquisition waiting period before completing the acquisition.

-

- Under Federal Communications Commission ("FCC") regulations implementing provisions of the Communications Act of 1934, as amended, an entity holding private radio licenses for internal communications purposes generally must obtain the pre-approval of the FCC before the direct or indirect transfer of control or assignment of those licenses. If it is determined during our confirmatory due diligence of SJW that SJW holds FCC licenses for private internal communications, then SJW will have to obtain prior FCC approval to assign or transfer indirect control of those licenses.

5

CERTAIN INFORMATION CONCERNING THE PROPOSED CTWS MERGER

At the Special Meeting, SJW stockholders of record at the close of business on the Record Date will be voting on, among other things, whether to approve the Share Issuance Proposal and the Certificate Amendment Proposal in connection with the closing of the Proposed CTWS Merger. According to the SJW/CTWS Proxy Statement, under the terms of the CTWS Merger Agreement, each share of common stock, without par value, of CTWS (each, a "CTWS Common Share"), other than CTWS Common Shares directly or indirectly owned by SJW, Hydro Sub, Inc., a direct wholly owned subsidiary of SJW ("Merger Sub"), CTWS or any of their respective subsidiaries (in each case, other than any CTWS Common Shares held on behalf of third parties), will be converted into the right to receive 1.1375 SJW Shares. SJW stockholders would continue to retain their shares after the Proposed CTWS Merger. According to the SJW/CTWS Proxy Statement, as a result of the Proposed CTWS Merger, SJW stockholders would own approximately 60% of the combined company.

Closing Conditions

According to the SJW/CTWS Proxy Statement, each party's obligations to consummate the Proposed CTWS Merger is conditioned upon the satisfaction (or waiver by such party) at or prior to the closing of the Proposed CTWS Merger of each of the following:

-

-

approval of the merger agreement by CTWS shareholders;

-

-

approval of the Share Issuance Proposal by SJW stockholders;

-

-

approval of the Certificate Amendment Proposal by SJW stockholders;

-

-

filing with and acceptance by the Secretary of State of the State of Delaware of the SJW certificate of incorporation amendment;

-

-

approval of the listing on the NYSE of the shares of SJW common stock to be issued to CTWS shareholders pursuant to the merger, subject to

official notice of issuance;

-

-

any required approvals (as listed below) having been obtained and having become final orders (as to which all conditions, not within the

control of SJW or CTWS, to the consummation of such transactions prescribed by applicable law or order have been satisfied) and any waiting period having expired or been terminated, and that do not

impose terms or conditions that are materially adverse to CTWS, SJW, or CTWS and SJW as a combined company ("Combined SJW"), in each case, taken as a

whole (and in the case of SJW and Combined SJW, the materiality assessed for an equivalent entity of the size and scale of CTWS);

-

-

the expiration or earlier termination of the waiting period applicable to the completion of the merger and the other transactions

contemplated by the merger agreement under the HSR Act. SJW and CTWS announced on April 30, 2018 that the Federal Trade Commission has granted early termination of the waiting period under the

HSR Act;

-

-

any pre-approvals of license transfers by the FCC;

-

-

consents required by the Connecticut Public Utilities Regulatory Authority; and

-

-

consents required by the Maine Public Utilities Commission;

-

-

absence of any statute, law, ordinance, rule, regulation, binding legal requirement, judgment, order or decree by any court, tribunal or other

governmental entity of appropriate jurisdiction that seeks to make illegal or prohibit the consummation of the merger, the SJW certificate of incorporation amendment or the other transactions

contemplated by the merger agreement; and

-

- effectiveness of the SJW/CTWS Proxy Statement and the absence of a stop order or proceedings initiated and not subsequently withdrawn by the SEC for that purpose.

6

According to the SJW/CTWS Proxy Statement, the obligations of each of SJW and Merger Sub, on the one hand, and CTWS, on the other hand, to effect the merger is subject to the satisfaction or waiver of each of the following additional conditions:

-

-

the representations and warranties of the other party (other than the representations and warranties related to (i) the shares of

capital stock issued and outstanding or reserved for issuance, (ii) the absence of any outstanding voting debt interests, (iii) the authority with respect to the execution, delivery, and

performance of the merger agreement and the due and valid authorization and enforceability of the merger agreement, (iv) the fees payable to a financial advisor, broker or finder in connection

with the transactions under the merger agreement and (v) solely in the case of SJW and Merger Sub, the sole purpose of and lack of business engagement by Merger Sub) will be true and correct

(without giving effect to any materiality or material adverse effect qualifications contained in such representations and warranties) as of the closing date of the merger (except to the extent such

representations or warranties are expressly made as of an earlier date, which need only be true and correct as of such earlier date), except to the extent that any failures of such representations and

warranties to be so true and correct, individually or in the aggregate, have not had and would not reasonably be expected to have a material adverse effect;

-

-

the representations and warranties of the other party relating to (i) the absence of any outstanding voting debt interests,

(ii) the authority with respect to the execution, delivery, and performance of the merger agreement and the due and valid authorization and enforceability of the merger agreement and

(iii) the fees payable to a financial advisor, broker or finder in connection with the transactions under the merger agreement will be true and correct in all material respects as of the

closing date of the merger (except to the extent such representations or warranties address matters only as of an earlier date, which need only be true and correct as of such earlier date);

-

-

the representations and warranties of the other party relating to (i) the shares of capital stock issued and outstanding or reserved for

issuance and (ii) solely in the case of SJW and Merger Sub, the sole purpose of and lack of business engagement by Merger Sub, will be true and correct in all respects (except de minimis errors) as

of the closing date of the merger (except to the extent such representations or warranties are expressly made as of an earlier

date, which need only be true and correct as of such earlier date);

-

-

the other party having performed in all material respects all of its obligations under the merger agreement at or prior to the closing of the

merger;

-

-

receipt of a certificate executed by an executive officer of the other party certifying as to the satisfaction of the conditions described in

the preceding four bullet points;

-

-

no fact, circumstance, effect, change, event or development will have occurred that, individually or in the aggregate, has had or would

reasonably be expected to have a material adverse effect on the other party that has not been ameliorated or cured; and

-

- receipt of a legal opinion of such party's counsel (or such other nationally recognized tax counsel), dated as of the closing date of the merger, to the effect that the merger will qualify as a "reorganization" within the meaning of Section 368(a) of the U.S. Internal Revenue Code of 1986, as amended.

7

Termination

According to the SJW/CTWS Proxy Statement, the merger agreement may be terminated at any time prior to the effective time of the merger, before or after the receipt of the required SJW stockholder and CTWS shareholder approvals, under the following circumstances:

-

-

by mutual written consent of SJW and CTWS;

-

-

by either SJW or CTWS:

-

-

if the merger is not consummated on or before March 14, 2019, except if, as of 5:00 p.m., Pacific time, on

March 14, 2019, all the conditions to closing have been satisfied or waived, or will then be capable of being satisfied (other than the conditions related to required governmental approvals

having been obtained and having become final orders and those conditions that by their nature are to be satisfied at the closing of the merger), such date will be extended automatically to

June 14, 2019 (such date, as so extended, the "end date"); provided that the right to terminate the merger agreement under the provision described in this bullet will not be available to any

party if such failure of the merger to occur on or before the end date is the result of a material breach of any representation, warranty, covenant or agreement of the merger agreement by such party

(the "end-date termination provision");

-

-

if any law or final and non-appealable judgment, order or decree is issued, imposed or deemed applicable to the merger by any

governmental entity of competent jurisdiction which permanently prohibits or makes illegal the consummation of the merger, the SJW certificate of incorporation amendment or the other transactions

contemplated by the merger agreement; except that the right to terminate the merger agreement under the provision described in this bullet will not be available to any party if such failure of the

merger to be capable of being consummated is the result of the failure of such party to comply with the reasonable best efforts covenant under the merger agreement;

-

-

if SJW stockholders fail to approve either the Share Issuance Proposal or Certificate Amendment Proposal at the Special Meeting

(the "SJW stockholder approval failure termination provision"); or

-

-

if CTWS shareholders fail to approve the merger agreement at the CTWS shareholders meeting (or, if the CTWS shareholders meeting

has been adjourned or postponed, at the final adjournment or postponement thereof) (the "CTWS shareholder approval failure termination provision");

-

-

by SJW:

-

- if CTWS has breached or failed to perform any of its obligations under the merger agreement, or if any of its representations or warranties has failed to be true and correct, which breach or failure to perform (i) is not reasonably capable of being cured by CTWS by the end date, or is not cured by CTWS within the earlier of (x) 45 days after receiving written notice from SJW or (y) three business days prior to the end date and (ii) would give rise to the failure of certain closing conditions; provided that the right to terminate the merger agreement under the provision described in this bullet will not be available to SJW if SJW is then also in breach of any of its covenants or agreements, or if any of its representation or warranties has failed to be true and correct such as would give rise to the failure of certain closing conditions;

8

-

-

prior to the time that CTWS shareholders approve the merger agreement, if:

-

-

CTWS materially breaches any of its obligations described under "No Solicitation of Alternative Proposals" in the

SJW/CTWS Proxy Statement;

-

-

the CTWS board of directors has made an adverse recommendation change;

-

-

CTWS has failed to include, in this joint proxy statement/prospectus, the recommendation of its board of directors that CTWS

shareholders approve the merger agreement;

-

-

following the receipt of a takeover proposal with respect to CTWS, the CTWS board of directors has failed to publicly reaffirm its

recommendation of the merger agreement, the merger and the other transactions contemplated by the merger agreement within 10 business days after SJW reasonably requests in writing that such

recommendation be reaffirmed; or

-

-

a tender or exchange offer relating to any shares of CTWS common stock has been publicly commenced and CTWS has not, within 10

business days after the commencement thereof, recommended rejection of such tender or exchange offer and reaffirmed its recommendation of the merger agreement and the merger and the other transactions

contemplated by the merger agreement; or

-

-

prior to the time that SJW stockholders approve both the Share Issuance Proposal and Certificate Amendment Proposal, if SJW is not

in material breach of its obligations described under "No Solicitation of Alternative Proposals" in the SJW/CTWS Proxy Statement in order to accept a superior proposal with respect to SJW

and enter into an acquisition agreement related to such superior proposal, and SJW pays to CTWS a termination fee of $42.5 million pursuant to the terms of the merger agreement;

-

-

by CTWS:

-

-

if SJW or Merger Sub has breached or failed to perform any of its obligations under the merger agreement, or if any of their

respective representations or warranties has failed to be true and correct, which breach or failure to perform (i) is not reasonably capable of being cured by SJW or Merger Sub by the end date,

or is not cured by SJW or Merger Sub, as applicable, within the earlier of (x) 45 days after receiving written notice from CTWS or (y) three business days prior to the end date

and (ii) would give rise to the failure of certain closing conditions; provided that the right to terminate the merger agreement under the provision described in this bullet will not be

available to CTWS if CTWS is then also in breach of any of its covenants or agreements, or if any of its representation or warranties has failed to be true and correct such as would give rise to the

failure of certain closing conditions (the "SJW material breach termination provision");

-

-

prior to the time that SJW stockholders approve both the Share Issuance Proposal and Certificate Amendment Proposal,

if:

-

-

SJW materially breaches any of its obligations described under "No Solicitation of Alternative Proposals" in the

SJW/CTWS Proxy Statement;

-

-

the SJW board of directors has made an adverse recommendation change;

-

- SJW has failed to include, in the SJW/CTWS Proxy Statement, the recommendation of its board of directors that SJW stockholders approve both the Share Issuance Proposal and Certificate Amendment Proposal;

9

-

-

following the receipt of a takeover proposal with respect to SJW, the SJW board of directors has failed to publicly reaffirm its

recommendation of the merger agreement, the merger and the other transactions contemplated by the merger agreement within 10 business days after CTWS reasonably requests in writing that such

recommendation be reaffirmed; or

-

-

a tender or exchange offer relating to any shares of SJW common stock has been publicly commenced and SJW has not, within 10

business days after the commencement thereof, recommended rejection of such tender or exchange offer and reaffirmed its recommendation of the merger agreement and the merger and the other transactions

contemplated by the merger agreement; or

-

- prior to the time that CTWS shareholders approve the merger agreement, if CTWS is not in material breach of its obligations described under "No Solicitation of Alternative Proposals" in the SJW/CTWS Proxy Statement in order to accept a superior proposal with respect to CTWS and enter into an acquisition agreement related to such superior proposal, and CTWS pays to SJW a termination fee of $28.1 million pursuant to the terms of the merger agreement.

Effects of Termination; Termination Fees

According to the SJW/CTWS Proxy Statement, in the event of a valid termination of the merger agreement, other than termination by mutual written consent, written notice will be given by the terminating party to the other party specifying the provision pursuant to which such termination is made. In the event of a valid termination of the merger agreement, the merger agreement will be terminated and will become void and have no effect, without any liability or obligation on the part of SJW or CTWS, except that certain provisions regarding the termination fee and other general matters will survive such termination and nothing in the merger agreement will relieve any party from liabilities or damages incurred or suffered as a result of fraud, willful misconduct, intentional misrepresentation or intentional breach by such party of any covenant or agreement set forth in the merger agreement. In such case, neither party will be under any obligation to hold a special meeting. The termination of the merger agreement will not affect the obligations of the parties contained in the confidentiality agreement between SJW and CTWS.

According to the SJW/CTWS Proxy Statement, each party will pay all fees and expenses incurred by it in connection with the merger and the other transactions contemplated by the merger agreement. SJW will be obligated to pay a termination fee of $42.5 million to CTWS if:

-

-

CTWS terminates the merger agreement, prior to the time that SJW stockholders approve both the Share Issuance Proposal and Certificate

Amendment Proposal, as a result of any of the following:

-

-

SJW materially breaches any of its obligations described under "No Solicitation of Alternative Proposals" in the

SJW/CTWS Proxy Statement;

-

-

the SJW board of directors has made an adverse recommendation change;

-

-

SJW has failed to include, in the SJW/CTWS Proxy Statement, the recommendation of its board of directors that SJW stockholders

approve both the Share Issuance Proposal and Certificate Amendment Proposal;

-

- following the receipt of a takeover proposal with respect to SJW, the SJW board of directors has failed to publicly reaffirm its recommendation of the merger agreement, the merger and the other transactions contemplated by the merger agreement within 10

10

-

-

a tender or exchange offer relating to any shares of SJW common stock has been publicly commenced and SJW has not, within 10

business days after the commencement thereof, recommended rejection of such tender or exchange offer and reaffirmed its recommendation of the merger agreement and the merger and the other transactions

contemplated by the merger agreement;

-

-

SJW terminates the merger agreement because SJW stockholders fail to approve either the Share Issuance Proposal and Certificate Amendment

Proposal at the Special Meeting, at any time during which CTWS would have been permitted to terminate the merger agreement under the provision described in the primary bullet immediately above;

-

-

SJW terminates the merger agreement in order to accept a superior proposal and enter into an acquisition agreement related to such superior

proposal, prior to the time that SJW stockholders approve both the Share Issuance Proposal and Certificate Amendment Proposal, if SJW is not in material breach of its obligations described under

"No Solicitation of Alternative Proposals" in the SJW/CTWS Proxy Statement; or

-

-

each of the following three events occurs:

-

-

a takeover proposal is made to SJW or becomes publicly known, or an intention to make such a takeover proposal is publicly

announced and not publicly withdrawn, after the date of the merger agreement and prior to the SJW stockholders meeting;

-

-

the merger agreement is thereafter terminated by (A) CTWS or SJW pursuant to either of the end-date termination provision

(if the SJW stockholders meeting has not been held) or the SJW stockholder approval failure termination provision, or (B) CTWS pursuant to the SJW material breach termination provision; and

-

- within 12 months of such termination of the merger agreement, SJW enters into a definitive contract to consummate or consummates a takeover proposal; provided that for purposes of the provision described in this bullet, the term "takeover proposal" has the meaning described under "No Solicitation of Alternative Proposals" in the SJW/CTWS Proxy Statement, except that all references to 15% therein will be changed to 50%.

business days after CTWS reasonably requests in writing that such recommendation be reaffirmed; or

SJW will be obligated to reimburse CTWS for certain fees and expenses in an amount not to exceed $5 million if either SJW or CTWS terminates the merger agreement because SJW stockholders fail to approve of either or both of the Share Issuance Proposal and Certificate Amendment Proposal. If any termination fee is later payable by SJW to CTWS, the amount of such termination fee payable by SJW will be reduced by the expense reimbursement amount actually paid by SJW to CTWS.

11

CERTAIN INFORMATION CONCERNING CALIFORNIA WATER

California Water Service Group is a holding company incorporated in Delaware in 1999 with six operating subsidiaries: California Water Service Company ("Cal Water"), Washington Water Service Company ("Washington Water"), New Mexico Water Service Company ("New Mexico Water"), Hawaii Water Service Company, Inc. ("Hawaii Water"), CWS Utility Services, and HWS Utility Services LLC (CWS Utility Services and HWS Utility Services LLC being referred to collectively as "Utility Services"). Together, these companies provide regulated and non-regulated water service to nearly two million people in California, Washington, New Mexico, and Hawaii.

Cal Water, New Mexico Water, Washington Water, and Hawaii Water are regulated public utilities. The regulated utility entities also provide some non-regulated services. Utility Services provides non-regulated services to private companies and municipalities. Cal Water was the original operating company and began operations in 1926. California Water Service Group's common stock trades on the New York Stock Exchange under the symbol "CWT." California Water has approximately 1,176 employees

Our business is conducted through our operating subsidiaries. The bulk of the business consists of the production, purchase, storage, treatment, testing, distribution and sale of water for domestic, industrial, public and irrigation uses, and for fire protection. We also provide non-regulated water-related services under agreements with municipalities and other private companies. The non-regulated services include full water system operation, billing and meter reading services. Non-regulated operations also include the lease of communication antenna sites, lab services and promotion of other non-regulated services.

Our mailing address and contact information is:

California

Water Service Group

1720 North First Street

San Jose, California 95112-4598

Telephone Number: 408-367-8200

The names of the directors and officers of California Water who are considered to be participants in this proxy solicitation and certain other information are set forth in Schedule I hereto. Other than as set forth herein, none of California Water or any of the participants set forth on Schedule I hereto has any substantial interest, direct or indirect, by security holdings or otherwise, in the Proposed CTWS Merger.

12

According to the SJW/CTWS Proxy Statement, as of the Record Date there were · SJW Shares entitled to vote at the Special Meeting. Each outstanding SJW Share is entitled to one vote on each proposal and any other matter properly coming before the Special Meeting.

Under SJW's bylaws, the presence, in person or by proxy, of the holders of a majority of the SJW Shares outstanding as of the Record Date and entitled to vote at the Special Meeting is necessary to constitute a quorum at the Special Meeting. Once an SJW Share is represented at the Special Meeting, it will be counted for the purpose of determining a quorum at the Special Meeting and any adjournment of the Special Meeting. However, if a new Record Date is set for the adjourned Special Meeting, then a new quorum will have to be established.

In accordance with NYSE rules, brokers and nominees who hold SJW Shares in street-name for customers may not exercise their voting discretion with respect to the Share Issuance Proposal, the Certificate Amendment Proposal, or the Adjournment Proposal related thereto. Thus, absent specific instructions from the beneficial owner of such SJW Shares, these SJW Shares will not be counted for purposes of determining whether a quorum is present.

The Share Issuance Proposal requires the affirmative vote of holders of a majority of the outstanding SJW Shares present in person or represented by proxy at the Special Meeting and entitled to vote on the proposal. Failures to vote and broker non-votes will have no effect on the proposal, assuming a quorum is present. Abstentions are treated the same as votes "AGAINST" this proposal.

Approval of the Certificate Amendment Proposal requires the affirmative vote of holders of a majority of the outstanding SJW Shares entitled to vote on the proposal. Failures to vote, broker non-votes and abstentions will have the effect of a vote "AGAINST" this proposal.

Approval of the Adjournment Proposal requires the affirmative vote of holders of a majority of the outstanding SJW Shares present in person or represented by proxy at the Special Meeting and entitled to vote on the proposal. SJW stockholders may adjourn the Special Meeting to another time or place without further notice unless the adjournment is for more than 30 days or if after the adjournment a new record date is fixed for the adjourned meeting, in which case a notice of the adjourned meeting shall be given to each SJW stockholder of record entitled to vote at the meeting. Failures to vote and broker non-votes will have no effect on the proposal. Abstentions will have the effect of a vote "AGAINST" this proposal.

SJW stockholders may abstain from voting on any or all of the proposals or may vote for or against any or all of the proposals by internet or telephone or by marking the proper box on the WHITE proxy card and signing, dating and returning it promptly in the enclosed postage-paid envelope. If an SJW stockholder returns a WHITE proxy card that is signed, dated and not marked with respect to an SJW Proposal, that stockholder will be deemed to have voted "AGAINST" such proposal.

If an SJW stockholder returns a WHITE proxy card that is signed and dated but not marked with respect to any proposal unrelated to the Proposed CTWS Merger, we will vote to "ABSTAIN" unless such proposal adversely affect the interests of California Water as determined by California Water in its sole discretion, in which event such persons will vote on such proposals in their discretion.

Only SJW stockholders (or their duly appointed proxies) of record on the Record Date are eligible to vote in person or submit a proxy.

YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO ITS EXERCISE BY ATTENDING THE SPECIAL MEETING AND VOTING IN PERSON, BY SUBMITTING A DULY EXECUTED, LATER DATED PROXY BY INTERNET OR TELEPHONE OR BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD OR BY SUBMITTING A WRITTEN NOTICE OF REVOCATION TO EITHER (A) CALIFORNIA WATER, CARE OF

13

INNISFREE M&A INCORPORATED, 501 MADISON AVENUE, 20TH FLOOR, NEW YORK, NEW YORK 10022, OR (B) THE PRINCIPAL EXECUTIVE OFFICES OF SJW AT 110 WEST TAYLOR STREET, SAN JOSE, CALIFORNIA 95110. A REVOCATION MAY BE IN ANY WRITTEN FORM VALIDLY SIGNED BY THE RECORD HOLDER AS LONG AS IT CLEARLY STATES THAT THE PROXY PREVIOUSLY GIVEN IS NO LONGER EFFECTIVE. STOCKHOLDERS WHO HOLD THEIR SJW SHARES IN A BANK OR BROKERAGE ACCOUNT WILL NEED TO NOTIFY THE PERSON RESPONSIBLE FOR THEIR ACCOUNT TO REVOKE OR WITHDRAW PREVIOUSLY GIVEN INSTRUCTIONS. WE REQUEST THAT A COPY OF ANY REVOCATION SENT TO SJW OR ANY REVOCATION NOTIFICATION SENT TO THE PERSON RESPONSIBLE FOR A BANK OR BROKERAGE ACCOUNT ALSO BE SENT TO CALIFORNIA WATER, CARE OF INNISFREE M&A INCORPORATED, AT THE ADDRESS BELOW SO THAT CALIFORNIA WATER MAY DETERMINE IF AND WHEN PROXIES HAVE BEEN RECEIVED FROM THE HOLDERS OF RECORD ON THE RECORD DATE OF A MAJORITY OF SJW SHARES THEN OUTSTANDING. UNLESS REVOKED IN THE MANNER SET FORTH ABOVE, SUBJECT TO THE FOREGOING, DULY EXECUTED PROXIES IN THE FORM ENCLOSED WILL BE VOTED AT THE SPECIAL MEETING AS SET FORTH ABOVE.

BY EXECUTING THE WHITE PROXY CARD YOU ARE AUTHORIZING THE PERSONS NAMED AS PROXIES TO REVOKE ALL PRIOR PROXIES ON YOUR BEHALF.

If you have any questions or require any assistance in voting your SJW Shares, please contact:

Innisfree

M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Stockholders May Call Toll Free: (888) 750-5834

Banks and Brokers May Call Collect: (212) 750-5833

14

Except as set forth below, California Water will not pay any fees or commissions to any broker, dealer, commercial bank, trust company or other nominee for the solicitation of proxies in connection with this solicitation.

Proxies will be solicited by mail, telephone, facsimile, the internet, e-mail, newspapers and other publications of general distribution and in person. Directors and officers of California Water listed on Schedule I hereto may assist in the solicitation of proxies without any additional remuneration (except as otherwise set forth in this Proxy Statement).

California Water has retained Innisfree M&A Incorporated ("Innisfree") for solicitation and advisory services in connection with solicitations relating to the Special Meeting, for which Innisfree may receive a fee of up to $ · in connection with the solicitation of proxies for the Special Meeting. Up to approximately 30 people may be employed by Innisfree in connection with the solicitation of proxies for the Special Meeting. California Water has also agreed to reimburse Innisfree for out-of-pocket expenses and to indemnify Innisfree against certain liabilities and expenses, including reasonable legal fees and related charges. Innisfree will solicit proxies for the Special Meeting from individuals, brokers, banks, bank nominees and other institutional holders. The entire expense of soliciting proxies for the Special Meeting by or on behalf of California Water is being borne by California Water.

If you have any questions concerning this Proxy Statement or the procedures to be followed to execute and deliver a proxy, please contact Innisfree at the address or phone number specified above.

This Proxy Statement contains forward-looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 ("Act"). The forward-looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatment established by the Act. Forward-looking statements are based on currently available information, expectations, estimates, assumptions and projections, and management's judgment about California Water, the water utility industry and general economic conditions. Such words as would, expects, intends, plans, believes, estimates, assumes, anticipates, projects, predicts, forecasts or variations of such words or similar expressions are intended to identify forward-looking statements. The forward-looking statements are not guarantees of future performance. They are subject to uncertainty and changes in circumstances. Actual results may vary materially from what is contained in a forward-looking statement. Factors that may cause a result different than expected or anticipated include, but are not limited to: the failure to consummate the proposed transaction with SJW upon the terms set forth in California Water's Acquisition Proposal; governmental and regulatory commissions' decisions; changes in regulatory commissions' policies and procedures; the timeliness of regulatory commissions' actions concerning rate relief; changes in environmental compliance and water quality requirements; electric power interruptions; changes in customer water use patterns and the effects of conservation; the impact of weather and climate on water availability, water sales and operating results; civil disturbances or terrorist threats or acts, or apprehension about the possible future occurrences of acts of this type; labor relations matters as we negotiate with the unions; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; and, other risks and unforeseen events. When considering forward-looking statements, you should keep in mind the cautionary statements included in this paragraph, as well as our annual 10-K, Quarterly 10-Q, and other reports filed from time-to-time with the Securities and Exchange Commission. California Water assumes no obligation to provide public updates of forward-looking statements except to the extent required by law.

15

The information concerning SJW and the Proposed CTWS Merger contained herein (including Schedule II) has been taken from, or is based upon, publicly available documents on file with the SEC and other publicly available information. Although California Water has no knowledge that would indicate that statements relating to SJW or the CTWS Merger Agreement contained in this Proxy Statement, in reliance upon publicly available information, are inaccurate or incomplete, to date it has not had access to the books and records of SJW, was not involved in the preparation of such information and statements and is not in a position to verify any such information or statements. See Schedule II for information regarding persons who beneficially own more than 5% of the SJW Shares and the ownership of the SJW Shares by the directors and officers of SJW.

Pursuant to Rule 14a-5 promulgated under the Securities Exchange Act of 1934, as amended, reference is made to the preliminary joint proxy statement/prospectus included in the SJW/CTWS Proxy Statement for information concerning the CTWS Merger Agreement, the Proposed CTWS Merger, financial information regarding SJW, CTWS and the proposed combination of SJW and CTWS, the proposals to be voted upon at the Special Meeting, the SJW Shares, other information concerning SJW's management, the procedures for submitting proposals for consideration at the next annual meeting of stockholders of SJW and certain other matters regarding SJW and the Special Meeting.

The California Water Acquisition Proposal is subject to a number of conditions, including the termination of the CTWS Merger Agreement, and receipt of all required regulatory approvals, consents and waivers. There are no assurances that all of the conditions to the California Water Acquisition Proposal will be satisfied or that the California Water Acquisition Proposal will be consummated if SJW stockholders reject the Proposed CTWS Merger. Consequently, following a rejection of the Proposed CTWS Merger, SJW may remain independent of California Water and CTWS. SJW stockholders should take all of these factors into account when determining how to vote their SJW Shares.

THIS PROXY STATEMENT RELATES SOLELY TO THE SOLICITATION OF PROXIES WITH RESPECT TO THE PROPOSED CTWS MERGER AND IS NOT A SOLICITATION OF PROXIES WITH RESPECT TO THE CALIFORNIA WATER ACQUISITION PROPOSAL.

WE URGE YOU NOT TO RETURN ANY PROXY CARD YOU RECEIVE FROM SJWEVEN AS A PROTEST VOTE AGAINST THE PROPOSED CTWS MERGER. EVEN IF YOU PREVIOUSLY HAVE SUBMITTED A PROXY CARD FURNISHED BY SJW, IT IS NOT TOO LATE TO CHANGE YOUR VOTE BY INTERNET OR TELEPHONE OR SIMPLY BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. WE URGE YOU VOTE BY INTERNET OR TELEPHONE OR BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD TO US TODAY.

WHETHER OR NOT YOU INTEND TO ATTEND THE SPECIAL MEETING, YOUR PROMPT ACTION IS IMPORTANT. MAKE YOUR VIEWS CLEAR TO THE SJW BOARD BY VOTING "AGAINST" THE SHARE ISSUANCE PROPOSAL, THE CERTIFICATE AMENDMENT PROPOSAL AND THE ADJOURNMENT PROPOSAL BY INTERNET OR TELEPHONE OR BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD TODAY. A VOTE AGAINST THE SHARE ISSUANCE PROPOSAL, THE CERTIFICATE AMENDMENT PROPOSAL AND THE ADJOURNMENT PROPOSAL WILL NOT OBLIGATE YOU TO VOTE FOR THE CALIFORNIA WATER ACQUISITION PROPOSAL IN THE FUTURE.

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN.

CALIFORNIA

WATER SERVICE GROUP

May 2, 2018

16

SCHEDULE I

INFORMATION CONCERNING DIRECTORS AND OFFICERS OF CALIFORNIA

WATER WHO ARE PARTICIPANTS AND INTERESTS OF PARTICIPANTS

Directors and Officers of California Water Who are Participants

The following table sets forth the name of each director and officer of California Water that is a participant in the solicitation. Unless otherwise indicated, the current business address of each person is 1720 North First Street, San Jose, California 95112 and the current business telephone number is (408) 367-8200.

| DIRECTORS | PARTICIPANT OFFICERS | |

|---|---|---|

| Gregory E. Aliff | Martin A. Kropelnicki | |

|

Terry P. Bayer |

Thomas F. Smegal |

|

|

Edwin A. Guiles |

Lynne P. McGhee |

|

|

Martin A. Kropelnicki |

Paul G. Townsley |

|

|

Thomas M. Krummel |

Robert J. Kuta |

|

|

Richard P. Magnuson |

Shannon Dean |

|

|

Peter C. Nelson |

|

|

|

Carol M. Pottenger |

|

|

|

Lester A. Snow |

|

|

|

George A. Vera |

|

Peter C. Nelson is the beneficial owner of 100 SJW Shares and 610 CTWS Common Shares.

I-1

SCHEDULE II

SECURITY OWNERSHIP OF SJW PRINCIPAL

STOCKHOLDERS AND MANAGEMENT

THE FOLLOWING TABLES ARE REPRINTED FROM SJW'S

DEFINITIVE PROXY STATEMENT FILED WITH THE SECURITIES AND

EXCHANGE COMMISSION ON MARCH 6, 2018

The following table sets forth, as of February 5, 2018, certain information concerning beneficial ownership of shares of SJW common stock by each director of the Corporation, nominee for director, and each of the two individuals who served as the Corporation's Chief Executive Officer during 2017, the Corporation's Chief Financial Officer and each of the Corporation's other executive officers named in the Summary Compensation Table of SJW's last annual meeting proxy statement (the "named executive officers"), and all directors, nominees and named executive officers as a group and beneficial owners of five percent or more of outstanding shares of common stock of SJW. Unless otherwise indicated, the beneficial ownership consists of sole voting and investment power with respect to the shares indicated, except to the extent that spouses share authority under applicable law. None of the shares reported as beneficially owned by the named executive officers and directors have been pledged as security for any loan or indebtedness. Unless otherwise indicated, the principal address of each of the stockholders below is c/o SJW Group, 110 W. Taylor Street, San Jose, California 95110. The calculations in the table below are based on 20,557,554 shares of common stock issued and outstanding as of February 5, 2018. In addition, shares of common stock that may be acquired by the person shown in the table within 60 days of February 5, 2018 are deemed to be outstanding for the purpose of computing the percentage ownership of such person, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table.

Additionally, the SJW/CTWS Proxy Statement also discloses that, as of April 13, 2018, Eric W. Thornburg beneficially owns 152,411 shares of CTWS capital stock, which includes shares that Mr. Thornburg has a contractual right to acquire within 60 days of April 13, 2018.

Name

|

Shares Beneficially Owned |

Percent of Class |

|||||

|---|---|---|---|---|---|---|---|

Directors: |

|||||||

Katharine Armstrong(1) |

8,343 | * | |||||

Walter J. Bishop(2) |

8,153 | * | |||||

Douglas R. King(3) |

8,293 | * | |||||

Gregory P. Landis |

| * | |||||

Debra C. Man |

957 | * | |||||

Daniel B. More(4) |

2,126 | * | |||||

George E. Moss(5)(6) |

1,092,728 | 5.3 | % | ||||

W. Richard Roth, Chairman of the Board(7) |

156,988 | * | |||||

Eric W. Thornburg, President and Chief Executive Officer |

| * | |||||

Robert A. Van Valer(8)(9) |

2,217,280 | 10.8 | % | ||||

Named Executive Officers not listed above: |

|||||||

Andrew R. Gere, President and Chief Operating Officer of SJWC(10) |

13,129 | * | |||||

Palle L. Jensen, Executive Vice President of SJWC(11) |

8,753 | * | |||||

James P. Lynch, Chief Financial Officer and Treasurer(12) |

19,949 | * | |||||

Suzy Papazian, General Counsel and Corporate Secretary(13) |

9,057 | * | |||||

All directors, nominees and executive officers as a group (14 individuals)(14) |

3,545,756 | 17.2 | % | ||||

Beneficial owners of five percent or more not listed above: |

|||||||

Nancy O. Moss(15) |

1,181,092 | 5.7 | % | ||||

BlackRock, Inc. and Certain Subsidiaries(16) |

1,283,440 | 6.2 | % | ||||

55 East 52nd Street, New York, New York 10055 |

|||||||

- *

- Represents less than one percent of the outstanding shares of SJW's common stock.

II-1

- (1)

- Includes

(i) 2,550 shares of common stock held in a joint account with spouse and for which Katharine Armstrong and her spouse share voting and investment

power, (ii) 1,000 shares of common stock held under an IRA account, and (iii) 4,793 shares of common stock held by the Katharine Armstrong Love Exempt Trust U/A/D 6/30/2009, for which

Katharine Armstrong is the sole trustee.

- (2)

- Includes

8,153 shares of common stock held by the Bishop Family Trust, for which Walter Bishop and his spouse are trustees. Mr. Bishop has shared voting and

investment powers with respect to such shares.

- (3)

- Includes

8,293 shares of common stock held by the King Family Trust dated June 6, 2005 of which Mr. King and Melinda King are trustees. Mr. King

has shared voting and investment powers with respect to such shares.

- (4)

- Includes

2,126 shares of common stock held by the Daniel B. More and Laura A. More Joint Tenancy. Mr. More has shared voting and investment powers with

respect to such shares.

- (5)

- Includes

(i) 1,083,980 shares of common stock held by the George Edward Moss Trust, a living trust of which Mr. Moss is the sole trustee and sole

beneficiary, (ii) 6,645 shares of common stock held by his spouse's revocable trust, (iii) 800 shares of common stock held under his spouse's IRA, and (iv) 1,303 shares of common

stock held under his spouse's Roth IRA.

- (6)

- The

address for George E. Moss is 4360 Worth Street, Los Angeles, California 90063.

- (7)

- Includes

(i) 138,688 shares of common stock held by the W. Richard Roth and Viviane L. Roth Community Property Revocable Trust dated December 17, 2004

of which 23,433 shares of such common stock subject to restricted stock unit awards were issued on February 28, 2018, and (ii) 18,300 shares of common stock held by a separate property

trust for which Mr. Roth is trustee. Mr. Roth has shared voting and investment powers with respect to the 138,688 shares. Mr. Roth served as SJW's Chief Executive Officer and

President until November 5, 2017 and as Chief Executive Emeritus until December 31, 2017. Mr. Roth did not stand for reelection as a nominee for director at the 2018 annual

meeting and therefore his term as Chairman expired on April 25, 2018. The Board appointed Eric W. Thornburg, the current Chief Executive Officer and President of SJW, as the Chairman following

the annual meeting.

- (8)

- Includes

(i) 79,412 shares of common stock, (ii) 1,937,226 shares of common stock held under the Non Exempt Bypass Trust created under the Roscoe Moss

Jr Revocable Trust dated March 24, 1982 for which Mr. Van Valer has sole voting and dispositive powers, and (iii) 200,642 shares of common stock held under an Exempt Bypass Trust

created under the Roscoe Moss Jr Revocable Trust dated March 24, 1982 for which Mr. Van Valer has sole voting and dispositive powers.

- (9)

- The

address for Robert A. Van Valer is 4360 Worth Street, Los Angeles, California 90063.

- (10)

- Includes

(i) 12,224 shares of common stock and (ii) 905 shares of common stock subject to a restricted stock unit award that were issued on

February 28, 2018 (which amount is net of shares withheld to cover withholding taxes).

- (11)

- Includes

(i) 7,992 shares of common stock and (ii) 761 shares of common stock subject to a restricted stock unit award that were issued on

February 28, 2018 (which amount is net of shares withheld to cover withholding taxes).

- (12)

- Includes

(i) 2,114 shares of common stock, (ii) 2,500 shares of common stock held under a Roth IRA, and (iii) 15,335 shares of common stock

held by Mr. Lynch and his spouse in joint tenancy of which 871 shares of common stock subject to a restricted stock unit award were issued on February 28, 2018 (which amount is net of

shares withheld to cover withholding taxes). Mr. Lynch has shared voting and investment powers with respect to 15,335 shares.

- (13)

- Includes (i) 3,531 shares of common stock and (ii) 5,526 shares of common stock held by the John Affaki and Suzy Papazian Living Trust dated December 10, 2008 of which 733 shares of such common stock subject to a restricted stock unit award were issued on February 28, 2018 (which amount is net of shares withheld to cover withholding taxes).

II-2

- (14)

- Includes

26,703 shares of common stock subject to restricted stock unit awards that were issued to the named executive officers on February 28, 2018 (which

amount is net of shares withheld to cover withholding taxes). See footnotes (7) and (10) through (13) above.

- (15)

- Includes

(i) 1,180,092 shares of common stock held by the Nancy O. Moss Trust and (ii) 1,000 shares of common stock held under a SEP-IRA account.

Ms. Moss has shared voting and investment powers over the shares held in her trust. The mailing address of Nancy O. Moss is 25 Kewen Place, San Marino, California 91108.

- (16)

- Pursuant to Schedule 13G/A filed with the SEC on January 23, 2018, BlackRock, Inc. had sole power to vote or to direct the vote of 1,242,690 shares of common stock and sole power to dispose or to direct the disposition of 1,283,440 shares of common stock.

II-3

If your SJW Shares are held in your own name, please use the WHITE proxy card to vote by Internet or telephone or sign, date and return the enclosed WHITE proxy card today. If your SJW Shares are held in "street-name," only your broker or bank can vote your shares and only upon receipt of your specific instructions. Please return the enclosed WHITE voting instruction form to your broker or bank and contact the person responsible for your account to ensure that a WHITE proxy card is voted on your behalf. If your broker or bank provides for voting instructions to be delivered to them by Internet or telephone, instructions will be included on the enclosed WHITE voting instruction form.

We urge you not to sign any proxy card you may receive from SJW, even as a protest vote against the Proposed CTWS Merger.

If you have any questions or require any assistance in voting your SJW Shares, please contact:

Innisfree

M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Stockholders May Call Toll Free: (888) 750-5834

Banks and Brokers May Call Collect: (212) 750-5833

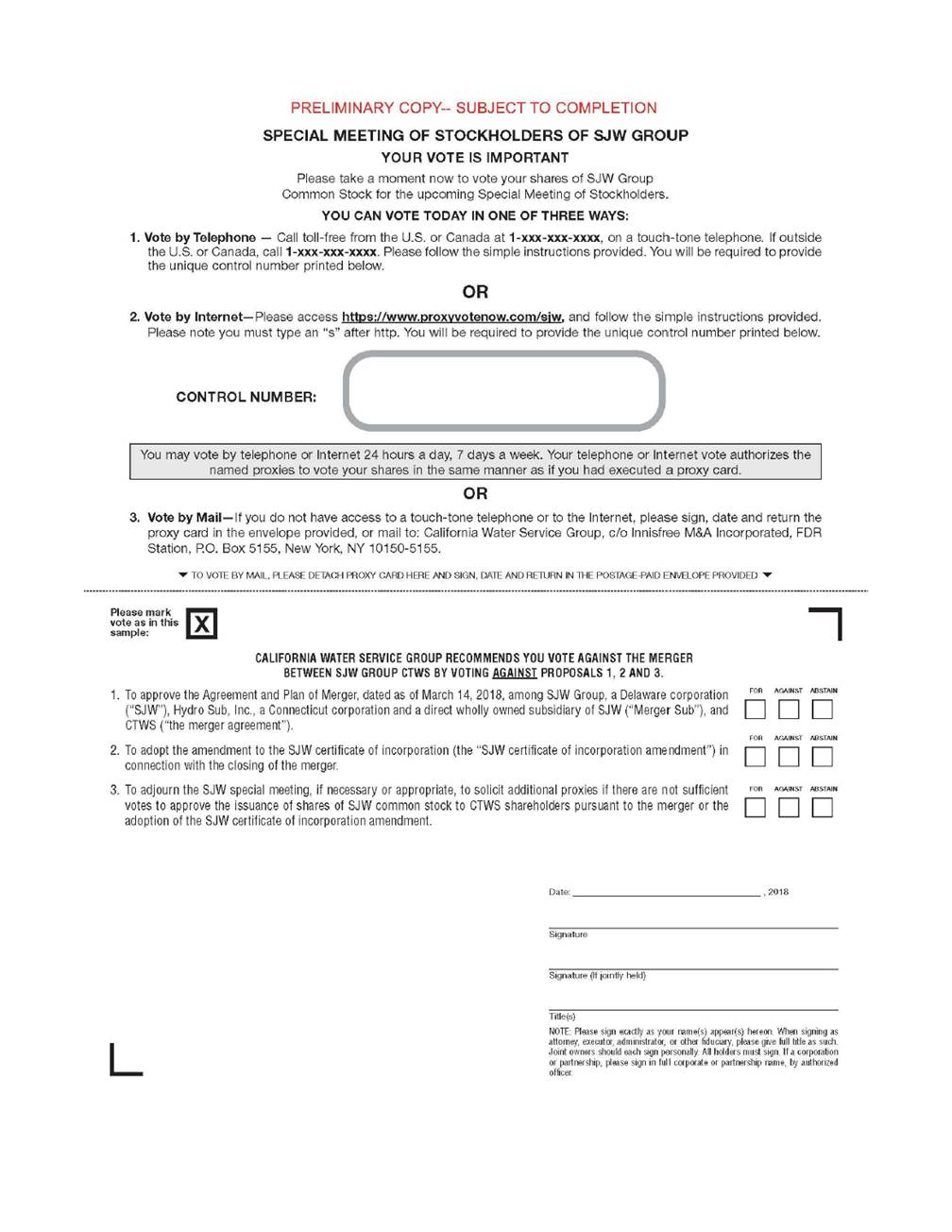

PRELIMINARY COPY--SUBJECT TO COMPLETION SPECIAL MEETING OF STOCKHOLDERS OF SJW GROUP YOUR VOTE IS IMPORTANT Please take a moment now to vote your shares of SJW Group Common Stock for the upcoming Special Meeting of Stockholders. YOU CAN VOTE TODAY IN ONE OF THREE WAYS: 1. Vote by Telephone - Call toll-free from the U.S. or Canada at 1-xxx-.xxx-xxxx, on a touch-tone telephone. If outside the U.S. or Canada, call1-xxx-xxx-xxxx. Please follow the simple instructions provided. You will be required to provide the unique control number printed below. OR 2. Vote by Internet-Please access https://www.proxvvotenow.com/sjw, and follow the simple instructions provided. Please note you must type an "s" after http. You will be required to provide the unique control number printed below. ( ) CONTROL NUMBER: You may vote by telephone or Internet 24 hours a day, 7 days a week. Your telephone or Internet vote authorizes the named proxies to vote your shares in the same manner as if you had executed a proxy card. OR 3. Vote by Mail-If you do not have access to a touch-tone telephone or to the Internet, please sign, date and return the proxy card in the envelope provided, or mail to: California Water Service Group, c/o lnnisfree M&A Incorporated, FOR Station, P.O. Box 5155, New York, NY 10150-5155. T TO VOlE BY MAIL, PLEASE DETACH PROXY CARD HERE AND SIGN, DAlE AND RETURN IN THE POSTAGE-PAID ENVELOPE PROVIDED T Please mark IX] vote as in this X sample: CALIFORNIA WATER SERVICE GROUP RECOMMENDS YOU VOTE AGAINST THE MERGER BETWEEN SJW GROUP CTWS BY VOTING AGAINST PROPOSALS 1, 2 AND 3. 1. To approve the Agreement and Plan of Merger, dated as of March 14, 2018, among SJW Group, a Delaware corporation ("SJW"), Hydro Sub, Inc., a Connecticut corporation and a direct wholly owned subsidiary of SJW ("Merger Sub"), and CTWS ("the merger agreement"). FOR AGANI ST ABSTAIN DOD 0 0 0 FOR AGAINST ABSTAIN 2. To adopt the amendment to the SJW certificate of incorporation (the "SJW certificate of incorporation amendment") in connection with the closing of the merger. 3. To adjourn the SJW special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve the issuance of shares of SJW common stock to CTWS shareholders pursuant to the merger or the adoption of the SJW certificate of incorporation amendment. D D D FoR AGANI sT ABsTAIN Date: , 2018 Signature Signature (If jointly held) Title(s) NOTE Please s1gn exactly as your name(s) appear(s) hereon When Signing as attorney, executor. administrator.or other fiduciary,please grve full title as such. Joint owners should each gn personally. All holders must sign. If a corporation or partnership, please sign in lull corporate or partnership name, by authorized officer L

PLEASE VOTE TODAY! SEE REVERSE SIDE FOR THREE EASY WAYS TO VOTE. .,.. TO VOlE BY MAIL, PLEASE DETACH PROXY CARD HERE, AND SIGN, DAlE AND RETURN IN THE POSTAGE-PAID ENVELOPE PROVIDED .,.. THIS PROXY IS SOLICITED ON BEHALF OF CALIFORNIA WATER SERVICE GROUP AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OF SJW GROUP SPECIAL MEETING OF STOCKHOLDERS OF SJW GROUP - , 2018 The undersigned appoints each of and , and each of them, with full power of substitution, to represent the undersigned at the special meeting of stockholders of SJW Group. on , 2018, and at any adjournment or postponement thereof, and to vote at such meeting the shares of common stock that the undersigned would be entitled to vote if personally present in accordance with the following instructions and to vote in their judgment upon all other matters that may properly come before the meeting and any adjournment or postponement. The undersigned revokes any proxy previously given to vote at such meeting. CALIFORNIA WATER SERVICE GROUP RECOMMENDS YOU VOTE AGAINST PROPOSALS 1, 2 AND 3. IF THIS PROXY IS PROPERLY SIGNED AND RETURNED, IT WILL BE VOTED IN ACCORDANCE WITH YOUR INSTRUCTIONS. IF YOU VALIDLY EXECUTE AND RETURN THIS PROXY CARD WITHOUT INDICATING YOUR INSTRUCTIONS ON A MATTER LISTED ON THE BACK OF THE PROXY CARD, YOUR PROXY WILL BE VOTED AGAINST PROPOSALS 1, 2 AND 3. THIS PROXY WILL REVOKE ANY PREVIOUSLY EXECUTED PROXY WITH RESPECT TO ALL PROPOSALS. w H I T E p R 0 X y Continued and to be signed and dated on reverse side

REASONS TO VOTE "AGAINST" THE SJW PROPOSALS

BACKGROUND OF THE SOLICITATION

CERTAIN INFORMATION CONCERNING THE CALIFORNIA WATER ACQUISITION PROPOSAL

CERTAIN INFORMATION CONCERNING THE PROPOSED CTWS MERGER

CERTAIN INFORMATION CONCERNING CALIFORNIA WATER

VOTING PROCEDURES

SOLICITATION OF PROXIES

FORWARD-LOOKING STATEMENTS

OTHER INFORMATION

SCHEDULE I INFORMATION CONCERNING DIRECTORS AND OFFICERS OF CALIFORNIA WATER WHO ARE PARTICIPANTS AND INTERESTS OF PARTICIPANTS

INTERESTS OF PARTICIPANTS

SCHEDULE II SECURITY OWNERSHIP OF SJW PRINCIPAL STOCKHOLDERS AND MANAGEMENT

THE FOLLOWING TABLES ARE REPRINTED FROM SJW'S DEFINITIVE PROXY STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 6, 2018

IMPORTANT