DEF 14A: Definitive proxy statements

Published on April 17, 2019

Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

|

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

|

o |

Preliminary Proxy Statement |

|

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

ý |

Definitive Proxy Statement |

|

|

o |

Definitive Additional Materials |

|

|

o |

Soliciting Material under §240.14a-12 |

|

| California Water Service Group | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

|

ý |

No fee required. |

|||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) |

Title of each class of securities to which transaction applies: |

|||

| (2) |

Aggregate number of securities to which transaction applies: |

|||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) |

Proposed maximum aggregate value of transaction: |

|||

| (5) |

Total fee paid: |

|||

|

o |

Fee paid previously with preliminary materials. |

|||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

| (2) |

Form, Schedule or Registration Statement No.: |

|||

| (3) |

Filing Party: |

|||

| (4) |

Date Filed: |

|||

California Water Service Group

California Water Service Company, Hawaii Water Service Company,

New Mexico Water Service Company, Washington Water Service Company,

CWS Utility Services, and HWS Utility Services

1720 North First Street

San Jose, CA 95112-4508

(408) 367-8200

April 17, 2019

Dear Fellow Stockholder:

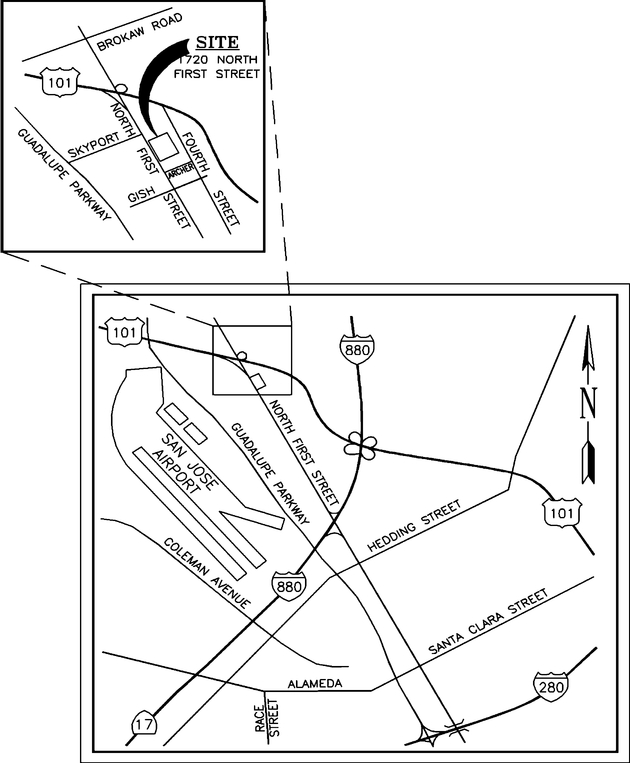

You are cordially invited to attend our Annual Meeting of Stockholders at 9:30 a.m. on May 29, 2019, at the executive offices of California Water Service Group, located at 1720 North First Street in San Jose, California.

Enclosed please find a notice of matters to be voted on at the meeting, our Proxy Statement, a proxy card, and our 2018 Annual Report.

Whether or not you plan to attend, your vote is important. Please vote your shares as soon as possible in one of three ways: by Internet, by telephone, or by mail. Instructions regarding how to vote are included on the proxy card or voting instruction card.

In a continuing effort to conserve natural resources and reduce costs, we produced a summary annual report again this year, opting not to duplicate the financial information that continues to be provided in our Form 10-K filed with the Securities and Exchange Commission. Your perspectives on the annual report are valuable to us. Please send your feedback to annualreport@calwater.com.

Thank you for your investment in the California Water Service Group.

Sincerely,

/s/ PETER C. NELSON

Peter C. Nelson

Chairman of the Board

Table of Contents

For directions to the Annual Meeting, please refer to page 61 of this Proxy Statement.

| California Water Service Group |

Notice of Annual Meeting of Stockholders

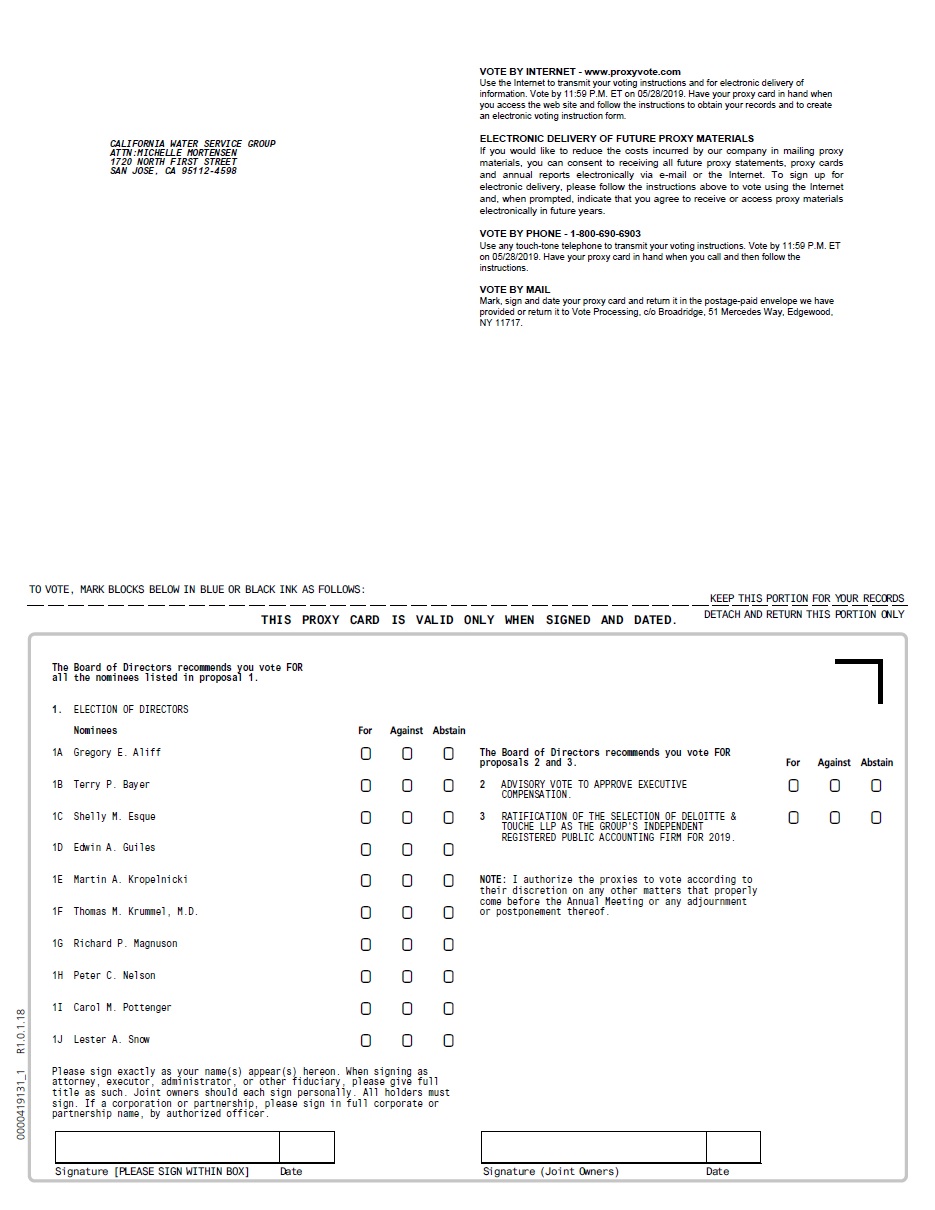

The 2019 Annual Meeting of Stockholders (Annual Meeting) of California Water Service Group (Group) will be held on Wednesday, May 29, 2019, at 9:30 a.m., at the executive offices of California Water Service Group, located at 1720 North First Street, San Jose, California 95112. At the Annual Meeting, stockholders will consider and vote on the following matters:

- 1.

- Election

of the ten directors named in the Proxy Statement;

- 2.

- An

advisory vote to approve executive compensation;

- 3.

- Ratification

of the selection of Deloitte & Touche LLP as the Group's independent registered public accounting firm for 2019; and

- 4.

- Such other business as may properly come before the Annual Meeting.

The Board of Directors has fixed the close of business on April 2, 2019 as the record date for the determination of holders of common stock entitled to notice of, and to vote at, the Annual Meeting.

Please submit a proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. You may submit your proxy: (a) by Internet, (b) by telephone, or (c) by U.S. Postal Service mail. You may revoke your proxy at any time prior to the vote at the Annual Meeting. Of course, in lieu of submitting a proxy, you may vote in person at the Annual Meeting; provided, however, that if you hold your shares in street name, you must request a legal proxy from your stockbroker in order to do so. For specific instructions, please refer to "Questions and Answers about the Proxy Materials and the Annual Meeting" in this Proxy Statement and the instructions on the proxy card.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be Held on May 29, 2019:Electronic copies of the Group's Form 10-K, including exhibits, and this Proxy Statement will be available at www.proxyvote.com.

By Order of the Board of Directors

/s/ MICHELLE R. MORTENSEN

MICHELLE R. MORTENSEN

Corporate Secretary

April 17, 2019

This Proxy Statement, dated April 17, 2019, relates to the solicitation of proxies by the Board of Directors of California Water Service Group (Group) for use at our 2019 Annual Meeting of Stockholders, which is scheduled to be held on May 29, 2019, at 9:30 a.m., at the executive offices of California Water Service Group, located at 1720 North First Street, San Jose, California 95112. We expect to begin mailing this Proxy Statement to stockholders on or about April 17, 2019.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

What am I voting on?

-

-

Election of the ten directors named in the Proxy Statement to serve until the 2020 Annual Meeting;

-

-

An advisory vote to approve executive compensation; and

-

- Ratification of the selection of Deloitte & Touche LLP as the Group's independent registered public accounting firm for 2019.

Who may attend the Annual Meeting?

Any stockholders of the Group may attend.

Who is entitled to vote?

Stockholders of record on the record date are entitled to vote. The Board has fixed the close of business on April 2, 2019 as the record date (Record Date) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting.

How many votes do I get?

Each share of common stock is entitled to one vote.

What constitutes a quorum?

A majority of the outstanding shares present at the Annual Meeting or represented by persons holding valid proxies constitutes a quorum. If you submit a valid proxy card, your shares will be considered in determining whether a quorum is present.

Without a quorum, no business may be transacted at the Annual Meeting. However, whether or not a quorum exists, a majority of the voting power of those present at the Annual Meeting may adjourn the Annual Meeting to another date, time, and place.

At the Record Date, there were 1,901 stockholders of record. There were 48,133,750 shares of our common stock outstanding and entitled to vote at the Annual Meeting.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 1

How are the directors elected?

Our bylaws provide for a majority voting standard for the election of directors in uncontested elections. Under this majority voting standard, each director must be elected by the affirmative vote of a majority of the votes cast with respect to the director. A majority of the votes cast means that the number of votes cast "FOR" a nominee for director exceeds the number of votes cast "AGAINST" that nominee for director. As a result, abstentions will not be counted in determining which nominees receive a majority of votes cast since abstentions do not represent votes cast for or against a nominee. If you hold your shares through a stockbroker (or other nominee), the stockbroker does not have authority to vote your shares in the election of directors without instructions from you. Shares that your stockbroker does not vote ("broker non-votes") are not considered votes cast for or against a nominee, and they will not be counted in determining which nominees receive a majority of votes cast. In accordance with our director resignation policy, the Nominating/Corporate Governance Committee has established procedures that require an incumbent nominee for director who does not receive the required votes for re-election to tender his or her resignation offer to the Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee will recommend to the Board whether to accept or reject the offer, or whether other action should be taken. The Board will act on the Nominating/Corporate Governance Committee's recommendation within 90 days after certification of the election results. We will promptly publicly disclose the Board's decision regarding the resignation offer, including the rationale for rejecting the resignation offer, if applicable.

Who are the Board's nominees?

The nominees are Gregory E. Aliff, Terry P. Bayer, Shelly M. Esque, Edwin A. Guiles, Martin A. Kropelnicki, Thomas M. Krummel, M.D., Richard P. Magnuson, Peter C. Nelson, Carol M. Pottenger, and Lester A. Snow. All of the nominees are current Board members. See "Proposal No. 1 Election of Directors" for biographical information and qualifications.

What are the Board's voting recommendations?

"FOR" each of the nominees to the Board (Proposal No. 1);

"FOR" the proposal regarding an advisory vote to approve executive compensation (Proposal No. 2); and

"FOR" the ratification of the selection of Deloitte & Touche LLP as the Group's independent registered public accounting firm for 2019 (Proposal No. 3).

How do I vote?

If you are a stockholder of record (that is, you hold your shares in your own name), you may vote by Internet, by telephone, by mail, or in person at the Annual Meeting. Different rules apply if your stockbroker or another nominee holds your shares for you (see below).

![]() You may vote by Internet.

You may vote by Internet.

You do this by following the "Vote by Internet" instructions on the proxy card. If you vote by Internet, you do not have to mail in your proxy card.

2 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

![]() You may vote by telephone.

You may vote by telephone.

You do this by following the "Vote by Phone" instructions on the proxy card. If you vote by telephone, you do not have to mail in your proxy card. You must have a touch-tone phone to vote by telephone.

![]() You may vote by mail.

You may vote by mail.

You do this by signing the proxy card and mailing it in the enclosed, prepaid, and addressed envelope. If you mark your voting instructions on the proxy card, your shares will be voted as you instruct.

If you return a signed card but do not provide voting instructions, your shares will be voted:

-

-

For the ten named director nominees;

-

-

For the advisory vote to approve executive compensation; and

-

- For the ratification of the selection of Deloitte & Touche LLP as the Group's independent registered public accounting firm for 2019.

You may vote in person at the Annual Meeting.

We will distribute written ballots to anyone who wants to vote at the Annual Meeting. If you hold your shares in street name, you must request a legal proxy from your stockbroker in order to vote at the Annual Meeting.

What if I change my mind after I return my proxy?

You may revoke your proxy and/or change your vote at any time before the polls close at the Annual Meeting. You may do this by:

-

-

Signing another proxy with a later date;

-

-

Voting by Internet or by telephone (your latest Internet or telephone proxy is counted);

-

-

Voting again at the Annual Meeting; or

-

- Notifying the Corporate Secretary, in writing, that you wish to revoke your previous proxy. We must receive your notice prior to the vote at the Annual Meeting.

Will my shares be voted if I do not return my proxy?

If you are a stockholder of record, and you do not return your proxy, your shares will not be voted unless you attend the Annual Meeting and vote in person.

What happens if my shares are held by my stockbroker (or other nominee)?

If your shares are held by a stockbroker (or other nominee), you will receive a voting instruction card so that you can instruct your stockbroker on how to vote your shares. If you do not return your voting instruction card, then your stockbroker, under certain circumstances, may vote your shares.

Specifically, stockbrokers have authority under exchange regulations to vote your uninstructed shares on certain "routine" matters. For "non-routine" matters, no votes will be cast on your behalf if you do not instruct your stockbroker on how to vote. If you wish to change the voting instructions that you gave to your stockbroker, you must ask your stockbroker how to do so.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 3

If you do not give your stockbroker voting instructions, your stockbroker may either:

-

-

Proceed to vote your shares on routine matters and refrain from voting on non-routine matters; or

-

- Leave your shares entirely unvoted.

Shares that your stockbroker does not vote ("broker non-votes") will count towards the quorum only. We encourage you to provide your voting instructions to your stockbroker. This ensures that your shares will be voted at the Annual Meeting.

As to my stockbroker voting, which proposals are considered "routine" or "non-routine"?

The ratification of the selection of Deloitte & Touche LLP as the Group's independent registered public accounting firm for 2019 (Proposal No. 3) is routine. A stockbroker may generally vote on routine matters if the stockbroker has not received voting instructions from you with respect to such matters.

The election of directors (Proposal No. 1) and the advisory vote to approve executive compensation (Proposal No. 2) are matters considered "non-routine" under applicable rules. A stockbroker cannot vote without your instructions on non-routine matters.

What is the voting requirement to approve each of the proposals?

Proposal

|

Vote Required | |||

|---|---|---|---|---|

| Proposal No. 1 | Election of ten directors | Majority of Votes Cast | ||

|

Proposal No. 2 |

Advisory vote to approve executive compensation |

Majority of Shares Present in Person or Represented by Proxy and Entitled to Vote |

||

|

Proposal No. 3 |

Ratify the selection of Deloitte & Touche LLP as the Group's independent registered public accounting firm for 2019 |

Majority of Shares Present in Person or Represented by Proxy and Entitled to Vote |

||

How are broker non-votes and abstentions treated?

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. Only "FOR" and "AGAINST" votes are counted for purposes of determining the votes received in connection with the proposal relating to the election of directors (Proposal No. 1), and therefore broker non-votes and abstentions have no effect on that proposal. Stockbrokers may not vote your shares on Proposal No. 1 without instructions from you. The affirmative vote of the majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting is required to approve Proposal No. 2 and Proposal No. 3. Proposal No. 2 is advisory, meaning that it is not binding on the Board, although the Board will consider the outcome of the vote on this proposal. Abstentions have the effect of a vote "AGAINST" Proposal No. 2 and Proposal No. 3. Stockbrokers may vote your shares on Proposal No. 3 (but not on Proposal No. 2) without instructions from you. Shares resulting in broker non-votes, if any, are not entitled to vote and will have no effect on the outcome of these proposals.

Who will count the vote?

Representatives of Broadridge Financial Services, Proxy Services, will serve as the inspector of elections and count the votes.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts at the transfer agent and/or with stockbrokers. Please sign and return all proxy cards to ensure that all your shares are voted.

4 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

What percentage of stock do the directors and executive officers own?

Together, directors and executive officers own approximately 1.0% of our common stock. See "Stock Ownership of Management and Certain Beneficial Owners" for more details elsewhere in this Proxy Statement.

Who are the largest common stockholders?

As of December 31, 2018, the largest stockholders were:

-

-

BlackRock, Inc. beneficially owned 7,470,871 shares of common stock, representing 15.5% of our aggregate outstanding stock as of such

date;

-

-

The Vanguard Group, Inc. beneficially owned 5,478,254 shares of common stock, representing 11.39% of our aggregate outstanding stock as

of such date;

-

-

State Street Corporation, beneficially owned 3,219,281 shares of common stock, representing 6.7% of our aggregate outstanding stock as of such

date; and

-

-

T. Rowe Price Associates, Inc. beneficially owned 3,110,975 shares of common stock, representing 6.4% of our aggregate outstanding stock

as of such date.

- *

- To the best of our knowledge, no other stockholders held more than 5% of our common shares as of such date.

What is the deadline for submitting stockholder proposals for the Group's proxy materials for next year's Annual Meeting?

Any proposals that stockholders intend to submit for inclusion in next year's Group proxy materials must be received by the Corporate Secretary of the Group by December 19, 2019. A proposal, together with any supporting statement, may not exceed 500 words and must comply with other requirements of Rule 14a-8 under the Securities Exchange Act of 1934. Please submit the proposal to the Corporate Secretary, California Water Service Group, 1720 North First Street, San Jose, California 95112-4508.

How can a stockholder propose a nominee for the Board or other business for consideration at a stockholders' meeting?

Stockholders who are entitled to vote at a stockholders' meeting may propose a nominee for the Board or other business for consideration at a meeting without seeking to have the matter included in the proxy materials for the Annual Meeting pursuant to Rule 14a-8. The bylaws contain the requirements for doing so. The bylaws are posted on the Group's website at http://www.calwatergroup.com. Physical copies of these documents are also available upon request to the Corporate Secretary, California Water Service Group, 1720 North First Street, San Jose, CA 95112-4508. Briefly, a stockholder must give timely prior notice of the matter to the Group. The notice must be received by the Corporate Secretary at the Group's principal place of business by the 150th day before the first anniversary of the prior year's Annual Meeting. For the 2020 Annual Meeting, to be timely, notice must be received by the Corporate Secretary not later than the close of business on December 31, 2019. If we change the date of the Annual Meeting by more than thirty days before or more than sixty days after the date of the previous meeting, notice is due not later than the close of business on the later of the 150th day before the Annual Meeting or the 10th day after we publicly announce the holding of the Annual Meeting. If the Group's Corporate Secretary receives notice of a matter after the applicable deadline, the notice will be considered untimely. In that case, or where notice is timely but the stockholder fails to satisfy the requirements of Rule 14a-4 under the Securities

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 5

Exchange of 1934, the persons named as proxies may exercise their discretion in voting with respect to the matter when and if it is raised at the Annual Meeting.

The bylaws specify what the notice must contain. Stockholders must comply with applicable law with respect to matters submitted in accordance with the bylaws. The bylaws do not affect any stockholder's right to request inclusion of proposals in the Group's Proxy Statement under Rule 14a-8.

How can a stockholder or other interested parties contact the independent directors, the director who chairs the Board's executive sessions, or the full Board?

Stockholders or other interested parties may address inquiries to any of the Group's directors, to the lead director (who chairs the Board's executive sessions), or to the full Board, by email to stockholdercommunication@calwater.com or by writing to them in care of the Corporate Secretary, California Water Service Group, 1720 North First Street, San Jose, California 95112-4508. All such communications are sent directly to the intended recipient(s).

Can I make comments and/or ask questions during the Annual Meeting?

Yes. Stockholders wishing to address the Annual Meeting are welcome to do so by adhering to the following guidelines:

- 1.

- Stockholders

may address the Annual Meeting when recognized by the Chairman or President & Chief Executive Officer (CEO);

- 2.

- Each

stockholder, when recognized, should stand and identify himself or herself; and

- 3.

- Stockholder remarks must be limited to matters before the Annual Meeting and may not exceed two minutes in duration per speaker.

No cameras, video, or recording equipment will be permitted at the Annual Meeting. Many cellular phones have built-in digital cameras, and while these phones may be brought into the Annual Meeting, the camera function may not be used at any time.

Where and when will I be able to find the results of the voting?

Preliminary results will be announced at the Annual Meeting. We will publish the final results in a current report on Form 8-K to be filed with the Securities and Exchange Commission ("SEC") within four business days of the Annual Meeting.

This section briefly describes the structure of the Board and the functions of the principal committees of the Board. The Board has adopted Corporate Governance Guidelines that, along with the charters of the Board committees, provide a framework for the governance of the Group. The Corporate Governance Guidelines and the current charters for the Audit, Organization and Compensation, Finance and Capital Investment, Nominating/Corporate Governance, and Enterprise Risk Management, Safety and Security committees are posted on the Group's website at http://www.calwatergroup.com. Physical copies of these documents are also available upon request to the Corporate Secretary, California Water Service Group, 1720 North First Street, San Jose, California 95112-4508.

The Group's policy is that all directors must be able to devote the required time to carry out director responsibilities and should attend all meetings of the Board and of committees on which they sit.

6 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

Leadership Structure

Peter C. Nelson has served as Chairman of the Board since 2012. The roles of Chairman of the Board and CEO are separate. The Board believes that separating these roles is the most appropriate leadership structure for the Group, based on numerous factors, including the Board's historical practice (which has predominantly been to separate the roles), its assessment of the Group's leadership, and the Group's current and anticipated needs. The Board attributes a portion of the historical success of its leadership model to the Chairman of the Board's 17-plus years of service as the former President & CEO of the Group. The Board believes that Mr. Nelson, who retired from the Group in 2013, brings significant experience in the water and public utility industries making him best positioned to lead the Board as it oversees and monitors implementation of the Group's business strategy, considers risks related to strategy and business decisions, and performs its oversight function with respect to the Group's operations.

The Board also has established the position of lead director because it supports having an independent director in a Board leadership position at all times. The lead director is an independent director who is elected by the independent directors to serve for a period of at least one year. Richard P. Magnuson currently serves as lead director. As set forth in the Corporate Governance Guidelines, the lead director's responsibilities and authority include:

-

-

Presiding over executive sessions of the non-management and independent directors and having the authority to call executive sessions;

-

-

Presiding at meetings of the Board in the absence of the Chairman of the Board;

-

-

Recommending to the Chairman of the Board items for consideration on the Board meeting agendas and schedules;

-

-

Serving as liaison between the Chairman of the Board and the independent directors; and

-

- Being available for consultation and communication with major stockholders upon request.

Risk Oversight

Under the Corporate Governance Guidelines, the full Board oversees the Group's processes for assessing and managing risk. The Board does not view risk in isolation, but considers risk as part of its regular consideration of business decisions and business strategy. The Board exercises its risk oversight function through the Board as a whole and through its committees. Each of the Board committees considers the risks within its areas of responsibility and identified in its charter. The Enterprise Risk Management, Safety and Security Committee, founded in 2019, reviews the Group's major risk exposures and the steps management has taken or proposes to take to mitigate, monitor, or control such risks. The Audit Committee reviews with management risks related to financial reporting and internal controls. At least annually, the Enterprise Risk Management, Safety and Security Committee discusses the Group's risk assessment and risk management plans with the Audit Committee. The Finance and Capital Investment Committee discusses with management the policies and procedures with respect to major risk exposures and the steps management has taken and/or proposes to take to monitor, mitigate, and control such exposures within the capital investment programs. The Organization and Compensation Committee reviews enterprise risks to ensure that our compensation plans and programs do not encourage management to take unreasonable risks relating to our business. The Nominating/Corporate Governance Committee oversees risks related to matters of corporate governance, including director independence and Board performance, as well as risks related to environmental, social responsibility, and sustainability matters. The Enterprise Risk

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 7

Management, Safety and Security Committee also oversees the Group's physical and cyber risk management program.

The Group has a Management Committee (MC) that provides oversight of major risks and risk management reporting. The MC is chaired by the Group's President & CEO and membership is comprised of our Group and subsidiary executives, hereafter collectively known as "executives" and meets monthly. Among other functions, the MC identifies and prioritizes key risks and recommends the implementation of appropriate mitigation measures, as needed. The MC provides reporting to the Audit Committee no less frequently than annually. Further review or reporting on risks is conducted as needed or as requested by the Board or committee. The Enterprise Risk Management Committee regularly briefs the full Board on issues related to the cyber risk management program and related cyber issues.

Committees

There are five committees within our Board of Directors: (1) Audit; (2) Organization and Compensation; (3) Finance and Capital Investment; (4) Nominating/Corporate Governance; (5) and Enterprise Risk Management, Safety and Security. The membership and the function of each of these committees are described below.

|

Name |

Audit |

Organization and Compensation |

Finance and Capital Investment |

Nominating/ Corporate Governance |

Enterprise Risk Management, Safety and Security |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Gregory E. Aliff |

Chair | | | | ü | |||||

Terry P. Bayer |

ü | ü | ü | |||||||

Shelly M. Esque |

| | | ü | ü | |||||

Edwin A. Guiles |

ü | ü | Chair | |||||||

Martin A. Kropelnicki |

||||||||||

Thomas M. Krummel, M.D. |

Chair | ü | ||||||||

Richard P. Magnuson |

ü | | ü | Chair | | |||||

Peter C. Nelson |

||||||||||

Carol M. Pottenger |

| | | ü | Vice-chair | |||||

Lester A. Snow |

ü | ü | Chair | |||||||

| | | | | | | | | | | |

Number of meetings held during 2018 |

5 | 3 | 3 | 2 | N/A | |||||

| | | | | | | | | | | |

AUDIT: Reviews the Group's auditing, accounting, financial reporting, and internal audit functions. The Audit Committee is also directly responsible for the appointment, compensation, and oversight of the independent registered public accounting firm, although stockholders are asked to ratify the Audit Committee's selection of this firm. All members are independent as defined in the listing standards of the New York Stock Exchange and meet the additional independence requirements for audit committee members imposed by the Sarbanes-Oxley Act and the rules of the SEC thereunder.

The Board has determined that Gregory E. Aliff, chair of the Audit Committee, Terry P. Bayer, and Edwin A. Guiles are audit committee financial experts and are independent under the standards applicable to audit committee members. Designation as an audit committee financial expert means that the Board believes Mr. Aliff, Ms. Bayer, and Mr. Guiles have:

- (i)

- An understanding of generally accepted accounting principles and financial statements;

8 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

- (ii)

- The

ability to assess the general application of such principles in connection with the accounting for estimates, accruals, and reserves;

- (iii)

- Experience

preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of accounting issues that are

generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Group's financial statements, or experience actively supervising one or more persons

engaged in such activities;

- (iv)

- An

understanding of internal controls over financial reporting; and

- (v)

- An understanding of audit committee functions.

Designation of a person as an audit committee financial expert does not result in the person being deemed an expert for any purpose, including under Section 11 of the Securities Act of 1933. The designation does not impose on the person any duties, obligations, or liability greater than those imposed on any other Audit Committee member or any other director and does not affect the duties, obligations, or liability of any other member of the Audit Committee or Board of Directors.

ORGANIZATION AND COMPENSATION: Reviews the Group's executive compensation programs, including their establishment, modification, and administration. All members are independent as defined in the listing standards of the New York Stock Exchange, and meet additional independence requirements for compensation committee members applicable under the New York Stock Exchange listing standards. The Organization and Compensation Committee has taken steps to analyze the current risk profile of the Group's executive compensation programs. In its evaluation, the Organization and Compensation Committee review took into account that the Group operates in a highly regulated environment and thus maintains strong internal controls, which factors tend to mitigate against undue risk.

As a result of this evaluation, the Committee does not believe that the Group's compensation practices and programs create risks that are reasonably likely to have a material adverse effect on the Group, nor does it believe that the Group's executive compensation practices and programs are designed to promote risk taking.

Compensation Consultant: The Organization and Compensation Committee retained Veritas Executive Compensation Consultants (Veritas) to advise it on marketplace trends in executive compensation, management proposals for the 2018 compensation program, and executive officer compensation decisions. Additionally, Veritas generally evaluated the Group's equity compensation programs. Veritas also consulted with the Nominating/Corporate Governance Committee about its recommendations to the Board on director compensation. Veritas has been retained for advice on 2019 executive compensation.

Veritas was directly accountable to the Organization and Compensation Committee. To maintain the independence of their advice, Veritas did not provide any services for the Group other than those described above. In addition, the Organization and Compensation Committee conducted a conflict of interest assessment, considering the following six factors with respect to Veritas: (i) the provision of other services to the Group by Veritas; (ii) the amount of fees received from the Group by Veritas, as a percentage of total revenue of Veritas; (iii) the policies and procedures of Veritas that are designed to prevent conflicts of interest; (iv) any business or personal relationship between the consultants at Veritas with whom the Group work and any members of the Organization and Compensation Committee; (v) any of our stock owned by the Veritas consultants; and (vi) any business or personal relationship of Veritas or the Veritas consultants with any of the Group's executive officers, and no conflict of interest was identified.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 9

For a description of the processes and procedures used by the Organization and Compensation Committee for the consideration and determination of executive compensation, see "Compensation Discussion and Analysis" elsewhere in this Proxy Statement.

FINANCE AND CAPITAL INVESTMENT: Assists the Board in reviewing the Group's financial policies, strategies, and capital structure. All members are independent as defined in the listing standards of the New York Stock Exchange.

NOMINATING/CORPORATE GOVERNANCE: Reviews the Group's director compensation and assists the Board by (i) overseeing director succession planning and recruitment of individuals qualified to become Board members; (ii) overseeing the Group's corporate governance practices; (iii) reviewing the Group's Corporate Governance Guidelines annually and recommending changes to the Board; and (iv) overseeing strategies, policies, and practices relating to environmental and social responsibility, and sustainability (collectively, "ESG Matters") issues and impacts. All members are independent as defined in the listing standards of the New York Stock Exchange.

ENTERPRISE RISK MANAGEMENT, SAFETY AND SECURITY: Assists the Board in reviewing the Group's enterprise risk management, safety, and security programs, including physical and cyber security.

During 2018, there were twelve meetings of the Board, five meetings of the Audit Committee, three meetings of the Organization and Compensation Committee, three meetings of the Finance and Risk Management Committee, and two meetings of the Nominating/Corporate Governance Committee. The incumbent directors attended at least 75% of all Board and applicable committee meetings in 2018 (held during the period each director served).

Independence of Directors

As discussed in the Group's Corporate Governance Guidelines, a substantial majority of the Board is comprised of independent directors. Currently, the Group's independent directors are Gregory E. Aliff, Terry P. Bayer, Shelly M. Esque, Edwin A. Guiles, Thomas M. Krummel, M.D., Richard P. Magnuson, Carol M. Pottenger, and Lester A. Snow. Under the listing standards of the New York Stock Exchange, a director is independent if he or she has no material relationship, whether commercial, industrial, banking, consulting, accounting, legal, charitable, familial, or otherwise, with the Group, either directly or indirectly as a partner, stockholder, or executive officer of an entity that has a material relationship with the Group. The Board makes an affirmative determination regarding the independence of each director annually, based on the recommendation of the Nominating/Corporate Governance Committee. The Board has adopted standards to assist it in assessing the independence of directors, which are set forth in the Corporate Governance Guidelines, which are posted on the Group's website at http://www.calwatergroup.com. Under these standards, the Board has determined that a director is not independent if:

-

-

The director is, or has been within the last three years, an employee of any company that comprises the Group or an immediate family member is,

or has been within the last three years, an executive officer of any company that comprises the Group;

-

- The director has received, or has an immediate family member who has received, during any twelve-month period during the last three years, more than $120,000 in direct compensation from companies that comprise the Group, other than director or committee fees and pension or other forms of deferred compensation for prior service (compensation received by an immediate family member for service as an employee, other than an executive officer, of the Group is not considered for purposes of this standard);

10 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

-

-

The director, or an immediate family member, is a current partner of the Group's internal or external auditor; the director is a current

employee of such a firm; the director's immediate family member is a current employee of such a firm who personally works on the Group's audit, or the director or an immediate family member was within

the last three years a partner or employee of such a firm and personally worked on the Group's audit within that time;

-

-

The director, or an immediate family member, is, or has been within the last three years, employed as an executive officer of another company

where any of the Group's present executive officers serves or served at the same time on that company's compensation committee;

-

-

The director is a current employee, or has an immediate family member who is a current executive officer, of a customer or vendor or other

party that has made payments to or received payments from companies that comprise the Group for property or services in an amount that, in any of the last three fiscal years, exceeded the greater of

$1 million or 2% of the party's consolidated gross revenues; or

-

- The director, or the director's spouse, is an executive officer of a non-profit organization to which the Group makes, or in the past three years has made, payments that, in any single fiscal year, exceeded the greater of $1 million or 2% of the non-profit organization's consolidated gross revenues.

In addition, the Board has determined that none of the following relationships, by itself, is a material relationship that would impair a director's independence:

-

-

Being a residential customer of any subsidiary of the Group;

-

-

Being a current executive officer or employee of, or being otherwise affiliated with, a commercial customer from which the Group has received

payments that, in any of the last three fiscal years, did not exceed the greater of (i) 1% of the Group's consolidated gross revenues for the year; or (ii) $500,000;

-

-

Being a current executive officer or employee of, or having a 5% or greater ownership or similar financial interest in, a supplier or vendor

that has received payments from the Group that, in any of the last three fiscal years, did not exceed the lesser of (i) 1% of the Group's consolidated gross revenues for the year; or

(ii) $500,000; or

-

- Being a director of any of the Group's subsidiaries.

Directors inform the Board as to their relationships with the Group and provide other pertinent information pursuant to questionnaires that they complete, sign, and certify on an annual basis. The Board reviews such relationships to identify possible impairments to director independence and in connection with disclosure obligations. For those directors who reside in a service territory of California Water Service Company and are customers, the Board has determined that it is not a material relationship that would impair their independence under the above standards.

Director Qualifications and Diversity

The Board believes that the Board of Directors, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Group's business. In addition, the Board believes that there are certain attributes that every director should possess, as reflected in the Board's membership criteria. Accordingly, the Board and the Nominating/Corporate Governance Committee consider the qualifications of directors and

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 11

director nominees individually and in the broader context of the Board's overall composition as well as in the Group's current and future business and operations.

The Nominating/Corporate Governance Committee is responsible for developing and recommending Board membership criteria to the Board for approval. The Board and the Nominating/Corporate Governance Committee seek a variety of occupational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the Board as a group. An annual evaluation of the Board's composition enables the Board and Nominating/Corporate Governance Committee to update the skills and experience they seek in the Board as a whole, and in individual directors, as the Group's needs evolve and change over time and to assess the diversity of the Board as a group. In identifying director nominees from time to time, the Board and the Nominating/Corporate Governance Committee may identify specific skills and experience that it believes the Group should seek in order to constitute a balanced and effective board.

The Group seeks directors having the following specific qualifications:

-

-

Evidence of leadership in his or her particular field;

-

-

Broad experience and sound business judgment;

-

-

Expertise in an area of importance to the Group and its subsidiaries;

-

-

The ability to work in a collegial Board environment;

-

-

High personal and professional ethics and integrity;

-

-

The ability to devote the required time to carry out director responsibilities;

-

-

The ability and willingness to contribute special competencies to Board activities, including appointment to Board committees;

-

-

Freedom from conflicts of interest that would interfere with serving and acting in the best interests of the Group and its stockholders; and

-

- Evidence of being a high caliber individual who has achieved a level of prominence in his or her career; for example, a CEO or highest level financial officer of a sizeable organization, a director of a major corporation, or a prominent civic or academic leader.

Additionally, Section 2.9 of the Group's bylaws contains requirements that a person must meet to avoid conflicts of interest that would disqualify that person from serving as a director.

Board membership should reflect diversity in its broadest sense. The Group seeks a Board that represents a diversity of backgrounds and experiences that will enhance the quality of the Board's deliberations and decisions. The Board, as a whole, should possess a combination of skills, professional experience, and backgrounds necessary to oversee the Group's business. The Board assesses the diversity of skills, experience, and backgrounds represented on the Board as part of the annual Board self-evaluation process.

Identification of Director Nominees

The Group identifies new director nominees through a variety of sources. The Nominating/Corporate Governance Committee will consider director nominees recommended by stockholders in the same manner it considers other nominees, as described in "Board Structure Director Qualifications and Diversity" elsewhere in this Proxy Statement. Stockholders seeking to recommend nominees for consideration by the Nominating/Corporate Governance Committee should submit a recommendation in writing describing the nominee's qualifications and other relevant biographical information and provide confirmation of the

12 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

nominee's consent to serve as director. Please submit this information to the Corporate Secretary, California Water Service Group, 1720 North First Street, San Jose, California 95112-4508.

Stockholders may also propose director nominees by adhering to the advance notice procedure described under "Questions and Answers About the Proxy Materials and the Annual Meeting How can a stockholder propose a nominee for the Board or other business for consideration at a stockholders' meeting?" elsewhere in this Proxy Statement.

Executive Sessions of the Board

Under the Group's Corporate Governance Guidelines, the non-management directors meet at least four times each year in executive session without management present, and the independent directors meet in executive session at least once a year. The lead director, Richard P. Magnuson, chairs these sessions.

Retirement Age of Directors

The Group has established a mandatory retirement age for directors. A director must retire no later than the Annual Meeting that follows the date of the director's 75th birthday. An employee director must retire as an employee no later than the Annual Meeting that follows the date of his or her 70th birthday, but may remain on the Board at the discretion of the Board of Directors.

Annual Meeting Attendance

All directors are expected to attend each Annual Meeting of the Group's stockholders, unless attendance is prevented by an emergency. All of the Group's directors who were directors as of the date of the Group's 2018 Annual Meeting attended the Group's 2018 Annual Meeting.

Other Governance Best Practices

The Group has adopted other practices that we believe reflect our commitment to good corporate governance including:

No Hedging and Pledging Policies

In accordance with our Insider Trading Policy, our directors and executives are prohibited from (i) hedging their ownership of Group stock, including trading in options, puts, calls, or other derivative instruments related to Group stock or debt; and (ii) pledging their ownership of Group stock.

Executive Compensation Recovery ("Clawback") Policy

The Board has adopted an executive compensation recovery, or "clawback," policy requiring the reimbursement of excess incentive-based compensation provided to the executives in the event of certain restatements of the Group's financial statements. A more detailed description of the Executive Compensation Recovery Policy appears in the "Compensation Discussion and Analysis" section of this Proxy Statement.

Stock Ownership Requirements

Our Board has adopted stock ownership requirements for directors and executives. These stock ownership requirements were adopted to promote a long-term perspective in managing the Group and to help align the interests of our stockholders, directors, and executives. As of

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 13

April 2, 2019, 17 of our non-employee directors and executives already met or exceeded their ownership requirements. New directors have five years to meet the requirements and executives must retain 50% of the net after-tax shares from equity awards until the relevant ownership requirement is achieved. A complete description of the stock ownership requirements for directors and executives appears in the "Compensation Discussion and Analysis" section of this Proxy Statement.

Our directors as of April 17, 2019, are as follows:

| Name | Age | Position | Current Term Expires |

Director Since |

Independent | Occupation | Other Board Experience |

Public Utilities or Public Health Experience |

||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Gregory E. Aliff | | 64 | Director | | 2019 | | 2015 | Yes | Former Vice Chairman and Senior Partner of U.S. Energy & Resources, Deloitte LLP | | Yes | | Yes | |||||||||

| Terry P. Bayer | 67 | Director | 2019 | 2014 | Yes | Former COO of Molina Healthcare, Inc. | Yes | Yes | ||||||||||||||

| Shelly M. Esque | | 58 | Director | | 2019 | | 2018 | Yes | Former Vice President and Global Director of Corporate Affairs of Intel Corporation | | Yes | | | |||||||||

| Edwin A. Guiles | 68 | Director | 2019 | 2008 | Yes | Former Executive Vice President of Corporate Development, Sempra Energy | Yes | Yes | ||||||||||||||

| Martin A. Kropelnicki | | 51 | President & CEO and Director | | 2019 | | 2013 | No | President & CEO of California Water Service Group | | Yes | | Yes | |||||||||

| Thomas M. Krummel, M.D. | 66 | Director | 2019 | 2010 | Yes | Emile Holman and Chair Emeritus of the Department of Surgery at Stanford University School of Medicine | Yes | Yes | ||||||||||||||

| Richard P. Magnuson | | 62 | Lead Director & Chair of the Board's Executive Sessions | | 2019 | | 1996 | Yes | Venture Capitalist | | Yes | | | |||||||||

| Peter C. Nelson | 70 | Chairman of the Board | 2019 | 1996 | No | Chairman of the Board of California Water Service Group | Yes | Yes | ||||||||||||||

| Carol M. Pottenger | | 62 | Director | | 2019 | | 2017 | Yes | Principal and Owner of CMP Global, LLC | | Yes | | | |||||||||

| Lester A. Snow | 66 | Director | 2019 | 2011 | Yes | Director and President of the Klamath River Renewal Corporation | Yes | Yes | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

14 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Upon the recommendation of the Nominating/Corporate Governance Committee, the Board has nominated for election at the 2019 Annual Meeting of Stockholders a slate of ten director nominees. All of the nominees, except Ms. Esque, have served as directors since the last Annual Meeting. Ms. Esque was recommended to the Nominating/Corporate Governance Committee by a third-party search firm and elected to the Board effective June 27, 2018. All directors are elected annually to serve until the next Annual Meeting or until their respective successors are elected.

Nominee Qualifications

When an incumbent director is up for re-election, the Nominating/Corporate Governance Committee reviews the performance, skills, and characteristics of such incumbent director before making a determination to recommend that the Board nominate him or her for re-election.

The Nominating/Corporate Governance Committee believes that all of the following ten director nominees listed are highly qualified and have the skills and experience required for membership on our Board. A description of the specific experience, qualifications, attributes and skills that led our Board to conclude that each of the nominees should serve as a director follows the biographical information of each nominee.

Vote Required

Each director must be elected by the affirmative vote of a majority of the votes cast. A majority of the votes cast means that the number of votes cast "FOR" a director nominee exceeds the number of votes cast "AGAINST" that nominee for director.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 15

Recommendation of the Board

Our Board of Directors unanimously recommends that you vote "FOR" the election of each of the following nominees:

| | | | | |

| Gregory E. Aliff | Age 65 | Director since 2015 | ||

| | | | | |

| | | | | |

Mr. Aliff is a retired Vice Chairman and Senior Partner, US Energy and Resources, at Deloitte LLP. From 2012 to his retirement in 2015, Mr. Aliff led Deloitte's US Sustainability Services, which focused on industrial and commercial water and energy management. From 2002 to 2012, he led Deloitte's US Energy and Resources practice, where he oversaw all professional services to the sector. Mr. Aliff also previously served on the Board of Directors of SCANA Corporation, Grid Alternatives and the United States Energy Association. Mr. Aliff earned his Bachelors of Science in Accounting and his Masters of Business Administration from Virginia Tech. He is a Certified Public Accountant, and is a designated Board Leadership Fellow of the National Association of Corporate Directors (NACD). He also holds a CERT Certificate in Cybersecurity Oversight from NACD.

Mr. Aliff brings extensive accounting, auditing, and financial reporting experience to the Board, with specific expertise in both the public utility and energy and resources industries. He also has in-depth experience in strategy, enterprise risk management, and regulatory affairs from his many years providing professional services to numerous major utilities. His deep understanding of public utility markets and the breadth of experience he has gained from working with public companies make him a valuable resource to the Group.

| | | | | |

| Terry P. Bayer | Age 68 | Director since 2014 | ||

| | | | | |

| | | | | |

Ms. Bayer is the former Chief Operating Officer (COO) for Molina Healthcare, Inc., a managed care company that provides solutions to meet the healthcare needs of low-income individuals and families who participate in government programs, including Medicaid, Medicare, and Marketplace. She held that position from 2005 until her retirement in February 2018. She was previously Executive Vice President of Health Plan Operations and also held management positions at Family Health Plan (FHP), Maxicare, Matria Healthcare, and AccentCare, Inc. Ms. Bayer previously served on the Board of Directors of Apria Healthcare Group, Inc. from 2006 to 2008 where she served as the chair of the compliance committee and served as a member of the compensation committee. She holds a Juris Doctor Degree from Stanford University, a Master's Degree in Public Health from the University of California, Berkeley, and a Bachelor's Degree in Communication from Northwestern University.

Ms. Bayer brings senior leadership, financial, operational, and public health expertise to the Board from her service as the COO of Molina Healthcare, Inc., a public company. She has many years of experience as an operating executive with a strong focus on government program compliance, public health and administration, as well as customer service. Her significant background and experience in healthcare supports the Board's efforts in overseeing and advising on employee health matters. Her previous experience as a director of Apria Healthcare Group, Inc. and a committee member also allows her to contribute to the Group.

16 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

| | | | | |

| Shelly M. Esque | Age 58 | Director since 2018 | ||

| | | | | |

| | | | | |

Ms. Esque, prior to her retirement in 2016, served as Vice President and Global Director of Corporate Affairs at Intel Corporation, a leader in the semiconductor industry, overseeing professionals in more than 35 countries responsible for enhancing Intel's reputation as the world's leading technology brand and corporate citizen. She also served as both president and chair of the Intel Foundation. In her capacity as a leader of Intel's corporate social responsibility, community, education, foundation, and government relations worldwide, Ms. Esque represented Intel at numerous events, including the World Economic Forum, World Bank, UNESCO, and forums promoting women in the workplace.

Ms. Esque received the Greater Phoenix Chamber of Commerce 2011 ATHENA Businesswoman of the Year Award for excellence in business and leadership, exemplary community service, and support and mentorship of other women. She was also recognized by AZ Business Magazine as one of the 50 Most Influential Women in Arizona. She is active on many non-profit boards, including Basis Charter Schools, Take the Lead, and the Boyce Thompson Arboretum, among others.

| | | | | |

| Edwin A. Guiles | Age 69 | Director since 2008 | ||

| | | | | |

| | | | | |

Mr. Guiles has been a director of Cubic Corporation since 2008. He was formerly Executive Vice President of Corporate Development at Sempra Energy. From 2000 to 2006, he was Chairman and CEO of San Diego Gas & Electric (SDG&E) and Southern California Gas Company (SoCal Gas), Sempra Energy's California regulated utilities. He held a variety of management positions at SDG&E since joining that company in 1972. Mr. Guiles is also past chairman of the California Chamber of Commerce. He has a Mechanical Engineering Degree from the University of Arizona.

Mr. Guiles is a former chairman & CEO with a strong public utility background. He has corporate governance experience through his service on the boards of SDG&E, SoCal Gas, and Cubic Corporation, a public company. He brings to the Board valuable senior management and operational expertise from his 37 years at Sempra Energy, SDG&E, and SoCal Gas. Additionally, Mr. Guiles' in depth knowledge of public utility regulation provides the Board with crucial insight.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 17

| | | | | |

| Martin A. Kropelnicki | Age 52 | Director since 2013 | ||

| | | | | |

| | | | | |

Mr. Kropelnicki is President & CEO of the Group. Mr. Kropelnicki joined the Group as Vice President, Chief Financial Officer (CFO) and Treasurer in 2006 and was named the President and COO in 2012. He then was appointed President & CEO of the Group effective September 1, 2013. He has over 30 years of experience in finance and operations, including 15-plus years as CFO at public listed companies and has held executive positions at PowerLight Corporation, Hall Kinion & Associates, Deloitte & Touche Consulting Group, and Pacific Gas & Electric Company. He serves as a director for the Bay Area Council, and the California Foundation on the Environment & Economy, and is a member of the Silicon Valley Leadership Group. Mr. Kropelnicki is the past President of the National Association of Water Companies and currently serves on their Executive Committee and Board of Directors. He holds a Bachelor of Arts Degree and Master of Arts Degree in Business Economics from San Jose State University. In 2016, Mr. Kropelnicki was awarded the United States Navy Memorial Fund's Naval Heritage Award. He is the 12th recipient of this award since its inauguration.

Mr. Kropelnicki is well positioned to lead the Group's management team and give guidance and perspective to the Board. His experience as the former CFO of the Group provides expertise in both corporate leadership and financial management. His 15-plus years as a CFO of publicly listed companies and operations management experience enables him to offer valuable perspectives on the Group's corporate planning, rate making, and budgeting along with operational and financial reporting.

| | | | | |

| Thomas M. Krummel, M.D. | Age 67 | Director since 2010 | ||

| | | | | |

| | | | | |

Dr. Krummel is the Emile Holman and Chair Emeritus of the Department of Surgery at Stanford University School of Medicine. A leader in his field, he has been honored with the Henry J. Kaiser Family Foundation Award for Excellence in Clinical Teaching; the John Austin Collins, M.D. Memorial Award for Outstanding Teaching and Dedication to Resident Training; and the Lucile Packard Children's Hospital Recognition of Service Excellence. He is currently Chair of the Board of Directors at The Fogarty Institute for Innovation and serves as a Director of The Morgridge Institute for Research University of Wisconsin.

Dr. Krummel brings to the Board experience with professional training and development as well as expertise with medical, public health, and science issues. He offers the Board unique insight on public health matters, including healthcare policy and legislation, drinking water quality, and employee health.

18 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

| | | | | |

| Richard P. Magnuson | Age 63 | Director since 1996 | ||

| | | | | |

| | | | | |

Mr. Magnuson is a private venture capitalist and is lead director. Mr. Magnuson holds an undergraduate degree in economics, a law degree and a master's degree in business administration from Stanford University. From 1984 to 1996, he was a general partner of Menlo Ventures, a venture capital firm. He has served on the boards of the following public companies: Rogue Wave Software (acquired by Quovadx), IKOS Systems, Inc. (acquired by Mentor Graphics), and OrCAD, Inc. (acquired by Cadence Design Systems). He has also served on the boards of several other privately held companies in the past.

With his legal and venture capital backgrounds, Mr. Magnuson brings valuable financial and business strategy expertise to the Board. His past experience on the boards of other public companies, and his insight on financial and operational matters, adds value to the Board. His past and current Board service also provides insight on corporate governance practices.

| | | | | |

| Peter C. Nelson | Age 71 | Director since 1996 | ||

| | | | | |

| | | | | |

Mr. Nelson is Chairman of the Board of the Group and its subsidiaries. He is a director of the California Chamber of Commerce and a past president of the National Association of Water Companies (NAWC).

Mr. Nelson has a strong record of operational and strategic leadership in the public utility business, including his 17-plus years of experience as the former President & CEO of the Group. An engineer by training with a graduate degree in business administration, he gained extensive senior executive experience at Pacific Gas & Electric Company. He has a vast understanding of the water industry from his role as the former President & CEO of the Group and from his leadership roles representing the water profession nationally at NAWC as well as in California at the State Chamber of Commerce.

| | | | | |

| Carol M. Pottenger | Age 63 | Director since 2017 | ||

| | | | | |

| | | | | |

Ms. Pottenger is principal and owner of CMP Global LLC, which provides consulting services in business development, process improvement, corporate governance, strategic planning, and cyber and information systems, which she founded and has owned since 2014. The first female three-star Admiral in American history to lead in a combat branch, Ms. Pottenger commanded two ships, a logistic force of 30 ships, a Japan-based strike-group of 8 ships, and the Expeditionary Force of 40,000 sailors during her 36 years in the U.S. Navy before retiring in 2013. She was also the senior U.S. Flag Officer responsible for military transformation and sensitive military topics such as counterterrorism and cyber security while on assignment with NATO.

Ms. Pottenger brings unique experience to the board, ranging from operations to technology to risk management. A graduate of Purdue University in Lafayette, Indiana, she also serves on various private, defense, and non-profit boards, including the U.S. Navy Memorial Foundation in Washington, D.C. and PricewaterhouseCoopers LLP Board of Partners and Principals.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 19

| | | | | |

| Lester A. Snow | Age 67 | Director since 2011 | ||

| | | | | |

| | | | | |

Mr. Snow has served as Secretary of the California Natural Resources Agency, Director of the California Department of Water Resources, Regional Director of the U.S. Bureau of Reclamation, Executive Director of the CALFED Bay Delta Program, and General Manager of the San Diego County Water Authority. He served as Executive Director of the California Water Foundation, an initiative of the Resources Legacy Fund, and serves on the board of the Klamath River Renewal Corporation. He holds a Master of Science Degree in Water Resources Administration from the University of Arizona and a Bachelor of Science Degree in Earth Sciences from Pennsylvania State University.

Mr. Snow brings more than 30 years of water and natural resource management experience to the Board. His distinguished public service career enables him to assist the Board in addressing water and environmental issues as well as regulatory and public policy matters.

Additionally, his executive experience in the public sector provides the Board with critical insight on a variety of operational and financial matters.

20 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

STOCK OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

Ownership of Directors and Executive Officers

The Group's Corporate Governance Guidelines, available on the Group's website at http://www.calwatergroup.com, include the stock ownership requirements for non-employee directors and executive officers. The requirements were adopted to promote a long-term perspective in managing the Group and to help align the interests of our stockholders, directors, and executive officers. A more complete description of the stock ownership requirements appears in the "Compensation Discussion and Analysis" section of this Proxy Statement.

Directors are required to achieve the relevant ownership threshold within five years following adoption of the requirements or five years after commencing service, whichever is later. Executives must retain 50% of the net after-tax shares from equity awards until the relevant ownership requirement is achieved.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 21

The following table shows the common stock ownership of our directors and executives as of April 2, 2019. All directors and executives have sole voting and investment power over their shares (or share such powers with their spouses).

|

Name |

Common Stock Beneficially Owned(*) |

|||

|---|---|---|---|---|

| | | | | |

Gregory E. Aliff |

| 9,597 | ||

Terry P. Bayer |

12,869 | |||

Shannon C. Dean |

|

| 11,409 | |

Shelly M. Esque |

2,696 | |||

Edwin A. Guiles |

| 33,710 | ||

David B. Healey |

16,197 | |||

Martin A. Kropelnicki |

|

| 83,547 | |

Thomas M. Krummel, M.D. |

25,434 | |||

Robert J. Kuta |

| 11,006 | ||

Michael B. Luu |

13,094 | |||

Richard P. Magnuson |

|

| 74,510 | |

Michael S. Mares, Jr. |

1,941 | |||

Lynne P. McGhee |

| 22,477 | ||

Greg A. Milleman |

1,246 | |||

Michelle R. Mortensen |

|

| 6,100 | |

Peter C. Nelson |

44,332 | |||

Elissa Y. Ouyang |

| 3,703 | ||

Carol M. Pottenger |

4,211 | |||

Gerald A. Simon |

|

| 4,729 | |

Thomas F. Smegal III |

39,136 | |||

Lester A. Snow |

| 18,196 | ||

Paul G. Townsley |

20,120 | |||

Ronald D. Webb |

|

| 15,462 | |

All directors and executives as a group |

475,722 | |||

| | | | | |

- *

- To the Group's knowledge, as of April 2, 2019, all directors and executives together beneficially owned an aggregate of approximately 1.0% of the Group's outstanding common shares. No one director or executive beneficially owns more than 1.0% of the Group's outstanding common shares.

22 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

Ownership of Largest Stockholders

As of December 31, 2018, the Group's records and other information available from outside sources indicated that the following stockholders were the beneficial owner of more than five percent of the outstanding shares of our common stock.

The information below is as reported in filings made by third parties with the SEC. Based solely on the review of our stockholder records and public filings made by the third parties with the SEC, the Group is not aware of any other beneficial owners of more than five percent of the common stock.

|

Class |

Beneficial Owner |

Number of Shares of Common Stock |

Percent of Class |

||||||

|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | |

Common |

BlackRock, Inc.(1) 55 East 52nd Street New York, NY 10055 |

| 7,470,871 | | 15.5% | ||||

Common |

The Vanguard Group, Inc.(2) 100 Vanguard Blvd. Malvern, PA 19355 |

5,478,254 | 11.39% | ||||||

Common |

State Street Corporation(3) One Lincoln Street Boston, MA 02111 |

|

| 3,219,281 | | 6.7% | |||

Common |

T. Rowe Price Associates, Inc.(4) 100 E. Pratt Street Baltimore, MD 21202 |

3,110,975 | 6.4% | ||||||

| | | | | | | | | | |

- (1)

- BlackRock, Inc.

has sole voting power over 7,287,917 shares and sole investment power over 7,470,871 shares as of December 31, 2018, as filed on SEC

Schedule 13G/A.

- (2)

- The

Vanguard Group, Inc. has sole voting power over 60,442 shares; sole investment power over 5,411,142 shares; shared voting power over 20,186 shares; and

shared investment power over 67,112 shares as of December 31, 2018, as filed on SEC Schedule 13G/A.

- (3)

- State

Street Corporation has shared voting power over 3,052,783 shares and shared investment power over 3,219,281 shares as of December 31, 2018, as filed on

SEC Schedule 13G.

- (4)

- T. Rowe Price Associates, Inc. has sole voting power over 764,485 shares and sole investment power over 3,110,975 shares as of December 31, 2018, as filed on SEC Schedule 13G/A.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, requires our directors, executive officers, and holders of more than 10% of our common stock to file with the SEC reports regarding their ownership, and changes in ownership of our securities. Based solely on its review of the copies of forms furnished to the Group, or written representations that no annual forms (SEC Form 5) were required, the Group believes that for fiscal year ended December 31, 2018, our directors and executive officers filed all reports on a timely basis with exception of Mr. Nelson who, in receiving his first required minimum distribution from his California Water Service Company 401(k) account, was not made aware that shares of the Group's common stock were liquidated as part of a weighted allocation of the Group's common stock and other non-Group securities liquidated to raise cash for the distribution. Upon discovery of the transaction, Mr. Nelson reporting the sale on a Form 4 filing.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 23

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis (CD&A) describes the material elements of our executive compensation program for 2018. This section focuses on the compensation of the our principal executive officer, principal financial officer, and the three other most highly compensated executive officers for 2018 referred to herein as "named executive officers" (NEOs) or "executives."

|

Name |

Title |

|

|---|---|---|

| | | |

| Martin A. Kropelnicki | President & CEO | |

| Thomas F. Smegal III | Vice President, Chief Financial Officer | |

| Paul G. Townsley | Vice President, Rates and Regulatory Matters | |

| Robert J. Kuta | Vice President, Engineering | |

| Lynne P. McGhee | Vice President, General Counsel | |

| | | |

-

-

Compensation philosophy: We strive to provide compensation that attracts, retains,

and motivates talented executives, rewards excellent job performance, overall leadership, and provides for fair, reasonable, and competitive total compensation that aligns executives' interests with

the long term interests of our stockholders and customers.

-

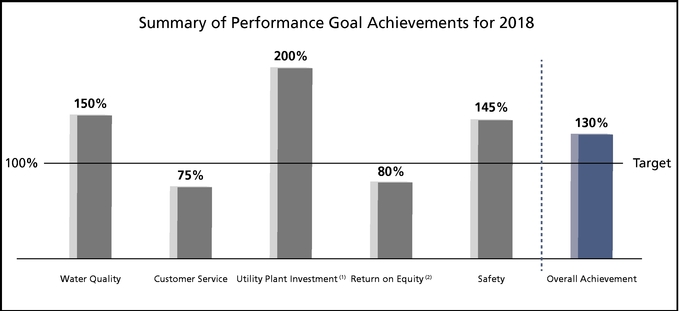

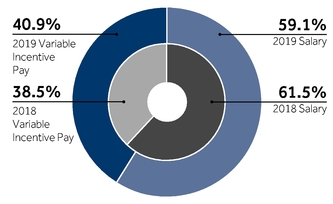

- Achievement of performance objectives in 2018: Our executive team's 2018 performance demonstrates our commitment to delivering value to our stockholders and customers, with strong performance on both financial and non-financial measures. This resulted in 130% achievement of target for the short-term incentive compensation plan and performance equity compensation for 2018.

-

- Compensation decisions for 2018: Our compensation decisions for 2018 are outlined below. These were intended to be consistent with our compensation philosophy, and were made with strong consideration for competitive market data and a variety of additional factors, including individual experience, expertise, performance and leadership, Group performance, and internal equity among the executives.

24 CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement

-

- Base salary: For 2018, as well as 2019, base salaries for NEOs were increased for the cost of living and, in some cases, performance. This is intended to compensate the individuals for job performance and overall leadership while maintaining salaries within the "competitive range" of the market data that is updated annually by the independent compensation consultant retained by the board.

|

Name |

2017 Base Salary |

2018 Base Salary |

Percent Increase |

2019 Base Salary |

Percent Increase |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | |

Martin A. Kropelnicki |

$ | 925,000 | $ | 958,000 | | 3.6 | $ | 987,000 | | 3.0 | ||||||

Thomas F. Smegal III |

427,000 | 442,000 | 3.5 | 457,500 | 3.5 | |||||||||||

Paul G. Townsley |

| 368,000 | | 391,000 | | 6.3 | | 405,000 | | 3.6 | ||||||

Robert J. Kuta |

322,000 | 334,000 | 3.7 | 347,500 | 4.0 | |||||||||||

Lynne P. McGhee |

| 293,000 | | 304,000 | | 3.8 | | 319,500 | | 5.1 | ||||||

| | | | | | | | | | | | | | | | | |

-

-

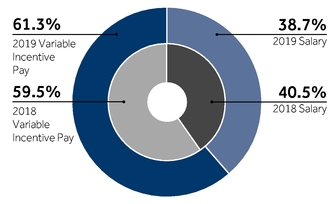

Short-term performance incentive award opportunity: For 2018, the

target opportunity for short-term incentives was increased to 100% of salary (from 85% in 2017) for our President & CEO, and 25% of base salary (from 20% in 2017) for all other executives. The

payout will range from 0% to 200% of target, based on actual performance.

-

- Performance and time-based equity compensation: Grant values for 2018 were unchanged from 2017 and 2016. For 2018, the Committee set the target total value for the equity compensation awards at $575,000 for our President & CEO, $150,000 for the Group's vice presidents, and $90,000 for all other executives, with 50% in the form of time-based RSAs vesting over three years and 50% in the form of performance-based RSUs with a three-year performance period vesting 0% to 200% based on performance of each metric for each year of the performance period aggregated to attain the three-year performance period's final achievement.

Role of the Organization and Compensation Committee

The Organization and Compensation Committee (Committee), which is comprised entirely of independent outside directors, is responsible for overseeing our compensation programs for executives and executive succession. After a review of compensation levels, the Committee recommends to the Board compensation levels and incentive performance objectives for executives for the 12-month period beginning January 1st of each year. These objectives align with stockholder and customer interests and support our long-term growth and health. The Committee starts its planning and review process in February of each preceding year and typically concludes its process in November. After year-end results are final, the Committee reviews the achieved results for the prior year, certifies the achievement of each goal, approves payment of incentive compensation as certified, and approves the incentive compensation targets for the current year.

CALIFORNIA WATER SERVICE GROUP | 2019 Proxy Statement 25

The following is a summary of the key features of our executive compensation program:

| WHAT WE DO | WHAT WE DON'T DO | |

|