DEF 14A: Definitive proxy statements

Published on April 15, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

|

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

|

o |

Preliminary Proxy Statement |

|

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

ý |

Definitive Proxy Statement |

|

|

o |

Definitive Additional Materials |

|

|

o |

Soliciting Material under §240.14a-12 |

|

| California Water Service Group | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

|

ý |

No fee required. |

|||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) |

Title of each class of securities to which transaction applies: |

|||

| (2) |

Aggregate number of securities to which transaction applies: |

|||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) |

Proposed maximum aggregate value of transaction: |

|||

| (5) |

Total fee paid: |

|||

|

o |

Fee paid previously with preliminary materials. |

|||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

| (2) |

Form, Schedule or Registration Statement No.: |

|||

| (3) |

Filing Party: |

|||

| (4) |

Date Filed: |

|||

California Water Service Group

California Water Service Company, Hawaii Water Service Company,

New Mexico Water Service Company, Washington Water Service Company,

CWS Utility Services, and HWS Utility Services

1720 North First Street

San Jose, CA 95112-4508

(408) 367-8200

April 15, 2020

Dear Fellow Stockholder:

You are cordially invited to attend our Annual Meeting of Stockholders at 9:30 a.m. Pacific Time on Wednesday, May 27, 2020. This year, we plan to hold the Annual Meeting online due to the public health impact of the novel coronavirus (COVID-19) and to support the health and well-being of our employees and stockholders. You will be able to attend and participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/CWT2020, where you will be able to listen to the meeting live, submit questions, and vote. We intend to return to an in-person annual meeting next year.

Enclosed please find a notice of matters to be voted on at the meeting, our Proxy Statement, a proxy card, and our 2019 Annual Report.

Whether or not you plan to attend, your vote is important. Please vote your shares as soon as possible in one of three ways: by Internet, by telephone, or by mail. Instructions regarding how to vote are included on the proxy card or voting instruction card.

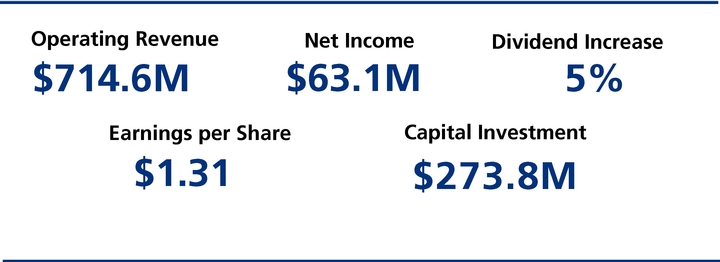

In a continuing effort to conserve natural resources and reduce costs, we produced a summary annual report again this year, opting not to duplicate the financial information that continues to be provided in our Form 10-K filed with the Securities and Exchange Commission. Your perspectives on the annual report are valuable to us. Please send your feedback to annualreport@calwater.com.

Thank you for your investment in the California Water Service Group.

Sincerely,

/s/ PETER C. NELSON

Peter C. Nelson

Chairman of the Board

TABLE OF CONTENTS |

California Water Service Group

Notice of Annual Meeting of Stockholders |

The 2020 Annual Meeting of Stockholders (Annual Meeting) of California Water Service Group (Group) will be held on Wednesday, May 27, 2020, at 9:30 a.m. Pacific Time. You will be able to attend and participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/CWT2020, where you will be able to listen to the meeting live, submit questions, and vote. At the Annual Meeting, stockholders will consider and vote on the following matters:

- 1.

- Election of the eleven directors named in the Proxy Statement;

- 2.

- An advisory vote to approve executive compensation;

- 3.

- Ratification of the selection of Deloitte & Touche LLP as the Group's independent registered public accounting firm for 2020; and

- 4.

- Such other business as may properly come before the Annual Meeting.

The Board of Directors has fixed the close of business on March 31, 2020 as the record date for the determination of holders of common stock entitled to notice of, and to vote at, the Annual Meeting.

Please submit a proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. You may submit your proxy: (a) by Internet, (b) by telephone, or (c) by U.S. Postal Service mail. You may revoke your proxy at any time prior to the vote at the Annual Meeting. Of course, in lieu of submitting a proxy, you may vote online during at the Annual Meeting. For specific instructions, please refer to "Questions and Answers about the Proxy Materials and the Annual Meeting" in this Proxy Statement and the instructions on the proxy card.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be Held on May 27, 2020:Electronic copies of the Group's Form 10-K, including exhibits, and this Proxy Statement will be available at www.proxyvote.com.

By Order of the Board of Directors

/s/ MICHELLE R. MORTENSEN

MICHELLE R. MORTENSEN

Corporate Secretary

April 15, 2020

At this time, we plan to hold the Annual Meeting entirely online. We are actively monitoring the public health and safety concerns relating to the novel coronavirus (COVID-19) and the advisories or mandates that federal, state, and local governments, and related agencies, may issue. Depending on developments relating to COVID-19, we may make alternative arrangements relating to the Annual Meeting, which could include changing the date and/or time of the meeting, or providing for the ability to attend the meeting in person as well as online if it is feasible to do so. We will announce any alternative arrangements for the meeting as promptly as practicable. Please monitor our Investor Relations website at http://ir.calwatergroup.com/ and check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

PROXY SUMMARY |

Information about our 2020 Annual Meeting of Stockholders

| Date and time: | Wednesday, May 27, 2020 at 9:30 a.m. Pacific Time | |

| Location: |

To attend and participate in the Annual Meeting visit www.virtualshareholdermeeting.com/CWT2020 |

|

|

Record Date: |

March 31, 2020 |

Voting matters Stockholders will be asked to vote on the following matters at the Annual Meeting:

| Items of Business |

Board's Recommendation |

Where to Find Details |

||||

| | | | | | | |

| 1. | Election of eleven directors | FOR all nominees | pp. 19-26 | |||

| | | | | | | |

| 2. | Advisory Vote on Executive Compensation | FOR | p. 72 | |||

| | | | | | | |

| 3. | Ratification of Deloitte & Touche LLP as the Group's independent registered public accounting firm | FOR | p. 76 | |||

| | | | | | | |

| | | | | | | |

| What's New |

|

| ||||

| | | | | | | |

| We continue to enhance our governance, compensation, and sustainability practices and disclosures. Among many other items, since last year California Water Service Group has: | ||||||

| ► | Formed the Enterprise Risk Management, Safety, and Security Committee | |||||

| ► | Environmental, social responsibility, and sustainability items are now overseen by the Nominating/Corporate Governance Committee | |||||

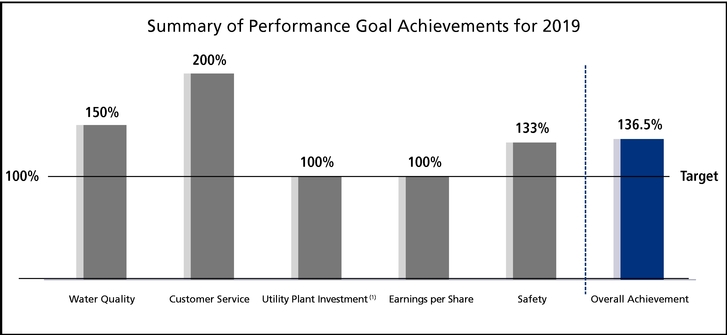

| ► | Modified the performance criteria used for the 2019 incentive compensation program as follows: | |||||

|

o Long-term performance-based equity compensation uses three performance metrics vesting over a three-year period from 2019 2021 |

||||||

|

o Short-term incentive compensation now uses five different performance metrics from the long-term performance-based equity compensation measures that are measured over fiscal year 2019 |

||||||

| | | | | | | |

Governance Highlights (PAGE 4)

Effective Board Leadership and Independent Oversight

- ►

- Election of two new independent directors in 2019

- ►

- Independent Lead Director with well-defined responsibilities

- ►

- Executive session led by independent Lead Director at Board meetings

- ►

- Ongoing review of the Board composition and succession planning

- ►

- Mandatory director retirement age 75

Overview of Corporate Governance

- ►

- Code of Conduct for Directors, Officers and Employees

- ►

- Clawback policy

- ►

- Stock ownership guidelines for directors and executive officers

- ►

- Prohibition on short sales, transactions in derivatives, and hedging and pledging of stock by directors and executive officers

- ►

- Annual election of all directors

- ►

- Majority voting for directors in uncontested elections

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 1

California Water Board of Directors (PAGE 4)

California Water's Board is composed of a diverse, experienced group of global thought, business, and academic leaders.

| | Director | | Committees | |||||||||||||

| | | | | | | | | | | | | | | | | |

| Name and Principal Occupation | Age | Since | Independent | A | C | F | NG | S | ||||||||

|

Gregory E. Aliff Former Vice Chairman and Senior Partner of U.S. Energy & Resources, Deloitte LLP |

66 | 2015 | YES | o | · | |||||||||||

| | | | | | | | | | | | | | | | | |

|

Terry P. Bayer Former COO of Molina Healthcare, Inc. |

69 | 2014 | YES | · | · | o | ||||||||||

| | | | | | | | | | | | | | | | | |

|

Shelly M. Esque Former Vice President and Global Director of Corporate Affairs of Intel Corporation |

59 | 2018 | YES | · | · | |||||||||||

| | | | | | | | | | | | | | | | | |

|

Martin A. Kropelnicki President & CEO of California Water Service Group |

53 | 2013 | | |||||||||||||

| | | | | | | | | | | | | | | | | |

|

Thomas M. Krummel, M.D. Emile Holman and Chair Emeritus of the Department of Surgery at Stanford University School of Medicine |

68 | 2010 | YES | o | · | |||||||||||

| | | | | | | | | | | | | | | | | |

|

Richard P. Magnuson Lead Director Venture Capitalist |

64 | 1996 | YES | · | · | o | ||||||||||

| | | | | | | | | | | | | | | | | |

|

Scott L. Morris Chairman of Avista Corporation |

62 | 2019 | YES | · | · | |||||||||||

| | | | | | | | | | | | | | | | | |

|

Peter C. Nelson Chairman of the Board of California Water Service Group |

72 | 1996 | | |||||||||||||

| | | | | | | | | | | | | | | | | |

|

Carol M. Pottenger Principal and Owner of CMP Global, LLC |

64 | 2017 | YES | · | · | · | ||||||||||

| | | | | | | | | | | | | | | | | |

|

Lester A. Snow Director and President of the Klamath River Renewal Corporation |

68 | 2011 | YES | · | · | o | ||||||||||

| | | | | | | | | | | | | | | | | |

|

Patricia K. Wagner Former Group President of U.S. Utilities for Sempra Energy |

57 | 2019 | YES | · | · | |||||||||||

| | | | | | | | | | | | | | | | | |

| Number of meetings held during 2019 | 4 | 3 | 4 | 4 | 2 | |||||||||||

| | | | | | | | | | | | | | | | | |

| o Chair | A: Audit | C: Organization and Compensation | F: Finance and Capital Investment | |||

| · Member | NG: Nominating/Corporate Governance | S: Enterprise Risk Management, Safety and Security | ||||

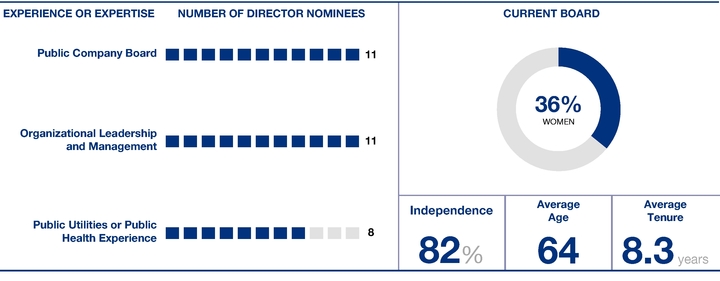

Optimal Mix of Skills and Experience of Director Nominees

California Water's directors collectively contribute significant experience in the areas most relevant to overseeing the Company's business and strategy.

2 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

Compensation Highlights (PAGE 41)

Our compensation program supports California Water's long-term business strategy and high value business model to create long-term shareholder value

| WHAT WE DO | | WHAT WE DON'T DO | ||||||

|

|

|

|||||||

| | | | | | | | | |

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 3

CORPORATE GOVERNANCE PRACTICES AT CALIFORNIA WATER SERVICE GROUP |

We are committed to objective, independent leadership for our Board and each of its committees. In addition, our Board believes the active, objective, and independent oversight of management is central to effective Board governance, and serves the best interests of all stakeholders, including customers, stockholders, regulators, suppliers, associates, and the general public.

Specifically, our Board has adopted Corporate Governance Guidelines comprised of rigorous governance practices and procedures. To maintain and enhance its independent oversight, our Board has implemented measures to further enrich Board composition, leadership, and effectiveness. These measures align our corporate governance structure with achieving our strategic objectives and enable our Board to effectively communicate and oversee our culture of compliance and in-depth risk management. Our Board frequently discusses business and other matters with the senior management team and principal advisors such as our legal counsel, auditors, consultants, and financial advisors. Our Board annually reviews and approves the Corporate Governance Guidelines and charters of the Board committees to ensure they reflect evolving best practices and regulatory requirements, including the New York Stock Exchange (NYSE) corporate governance listing standards. The Corporate Governance Guidelines and the current charters for the Audit, Organization and Compensation, Finance and Capital Investment, Nominating/Corporate Governance, and Enterprise Risk Management, Safety and Security committees are posted on our website at http://www.calwatergroup.com.

Board Structure and Independence

Our Board encompasses the optimal mix of diverse backgrounds, experiences, skills, expertise, and an uncompromising commitment to integrity and thorough judgment. The Board thoughtfully advises and guides management as they work to achieve our long-term strategic goals. To promote sound board structure and independence standards, our Board adheres to the following policies and procedures:

- ►

- Directors must retire no later than the Annual Meeting that follows the date of the director's 75th birthday.

- ►

- Our Board conducts an ongoing review of Board composition and succession planning, resulting in refreshment of the Board and a diversity of skills, attributes, and perspectives on the Board.

- ►

- Upon election at the annual meeting, the average tenure of the members of the Board will be approximately eight years.

- ►

- Our Board has a majority of independent directors.

In 2019, based upon the recommendation of the Nominating/Corporate Governance Committee, the Board has approved changes to the Committee memberships and elected Ms. Bayer as chair of the Finance and Capital Investment Committee.

4 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

Our Board is responsible for seeing that our organization is appropriately stewarding the resources entrusted to it and following legal and ethical standards. In addition, our Board has the fundamental and legal responsibility to provide oversight and accountability for the organization. By respecting the following key risk management principles, our Board provides a solid foundation of organizational oversight:

- ►

- Understands the organization's key drivers of success

- ►

- Continually assesses the risks in the organization's strategy

- ►

- Appropriately defines the role of the full Board and its standing committees specific to risk oversight

- ►

- Assesses the organization's risk management system including people and processes to ensure appropriateness and sufficient resources

- ►

- Works with management to understand and agree on the types (and format) of risk information the Board requires

- ►

- Encourages dynamic and constructive risk dialogue between management and the Board, including a willingness to challenge assumptions

- ►

- Closely monitors the potential risks to culture and the incentives structure

- ►

- Oversees the critical alignment of strategy, risk, controls, compliance, incentives, and people

Our director education about California Water Service Group, our strategy, control framework, regulatory environment, and our industry begins when a director is elected to our Board and continues throughout his or her tenure on the Board. Upon joining our Board, new directors are provided with a comprehensive orientation about our company which includes an overview of director duties and our corporate governance, one-on-one sessions with the Chairman and President and CEO, and presentations by senior management and other key management representatives on the organization's strategy, regulatory framework, and control framework. As directors are appointed to new committees or assume a leadership role, such as committee chair, they receive additional orientation sessions specific to such responsibilities.

Board and Committee presentations, educational briefings, discussions with subject matter experts on business, governance, regulatory, and control matters help to keep directors appropriately apprised of key developments in our business and in our industry, including material changes in regulation, so they can carry on their oversight responsibilities.

Peter C. Nelson has served as Chairman of the Board since 2012. The roles of Chairman of the Board and CEO for the organization are separate. Our Board believes separating these roles is the most appropriate leadership structure based on numerous factors, including the Board's historical practice (which has predominantly been to separate the roles), its assessment of the organization's leadership, and the organizations current and anticipated needs. The Board attributes a portion of the historical success of its leadership model to the Chairman of the Board's 17-plus years of service as the former President & CEO, including his industry knowledge and executive management skills, rather than by the particular leadership structure chosen. The Board believes that Mr. Nelson, who retired in 2013, brings significant experience in the water and public utility industries making him best positioned to lead the Board as it oversees and monitors implementation our business strategy, considers risks related to strategy and business decisions, and performs its oversight function.

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 5

Lead Independent Director

Our Lead Independent Director is selected from and by the independent directors, serves for a period of at least one year, and has expansive duties and authority as included in our Corporate Governance Guidelines.

Richard P. Magnuson currently serves as Lead Independent director. Our Corporate Governance Guidelines list the Lead Independent Director's responsibilities and authority including:

- ►

- Presides at meetings of the Board in the absence of the Chairman of the Board

- ►

- Recommends to the Chairman of the Board items for consideration to be included in the Board meeting agendas and schedules

- ►

- Serves as liaison between the Chairman of the Board and the independent directors

- ►

- Consults and communicates with major stockholders upon request

In evaluating candidates for Lead Independent Director, the independent directors consider several factors, including each candidate's corporate governance experience, board service and tenure, leadership roles, and the ability to meet the necessary time commitment. For an incumbent Lead Independent Director, the independent directors also consider the results of the annual Lead Independent Director assessment as described on Page 7.

As discussed in our Corporate Governance Guidelines, a substantial majority of the Board is comprised of independent directors. Currently, the Group's independent directors are Gregory E. Aliff, Terry P. Bayer, Shelly M. Esque, Thomas M. Krummel, M.D., Richard P. Magnuson, Scott L. Morris, Carol M. Pottenger, Lester A. Snow, and Patricia K. Wagner.

Under the listing standards of the New York Stock Exchange, a director is independent if he or she has no material relationship, whether commercial, industrial, banking, consulting, accounting, legal, charitable, familial, or otherwise, with the organization, either directly or indirectly as a partner, stockholder, or executive officer of an entity that has a material relationship with us. Our Board makes an affirmative determination regarding the independence of each director annually, based on the recommendation of the Nominating/Corporate Governance Committee.

The Board has adopted standards to assist in assessing the independence of directors, which are set forth in the Corporate Governance Guidelines, which are posted on our website at http://www.calwatergroup.com. Under these standards, our Board has determined that a director is not independent if:

| Director Independence |

- ►

- The director is, or has been within the last three years, an employee of any company that comprises the Group or an immediate family member is, or has been within the last three years, an executive officer of any company that comprises the Group;

- ►

- The director has received, or has an immediate family member who has received, during any 12-month period during the last three years, more than $120,000 in direct compensation from companies that comprise the Group, other than director or committee fees and pension or other forms of deferred compensation for prior service (compensation received by an immediate family member for service as an employee, other than an executive officer, of the Group is not considered for purposes of this standard);

- ►

- The director, or an immediate family member, is a current partner of the Group's internal or external auditor; the director is a current employee of such a firm; the director's immediate

6 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

family member is a current employee of such a firm who personally works on the Group's audit, or the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Group's audit within that time;

- ►

- The director, or an immediate family member, is, or has been within the last three years, employed as an executive officer of another company where any of the Group's present executive officers serves or served at the same time on that company's compensation committee;

- ►

- The director is a current employee, or has an immediate family member who is a current executive officer, of a customer or vendor or other party that has made payments to or received payments from companies that comprise the Group for property or services in an amount that, in any of the last three fiscal years, exceeded the greater of $1 million or 2% of the party's consolidated gross revenues; or

- ►

- The director, or the director's spouse, is an executive officer of a non-profit organization to which the Group makes, or in the past three years has made, payments that, in any single fiscal year, exceeded the greater of $1 million or 2% of the non-profit organization's consolidated gross revenues.

In addition, our Board has determined that none of the following relationships, by itself, is a material relationship that would impair a director's independence:

- ►

- Being a residential customer of any service territory;

- ►

- Being a current executive officer or employee of, or being otherwise affiliated with, a commercial customer from which the Group has received payments that, in any of the last three fiscal years, did not exceed the greater of (i) 1% of the Group's consolidated gross revenues for the year; or (ii) $500,000;

- ►

- Being a current executive officer or employee of, or having a 5% or greater ownership or similar financial interest in, a supplier or vendor that has received payments from the Group that, in any of the last three fiscal years, did not exceed the lesser of (i) 1% of the Group's consolidated gross revenues for the year; or (ii) $500,000; or

- ►

- Being a director of any of the Group's subsidiaries.

Directors inform the Board as to any relationships they may have with the organization and provide other pertinent information in annual questionnaires they complete, sign, and certify. The Board reviews relevant relationships to identify possible impairments to director independence and in connection with disclosure obligations. For those directors who reside in one of our service territories and are customers, our Board has determined that it is not a material relationship that would impair their independence under the above standards.

Annual Evaluation of Board, Committees and Independent Lead Director

Our Board and Committees maintain a regular and robust evaluation process to promote the effective functioning of our Board. It is important to examine Board, Committee, and director performance and to solicit and act upon feedback received from each member of our Board. The Board utilizes several long-standing corporate governance practices and processes to support evaluations, including annual assessments of the Board and its committees, annual assessments of the Lead Independent Director, annual assessments of individual directors, director questionnaires, and one-on-one discussions. Evaluations are intended to assess the effectiveness in board composition and conduct, meeting structure, materials and information, committee composition and effectiveness, strategic and succession planning, culture and exercise of oversight, as well as continued education and access to management.

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 7

Our Board believes our directors should possess a combination of skills, professional experience, and a diversity of backgrounds necessary to oversee our business. Also, the Board believes every director should possess certain attributes as reflected in the Board's membership criteria.

The Nominating/Corporate Governance Committee assesses the composition of and criteria for membership on the Board and its committees on an ongoing basis in consideration of our current and future business and operations. In fulfilling this responsibility, the Nominating/Corporate Governance Committee takes a long-term view and seeks a variety of occupational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the Board as a group. The Nominating/Corporate Governance Committee considers a variety of factors, including our long-term strategy, the skills and experiences that directors provide to the Board (including in the context of the our business strategy), the performance of the Board and the organization, the Board's director retirement policy, the Board's view that a balanced and effective board should include members across a continuum of tenure, and the belief that valuable insights can be gained from gender and ethnic diversity. As a result of these long-term strategic assessments, the Nominating/Corporate Governance Committee has articulated a set of principles on board composition, which include:

| | | | | | | | | |

| Board Composition |

|

| ||||||

| | | | | | | | | |

| Diversity | Our Board shall be comprised of members who demonstrate a diversity of thought, perspectives, skills, backgrounds and experiences, and have a goal of identifying candidates that can contribute to that diversity in a variety of ways, including ethnically and gender diverse candidates | |||||||

| | | | | | | | | |

| Board Skills | Our Board will have a collective set of skills to address management challenges, especially in the areas of business strategy, financial performance, risk management, cybersecurity, technology and enterprise innovation, and executive talent and leadership, and should evolve with the organization's business strategy | |||||||

| | | | | | | | | |

| Industry Experience | Our Board will seek and retain members with industry experience including water, utility and technology, that align with our long-term strategy; recognize the utility industry is complex and understand the importance of having directors who have witnessed challenging business cycles and can share the wisdom of those experiences | |||||||

| | | | | | | | | |

| Tenure | Our Board will seek and retain members across the director tenure spectrum to promote effective oversight, and embrace innovation, a changing market and customer expectations; seek to have a mix of long-standing members, relatively new members, and remaining members at different points along the tenure spectrum | |||||||

| | | | | | | | | |

| Board Size | Our Board will consider the appropriate size of the board in relation to promoting active engagement, open discussion and effective challenge of management; continuously assess the bench of successors for Board leadership positions in both expected and unexpected departure scenarios | |||||||

| | | | | | | | | |

The Nominating/Corporate Governance Committee's regular evaluation of the composition of, and criteria for membership on, the Board is ongoing. Incumbent directors eligible for re-election, nominees to fill vacancies on the Board, and any nominees recommended by stockholders all

8 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

undergo a strenuous review by the Committee. The Nominating/Corporate Governance Committee focuses on the development of a Board composed of directors that meet the criteria set forth below:

| | | | | | | | | |

| Director Criteria |

|

| ||||||

| | | | | | | | | |

| Personal Characteristics |

► High personal and professional ethics, integrity and honesty, good character and sound judgment ► Independence and absence of any actual or perceived conflicts of interest ► The ability to be an independent thinker |

|||||||

| | | | | | | | | |

| Commitment to the Organization |

► A willingness to put in the time and energy to satisfy the requirements of Board and committee membership, including attendance and participation in Board and committee meetings of which they are a member and

the annual meeting of stockholders and be available to management to provide advice and counsel ► Possess, or be willing to develop, a broad knowledge of critical issues facing the organization |

|||||||

| | | | | | | | | |

| Diversity | ► Diversity, including the candidate's professional and personal experience, background, perspective, and viewpoint; as well as the candidate's gender and ethnicity | |||||||

| | | | | | | | | |

| Skills and Experience |

► The value derived from each nominee's skills, qualifications, experience, and ability to impact long-term strategic objectives ► Solid educational background ► Substantial tenure and experience in leadership capacities ► Business and financial experience ► Understanding the intricacies of a public entity ► Experience in risk management ► Additionally, Section 2.9 of our bylaws contains requirements that a person must meet to avoid conflicts of interest that would disqualify that person from serving as a director. |

|||||||

| | | | | | | | | |

| Identification of Director Nominees | ► Through a variety of sources, the Nominating/Corporate Governance Committee identifies new director nominees and will consider director nominees recommended by stockholders in the same manner it considers other nominees. This process is described in "Director Qualifications and Diversity" and found elsewhere in this Proxy Statement. | |||||||

| | | | | | | | | |

| Retirement Age of Directors | ► We have established a mandatory retirement age for directors. A director must retire no later than the Annual Meeting that follows the date of the director's 75th birthday. An employee director must retire as an employee no later than the Annual Meeting that follows the date of his or her 70th birthday, but may remain on the Board at the discretion of the Board of Directors. | |||||||

| | | | | | | | | |

| Executive Sessions of the Board | ► Under our Corporate Governance Guidelines, the non-management directors meet at least four times each year in executive session without management present, and the independent directors meet in executive session at least once a year. The Lead Independent Director, Richard P. Magnuson, chairs these sessions. | |||||||

| | | | | | | | | |

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 9

Our directors as of April 15, 2020, are as follows:

| Name | Age | Position |

Current Term Expires |

Director Since |

Independent | Occupation |

Other Board Experience |

Public Utilities or Public Health Experience |

||||||||

| Gregory E. Aliff | 66 | Director | 2020 | 2015 | Yes | Former Vice Chairman and Senior Partner of U.S. Energy & Resources, Deloitte LLP | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

| Terry P. Bayer | 69 | Director | 2020 | 2014 | Yes | Former COO of Molina Healthcare, Inc. | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

| Shelly M. Esque | 59 | Director | 2020 | 2018 | Yes | Former Vice President and Global Director of Corporate Affairs of Intel Corporation | Yes | |||||||||

| | | | | | | | | | | | | | | | | |

| Martin A. Kropelnicki | 53 | President & CEO and Director | 2020 | 2013 | No | President & CEO of California Water Service Group | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

| Thomas M. Krummel, M.D. | 68 | Director | 2020 | 2010 | Yes | Emile Holman and Chair Emeritus of the Department of Surgery at Stanford University School of Medicine | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

| Richard P. Magnuson | 64 | Lead Director & Chair of the Board's Executive Sessions | 2020 | 1996 | Yes | Venture Capitalist | Yes | |||||||||

| | | | | | | | | | | | | | | | | |

| Scott L. Morris | 62 | Director | 2020 | 2019 | Yes | Chairman of Avista Corporation | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

| Peter C. Nelson | 72 | Chairman of the Board | 2020 | 1996 | No | Chairman of the Board of California Water Service Group | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

| Carol M. Pottenger | 64 | Director | 2020 | 2017 | Yes | Principal and Owner of CMP Global, LLC | Yes | |||||||||

| | | | | | | | | | | | | | | | | |

| Lester A. Snow | 68 | Director | 2020 | 2011 | Yes | Director and President of the Klamath River Renewal Corporation | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

| Patricia K. Wagner | 57 | Director | 2020 | 2019 | Yes | Former Group President of U.S. Utilities for Sempra Energy | Yes | Yes | ||||||||

| | | | | | | | | | | | | | | | | |

Identification of Director Nominees

Through a variety of sources, the Nominating/Corporate Governance Committee identifies new director nominees and will consider director nominees recommended by stockholders in the same manner it considers other nominees. This process is described in "Director Qualifications and Diversity" and found on page 9 in this Proxy Statement. Stockholders seeking to recommend nominees for consideration by the Nominating/Corporate Governance Committee should submit a recommendation in writing describing the nominee's qualifications and other relevant biographical information together with confirmation of the nominee's consent to serve as director. Please submit this information to the Corporate Secretary, California Water Service Group, 1720 North First Street, San Jose, California 95112-4508.

Stockholders may also propose director nominees by adhering to the advance notice procedure described under "Questions and Answers About the Proxy Materials and the Annual Meeting How can a stockholder propose a nominee for the Board or other business for consideration at a stockholders' meeting?" on page 83 in this Proxy Statement.

Under the Corporate Governance Guidelines, the full Board reviews and oversees our enterprise risk management program, including reviewing our enterprise risk portfolio and evaluating management's approach to addressing identified risks. The Board does not view risk in isolation, but

10 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

includes risk as part of its regular consideration of business decisions and business strategy. The Board exercises its risk oversight function through the Board as a whole and through its committees, which assist the Board in focusing on specific categories of risk relevant to the Group.

| | | | | | | | | |

| Board Committee | | Role and Oversight | | |||||

| | | | | | | | | |

| Audit | Oversees risks related to financial reporting and internal controls | |||||||

| | | | | | | | | |

| Organization and Compensation | Oversees periodic assessments of risks relating our compensation plans and programs to see that these plans and programs do not encourage management to take unreasonable risks relating to our business | |||||||

| | | | | | | | | |

| Finance and Capital Investment | Oversees risks within the capital investment programs | |||||||

| | | | | | | | | |

| Nominating/Corporate Governance | Oversees risks related to matters of corporate governance, including director independence and Board performance, as well as risks related to environmental, social responsibility, and sustainability matters | |||||||

| | | | | | | | | |

| Enterprise Risk Management, Safety and Security | Oversees management's development and execution of the Group's enterprise risk management, safety and security programs, including physical and cyber security. | |||||||

| | | | | | | | | |

The Group has a Management Committee (MC) that is chaired by our President & CEO and membership is comprised of our Group and subsidiary executives, hereafter collectively known as "executives" and meets monthly. Among other functions, the MC identifies and prioritizes key risks and recommends the implementation of appropriate mitigation measures, as needed. The MC provides reporting to the Audit Committee and Enterprise Risk Management, Safety, and Security Committee no less frequently than annually. Further review or reporting on risks is conducted as needed or as requested by the Board or committee.

All directors are expected to attend the Annual Meeting of Stockholders, unless attendance is prevented by an emergency. All of our board members who were directors as of the date of our 2019 Annual Meeting attended the meeting.

Board Meetings

Our policy is that all directors must be able to devote the required time to carry out director responsibilities and should attend all meetings of the Board and of committees on which they sit.

Members of the Board are expected to attend Board meetings in person, unless the meeting is held by teleconference. During 2019, there were nine meetings of the Board and collectively 17 committee meetings. The incumbent directors attended at least 75% of all Board and applicable committee meetings in 2019 (held during the period each director served). All then incumbent directors attended the 2019 annual meeting. Mr. Morris and Ms. Wagner joined the Board in November 2019.

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 11

Board Committees

There are five committees within our Board of Directors: (1) Audit; (2) Organization and Compensation; (3) Finance and Capital Investment; (4) Nominating/Corporate Governance; (5) and Enterprise Risk Management, Safety and Security. The membership and the function of each of these committees are described below.

Name |

Audit |

Organization and Compensation |

Finance and Capital Investment |

Nominating/ Corporate Governance |

Enterprise Risk Management, Safety and Security |

|||||

Gregory E. Aliff |

| o | | | | | · | |||

| | | | | | | | | | | |

Terry P. Bayer |

| · | | · | | o | | | ||

| | | | | | | | | | | |

Shelly M. Esque |

| | | | · | | · | |||

| | | | | | | | | | | |

Martin A. Kropelnicki |

| | | | | |||||

| | | | | | | | | | | |

Thomas M. Krummel, M.D. |

| | o | | | · | | |||

| | | | | | | | | | | |

Richard P. Magnuson |

| · | | | · | | o | | ||

| | | | | | | | | | | |

Scott L. Morris |

| | · | | | | · | |||

| | | | | | | | | | | |

Peter C. Nelson |

| | | | | |||||

| | | | | | | | | | | |

Carol M. Pottenger |

| | | · | | · | |

|

||

| | | | | | | | | | | |

Lester A. Snow |

| | · | | · | | | o | ||

| | | | | | | | | | | |

Patricia K. Wagner |

| · | | | | · | | |||

| | | | | | | | | | | |

Number of meetings held during 2019 |

| 4 | | 3 | | 4 | | 4 | | 2 |

| | | | | | | | | | | |

o Chair

![]() Vice Chair · Member

Vice Chair · Member

12 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

AUDIT COMMITTEE

| | | | | | | | | |

| AUDIT COMMITTEE | | Primary Responsibilities: | | |||||

| | | | | | | | | |

|

Current Members: Gregory E. Aliff, Chair Committee Meetings Held in 2019: 4 |

► Represents and assists the Board in oversight of the quality and integrity of the Company's financial statements, the Company's compliance with legal, environmental, regulatory and reporting requirements; the

qualifications, performance and independence of the Company's Independent Registered Public Accounting Firm; and the Company's internal audit function ► Responsible for the appointment, retention, compensation, and oversight of the Independent Registered Public

Accounting Firm ► Reviews with management each Form 10-K and 10-Q report required to be submitted to the

SEC ► Reviews annually the quality of internal accounting and financial controls, internal auditor

reports and opinions, and any recommendations the Independent Registered Public Accounting Firm may have for improving or changing the Company's internal controls ► Oversees and reviews with management risks related to the Company's financial reporting and internal controls ► Oversees the Company's compliance program with respect to legal and regulatory requirements,

including the Company's codes of conduct, and oversees the Company's policies and procedures for monitoring compliance The Board has determined that each Audit Committee member has considerable knowledge in financial and auditing matters to serve on the Audit Committee. Gregory E. Aliff, Terry P. Bayer, and Patricia K. Wagner meet the New York Stock Exchange listing standard of financial sophistication and are "audit committee financial experts" under SEC rules. |

|||||||

| | | | | | | | | |

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 13

ORGANIZATION AND COMPENSATION COMMITTEE

| | | | | | | | | |

|

ORGANIZATION & COMPENSATION COMMITTEE |

| Primary Responsibilities: | | |||||

| | | | | | | | | |

|

Current Members: Thomas M. Krummel, M.D., Chair Committee Meetings Held in 2019: 3 |

► Oversees the Company's officer compensation structure, policies and programs, assesses whether the Company's compensation structure establishes appropriate incentives for officers, and assesses the results of

the Company's most recent advisory vote on executive compensation ► Oversees the evaluation and recommendations of the compensation of the CEO to the independent directors and of the

executive officers to the Board of Directors ► Reviews the organizational structure for the Company's senior management ► Oversees a periodic assessment of the risk related to the Company's compensation policies and

practices applicable to offices and employees, and review the results ► Reviews and discusses with our management the Compensation Discussion and Analysis disclosure

required to be included in the proxy statement for the annual meeting of stockholders to be filed with the SEC and, based on such review and discussion, determines whether to recommend to the Board that the Compensation Discussion and Analysis

disclosure be included in such filing ► Oversees preparation of the Compensation Committee report required by SEC rules to be included in the proxy statement

for the annual meeting of stockholders All members are independent as defined in the listing standards of the New York Stock Exchange, and meet additional independence requirements for compensation committee members applicable under the New York Stock Exchange listing standards |

|||||||

| | | | | | | | | |

Compensation Consultant: The Organization and Compensation Committee retained Veritas Executive Compensation Consultants (Veritas) to advise it on marketplace trends in executive compensation, management proposals for the 2020 compensation program, and executive officer compensation decisions. Additionally, Veritas generally evaluated our equity compensation programs. Veritas also consulted with the Nominating/Corporate Governance Committee about its recommendations to the Board on director compensation. Veritas has been retained for advice on 2021 executive compensation.

Veritas was directly accountable to the Organization and Compensation Committee. To maintain the independence of their advice, Veritas did not provide any services to us other than those described above. In addition, the Organization and Compensation Committee conducted a conflict of interest assessment, considering the six factors below with respect to Veritas and no conflict of interest was identified:

- ►

- The provision of other services to the Group by Veritas;

- ►

- The amount of fees received from the Group by Veritas, as a percentage of total revenue of Veritas;

- ►

- The policies and procedures of Veritas that are designed to prevent conflicts of interest;

- ►

- Any business or personal relationship between the consultants at Veritas with whom the Group work and any members of the Organization and Compensation Committee;

14 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

- ►

- Any of our stock owned by the Veritas consultants; and

- ►

- Any business or personal relationship of Veritas or the Veritas consultants with any of the Group's executive officers.

For a description of the processes and procedures used by the Organization and Compensation Committee for the consideration and determination of executive compensation, see "Compensation Discussion and Analysis" on page 41 in this Proxy Statement.

FINANCE AND CAPITAL INVESTMENT COMMITTEE

| | | | | | | | | |

|

FINANCE AND CAPITAL INVESTMENT COMMITTEE |

| Primary Responsibilities: | | |||||

| | | | | | | | | |

|

Current Members: Terry P. Bayer, Chair Committee Meetings Held in 2019: 4 |

► Assists the Board of Directors in fulfilling its oversight responsibilities with respect to the monitoring and oversight of our financial resources, including its capital investment management and rate recovery

and resolution planning and processes ► Assists the Board in reviewing our financial policies, strategies, and capital structure ► Reviews and make recommendations to the Board for approval, where authority to do so has been

delegated by the Board, regarding:

o long-term financial objectives and policies

o financing requirements and financing plans

o the annual dividend plan

o oversight of the annual operating budgets

o oversight of the annual capital investment plans including periodic updates on the progress over the annual construction and capital investment programs efforts to increase stockholder value

o reports received from the employee benefit finance committee

o other finance matters as appropriate In addition, the Committee will discuss with management the policies and procedures concerning the major risk exposures and the steps management has taken and/or proposes to take to monitor, mitigate, and control such exposures within the capital investment process. All members are independent as defined in the listing standards of the New York Stock Exchange. |

|||||||

| | | | | | | | | |

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 15

NOMINATING/CORPORATE GOVERNANCE COMMITTEE

| | | | | | | | | |

|

NOMINATING/CORPORATE GOVERNANCE COMMITTEE |

| Primary Responsibilities: | | |||||

| | | | | | | | | |

|

Current Members: Richard P. Magnuson, Chair Committee Meetings Held in 2019: 4 |

► Oversees director succession planning and identifies individuals qualified to become Board members ► Oversees risks related to maters of corporate governance, including director independence and Board performance ► Recommends to the Board the size, structure, composition, and functioning of the Board and its

committees ► Reviews the compensation of directors for service on the Board and its committees and recommends

changes to the Board as appropriate ► Reviews the Corporate Governance Guidelines annually and recommends changes to the Board ► Oversees the Company's Code of Business Conduct and Ethics for Directors and compliance with the

code ► Provides oversight of and reviews the Company's strategy, policies, practices, risks, and

disclosures with respect to ESG matters, and makes recommendations to management as appropriate ► Assists management in overseeing internal and external communications with employees, investors,

and other stakeholders regarding the Company's position on or approach to ESG matters All members are independent as defined in the listing standards of the New York Stock Exchange. |

|||||||

| | | | | | | | | |

16 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

ENTERPRISE RISK MANAGEMENT, SAFETY AND SECURITY COMMITTEE

| | | | | | | | | |

|

ENTERPRISE RISK MANAGEMENT, SAFETY AND SECURITY COMMITTEE |

| Primary Responsibilities: | | |||||

| | | | | | | | | |

|

Current Members: Lester A. Snow, Chair Committee Meetings Held in 2019: 2 |

► Assists the Board in reviewing our enterprise risk management, safety, and security programs, including physical and cyber security ► Reviews with management our principal risks and the effectiveness of the processes used by

management to both identify and analyze major risk, as well as the effectiveness of the programs to manage and mitigate risks ► Reviews with management our risk assessments, the steps management has taken or would consider

taking to minimize such risks or exposures, safeguarding assets, and our underlying policies with respect to risk assessment, risk management, and asset protection ► Discusses with management current and emerging applicable matters that may affect the business, operations,

performance, or public image of the organization or are otherwise pertinent to us and our stakeholders ► Reviews our Emergency Preparedness program, including emergency response and coordination with

authorities ► Reviews our security programs, including physical and cybersecurity to ensure preventive

detection and remedial controls and processes are in place ► Oversees our compliance with Defense Finance and Accounting Services (DFAS), the National

Institute of Standards and Technology (NIST) Cybersecurity framework, and other applicable standards ► Makes recommendations to the Board and to our senior management with respect to any of the above matters as the

Committee deems necessary or appropriate All members are independent as defined in the listing standards of the New York Stock Exchange. |

|||||||

| | | | | | | | | |

Other Governance Best Practices

We adopted other practices we believe reflects our commitment to good corporate governance including:

Policies Prohibiting Hedging and Pledging

In accordance with our Insider Trading Policy, our directors and executives are prohibited from (i) hedging their ownership of Group stock, including trading in options, puts, calls, or other derivative instruments related to Group stock or debt; and (ii) pledging their ownership of Group stock.

Executive Compensation Recovery ("Clawback") Policy

Our Board has adopted an executive compensation recovery, or "clawback," policy requiring the reimbursement of excess incentive-based compensation provided to the executives in the event of

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 17

certain restatements of our financial statements. A more detailed description of the Executive Compensation Recovery Policy appears in the "Compensation Discussion and Analysis" section of this Proxy Statement.

Stock Ownership Requirements

Our Board has adopted stock ownership requirements for directors and executives. These stock ownership requirements were adopted to promote a long-term perspective of the organization and to help align the interests of our stockholders, directors, and executives. As of March 31, 2020, 17 of our non-employee directors and executives have met or exceeded their ownership requirements. New directors have five years to meet the requirements and executives must retain 50% of the net after-tax shares from equity awards until the relevant ownership requirement is achieved. A complete description of the stock ownership requirements for directors and executives appears in the "Compensation Discussion and Analysis" section of this Proxy Statement.

18 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

PROPOSAL NO. 1 ELECTION OF DIRECTORS |

Upon the recommendation of the Nominating/Corporate Governance Committee, our Board has nominated for election at the 2020 Annual Meeting of Stockholders a slate of eleven director nominees. All of the nominees, except Mr. Morris and Ms. Wagner, have served as directors since the last Annual Meeting. Mr. Morris and Ms. Wagner were recommended to the Nominating/Corporate Governance Committee by a third-party search firm and elected to our Board effective November 27, 2019. All directors are elected annually to serve until the next Annual Meeting or until their respective successors are elected.

When an incumbent director is up for re-election, the Nominating/Corporate Governance Committee reviews the performance, skills, and characteristics of such incumbent director before making a determination to recommend the Board nominate him or her for re-election.

The Nominating/Corporate Governance Committee believes that all of the following eleven director nominees listed are highly qualified and have the skills and experience required for membership on our Board. A description of the specific experience, qualifications, attributes and skills that led our Board to conclude that each of the nominees should serve as a director follows the biographical information of each nominee.

Each director must be elected by the affirmative vote of a majority of the votes cast. A majority of the votes cast means that the number of votes cast "FOR" a director nominee exceeds the number of votes cast "AGAINST" that nominee for director.

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 19

Our Board of Directors unanimously recommends that you vote "FOR" the election of each of the following nominees:

| | | | | | | | | |

| | Gregory E. Aliff | | | | ||||

| | | | | | | | | |

Independent Age: 66 Director Since 2015 Committees: ► Chair, Audit ► Enterprise Risk Management, Safety and Security Previous Board Directorships: ► SCANA Corporation ► Grid Alternatives ► United States Energy Association Current Board Directorship: ► New Jersey Resources Corp |

Retired Mr. Aliff is a retired Vice Chairman and Senior Partner, US Energy and Resources, at Deloitte LLP. From 2012 to his retirement in 2015, Mr. Aliff led Deloitte's US Sustainability Services, which focused on industrial and commercial water and energy management. From 2002 to 2012, he led Deloitte's US Energy and Resources practice, where he oversaw all professional services to the sector. Mr. Aliff earned his Bachelor of Science in Accounting and his Master of Business Administration from Virginia Tech. He is a Certified Public Accountant and is a designated Board Leadership Fellow of the National Association of Corporate Directors (NACD). He also holds a CERT Certificate in Cybersecurity Oversight from NACD. Mr. Aliff brings extensive accounting, auditing, and financial reporting experience to the Board, with specific expertise in both the public utility and energy and resources industries. He has in-depth experience in strategy, enterprise risk management, and regulatory affairs from his many years providing professional services to numerous major utilities. Mr. Aliff's deep understanding of public utility markets and the breadth of experience he has gained from working with public companies make him a valuable resource to the Board. |

|||||||

| | | | | | | | | |

20 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

| | | | | | | | | |

| Terry P. Bayer | | | | |||||

| | | | | | | | | |

Independent Age: 69 Director Since 2014 Committees: ► Chair, Finance and Capital Investment ► Organization & Compensation ► Audit Previous Board Directorship: ► Apria Healthcare Group, Inc. |

Retired Ms. Bayer is the former Chief Operating Officer (COO) for Molina Healthcare, Inc., a managed care company that provides solutions to meet the healthcare needs of low-income individuals and families who participate in government programs, including Medicaid, Medicare, and Marketplace. She held that position from 2005 until her retirement in February 2018. She was previously Executive Vice President of Health Plan Operations and also held management positions at Family Health Plan (FHP), Maxicare, Matria Healthcare, and AccentCare, Inc. She holds a Juris Doctor Degree from Stanford University, a master's degree in Public Health from the University of California, Berkeley, and a bachelor's degree in Communication from Northwestern University. Ms. Bayer brings senior leadership, financial, operational, and public health expertise to the Board from her service as the COO of Molina Healthcare, Inc., a public company. She has many years of experience as an operating executive with a strong focus on government program compliance, public health and administration, as well as customer service. Ms. Bayer's significant background and experience in healthcare supports the Board's efforts in overseeing and advising on employee health matters. Her previous experience as a director of Apria Healthcare Group, Inc. and her compliance and compensation committee memberships also allows Ms. Bayer to contribute to the Board. |

|||||||

| | | | | | | | | |

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 21

| | | | | | | | | |

| Shelly M. Esque | | | | |||||

| | | | | | | | | |

Independent Age: 59 Director Since 2018 Committees: ► Nominating/Corporate Governance ► Enterprise Risk Management, Safety and Security |

Retired Ms. Esque, prior to her retirement in 2016, served as Vice President and Global Director of Corporate Affairs at Intel Corporation, a leader in the semiconductor industry, overseeing professionals in more than 35 countries responsible for enhancing Intel's reputation as the world's leading technology brand and corporate citizen. She also served as both president and chair of the Intel Foundation. In her capacity as a leader of Intel's corporate social responsibility, community, education, foundation, and government relations worldwide, Ms. Esque represented Intel at numerous events, including the World Economic Forum, World Bank, UNESCO, and forums promoting women in the workplace. Ms. Esque received the Greater Phoenix Chamber of Commerce 2011 ATHENA Businesswoman of the Year Award for excellence in business and leadership, exemplary community service, and support and mentorship of other women. She was also recognized by AZ Business Magazine as one of the 50 Most Influential Women in Arizona. Ms. Esque is active on many non-profit boards, including Basis Charter Schools, Take the Lead, and the Boyce Thompson Arboretum, among others. |

|||||||

| | | | | | | | | |

22 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

| | | | | | | | | |

| | Martin A. Kropelnicki | | | | ||||

| | | | | | | | | |

Age: 53 Director Since 2013 |

President & CEO, California Water Service Group Mr. Kropelnicki is President & CEO of the Group. Mr. Kropelnicki joined the Group as Vice President, Chief Financial Officer (CFO) and Treasurer in 2006 and was named the President and COO in 2012. He then was appointed President & CEO of the Group effective September 1, 2013. He has over 30 years of experience in finance and operations, including 15-plus years as CFO at public listed companies and has held executive positions at PowerLight Corporation, Hall Kinion & Associates, Deloitte & Touche Consulting Group, and Pacific Gas & Electric Company. He serves as a director for the Bay Area Council, and the California Foundation on the Environment & Economy, and is a member of the Silicon Valley Leadership Group. Mr. Kropelnicki is the past President of the National Association of Water Companies and currently serves on their Board of Directors. He holds a Bachelor of Arts Degree and Master of Arts Degree in Business Economics from San Jose State University. In 2016, Mr. Kropelnicki was awarded the United States Navy Memorial Fund's Naval Heritage Award. He is the 12th recipient of this award since its inauguration. Mr. Kropelnicki is well positioned to lead the Group's management team and give guidance and perspective to the Board. His experience as the former CFO of the Group provides expertise in both corporate leadership and financial management. His 15-plus years as a CFO of publicly listed companies and operations management experience enables him to offer valuable perspectives to our corporate planning, rate making, and budgeting along with operational and financial reporting. |

|||||||

| | | | | | | | | |

| | | | | | | | | |

| Thomas M. Krummel, M.D. | | | | |||||

| | | | | | | | | |

Independent Age: 68 Director Since 2010 Board Committees:

► Chair, Organization & Compensation ► Nominating/Corporate Governance |

Emile Homan and Chair Emeritus, Department of Surgery, Stanford University Dr. Krummel is a leader in his field. He has been honored with the Henry J. Kaiser Family Foundation Award for Excellence in Clinical Teaching; the John Austin Collins, M.D. Memorial Award for Outstanding Teaching and Dedication to Resident Training; and the Lucile Packard Children's Hospital Recognition of Service Excellence. He is currently Chair of the Board of Directors at The Fogarty Institute for Innovation and serves as a Director of The Morgridge Institute for Research University of Wisconsin. Dr. Krummel brings to the Board experience with professional training and development, as well as expertise with medical, public health, and science issues. He offers the Board unique insight on public health matters, including healthcare policy and legislation, drinking water quality, and employee health. |

|||||||

| | | | | | | | | |

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 23

| | | | | | | | | |

| Richard P. Magnuson | | | | |||||

| | | | | | | | | |

|

Board Committees:

► Chair, Nominating/Corporate Governance ► Audit ► Finance and Capital Investment Previous Board ► Rogue Wave Software ► IKOS System, Inc. ► OrCAD |

Private Venture Capitalist Mr. Magnuson is a private venture capitalist and our Lead Independent Director. Mr. Magnuson holds an undergraduate degree in economics, a law degree and a master's degree in business administration from Stanford University. From 1984 to 1996, he was a general partner of Menlo Ventures, a venture capital firm. In addition to his previous public company experience, Mr. Magnuson has served on the boards of several privately held companies. With his legal and venture capital background, Mr. Magnuson brings valuable financial and business strategy expertise to the Board. His past experience on the boards of other public companies, as well as his insight on financial and operational matters, adds value to the Board. His past and current Board service also provides insight on corporate governance practices. |

|||||||

| | | | | | | | | |

| | | | | | | | | |

| Scott L. Morris | | | | |||||

| | | | | | | | | |

|

Committees: ► Organization & Compensation ► Enterprise Risk Management, Safety and Security Current Board Directorship: ► McKinstry |

Chairman, Avista Corporation Mr. Morris has been Chairman of Avista Corporation, a publicly traded electrical and natural gas utility serving customers primarily in the Pacific Northwest, since January 2008. From January 2008 to October 1, 2019, he also served as Avista's CEO. From January 2008 to January 2018 he served as its President. From May 2006 to December 2007, he served as its President and Chief Operating Officer. Mr. Morris joined Avista in 1981 and his experience at the company includes management positions in construction and customer service and general manager of the company's Oregon utility business. He is a graduate of Gonzaga University and received his master's degree from Gonzaga University in organizational leadership. He also attended the Stanford Business School Financial Management Program and the Kidder Peabody School of Financial Management. Mr. Morris serves on the board of McKinstry and on the Board of Trustees of Gonzaga University. He has served on a number of Spokane nonprofit and economic development boards. Mr. Morris brings to the Board a deep knowledge and understanding of the utility industry, having spent his entire career in the industry. As a former senior executive, he also contributes senior leadership experience and valuable perspectives on strategy, operations and business management. |

|||||||

| | | | | | | | | |

24 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

| | | | | | | | | |

| Peter C. Nelson | | | | |||||

| | | | | | | | | |

|

Chairman, California Water Service Group Mr. Nelson is Chairman of the Board of the Group and its subsidiaries. He is a director of the California Chamber of Commerce and a past president of the National Association of Water Companies (NAWC). Mr. Nelson has a strong record of operational and strategic leadership in the public utility business, including his 17-plus years of experience as the former President & CEO of the Group. An engineer by training with a graduate degree in business administration, he gained extensive senior executive experience at Pacific Gas & Electric Company. He has a vast understanding of the water industry from his role as the former President & CEO of the Group and from his leadership roles representing the water profession nationally at NAWC as well as in California at the State Chamber of Commerce. |

|||||||

| | | | | | | | | |

| | | | | | | | | |

| Carol M. Pottenger | | | | |||||

| | | | | | | | | |

|

Committees: ► Vice Chair, Enterprise Risk Management, Safety and Security ► Finance and Capital Investment ► Nominating/Corporate Governance |

Principal and Owner, CMP Global, LLC As principal and owner of CMP Global LLC, Ms. Pottenger's organization, which was founded in 2014, provides consulting services in business development, process improvement, corporate governance, strategic planning, and cyber and information systems. The first female three-star Admiral in American

history to lead in a combat branch, Ms. Pottenger commanded two ships, a logistic force of 30 ships, a Japan-based strike-group of 8 ships, and the Expeditionary Force of 40,000 sailors during her 36 years in the U.S. Navy before retiring

in 2013. She was also the senior U.S. Flag Officer responsible for military transformation and sensitive military topics such as counterterrorism and cyber security while on assignment with NATO. Ms. Pottenger brings unique experience to the board, ranging from operations to technology to risk management. A graduate of Purdue University in Lafayette, Indiana, she also serves on various private, defense, and non-profit boards, including the U.S. Navy Memorial Foundation in Washington, D.C. and PricewaterhouseCoopers LLP Board of Partners and Principals. |

|||||||

| | | | | | | | | |

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 25

| | | | | | | | | |

| Lester A. Snow | | | | |||||

| | | | | | | | | |

|

Committees: ► Chair, Enterprise Risk Management, Safety and Security ► Finance and Capital Investment ► Organization & Compensation |

Retired Mr. Snow has served as Secretary of the California Natural Resources Agency, Director of

the California Department of Water Resources, Regional Director of the U.S. Bureau of Reclamation, Executive Director of the CALFED Bay Delta Program, and General Manager of the San Diego County Water Authority. He served as Executive Director of the

California Water Foundation, an initiative of the Resources Legacy Fund, and serves on the board of the Klamath River Renewal Corporation. He holds a Master of Science Degree in Water Resources Administration from the University of Arizona and a

Bachelor of Science Degree in Earth Sciences from Pennsylvania State University. Mr. Snow brings more than 30 years of water and natural resource management experience to the Board. His distinguished public service career enables him to assist the Board in addressing water and environmental issues as well as regulatory and public policy matters. Mr. Snow's executive experience in the public sector provides the Board with critical insight on a variety of operational and financial matters. |

|||||||

| | | | | | | | | |

| | | | | | | | | |

| Patricia K. Wagner | | | | |||||

| | | | | | | | | |

|

Committees: ► Audit ► Nominating/Corporate Governance Previous Board Directorship: ► SoCalGas Current Board Directorship: ► Apogee Enterprises |

Retired Ms. Wagner, prior to her retirement in 2019, served as Group President, U.S. Utilities for Sempra Energy, an energy-services holding company whose subsidiaries include San Diego Gas & Electric Company (SDG&E) and Southern California Gas Company (SoCalGas), both California regulated utilities, as well as other companies operating in the electric and gas infrastructure business. Prior to her role as Group President, from 2017 to 2018 she served as Chairman and Chief Executive Officer of SoCalGas, one of the largest natural gas utilities in the country. She served as Executive Vice President of Sempra Energy in 2016, and as President and Chief Executive Officer of Sempra U.S. Gas & Power from 2014 to 2016. During her 24-year career in the utility sector, Ms. Wagner held a range of other leadership positions, including: Vice President of Audit Services for Sempra Energy; Vice President of Accounting and Finance for SoCalGas; Vice President of Information Technology for SoCalGas and SDG&E; and Vice President of Operational Excellence for SoCalGas and SDG&E. Ms. Wagner is currently a director of Apogee Enterprises, Inc., a public company that designs and develops commercial glass and metal products. Ms. Wagner earned her Master of Business Administration from Pepperdine University and a bachelor's degree in chemical engineering from California State Polytechnic University, Pomona. Ms. Wagner has immense working knowledge and familiarity with the California regulatory environment and has worked with the California Public Utilities Commission. Her deep understanding of regulatory affairs and experience working for an investor-owned utility make her a valuable asset to the Group. She also brings valuable accounting and finance, senior leadership and operational experience to the Board. |

|||||||

| | | | | | | | | |

26 CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement

For Fiscal Year Ended 2019

Our non-employee directors receive retainers comprised of both a cash award and an equity award along with meeting fees for their service. The Nominating/Corporate Governance Committee is responsible for non-employee director compensation and makes recommendations to the Board. For 2019, the Nominating/Corporate Governance retained the services of Veritas for determining non-employee director compensation.

Our 2019 director compensation program is summarized in the table below:

|

||||

Board Retainers: |

||||

Annual Base Retainer All Directors |

$ | 63,600 | ||

| | | | | |

Chairman of the Board Retainer |

$ | 60,000 | ||

| | | | | |

Lead Director Retainer |

$ | 22,000 | ||

| | | | | |

Committee Chair Retainers: |

||||

Audit Committee Chair Retainer |

$ | 18,000 | ||

| | | | | |

Organization and Compensation Committee Chair Retainer |

$ | 13,500 | ||

| | | | | |

Nominating/Corporate Governance Committee Chair Retainer |

$ | 12,500 | ||

| | | | | |

Finance and Risk Management Committee Chair Retainer |

$ | 10,000 | ||

| | | | | |

Enterprise Risk Management, Safety and Security Committee Chair Retainer |

$ | 11,000 | ||

| | | | | |

Enterprise Risk Management, Safety and Security Committee Vice Chair Retainer |

$ | 5,500 | ||

| | | | | |

Board/Committee Meeting Attendance Fees: |

||||

Chairman of the Board Board Attendance Fee |

$ | 4,600 | ||

| | | | | |

All other Directors Board Attendance Fee |

$ | 2,300 | ||

| | | | | |

Chairman of the Board Committee Attendance Fee |

$ | 1,800 | ||

| | | | | |

All other Directors Committee Attendance Fees |

$ | 1,800 | ||

| | | | | |

Equity: |

||||

Annual RSA Equity Grants(1) |

$ | 80,000 | ||

| | | | | |

- (1)

- In 2019, non-employee directors received grants of restricted stock valued at $80,000 as the Board retainer. The restricted stock grants were made on March 5, 2019, and were fully vested on the first anniversary of the grant date.

In September of 2019, Veritas provided assistance to the Nominating/Corporate Governance Committee in the annual review of director compensation, with recommendations based on competitive positioning, both in terms of individual compensation components and total compensation. With consideration for this review, the Nominating/Corporate Governance Committee approved increases to the foregoing amounts, effective January 1, 2020, as follows:

- ►

- Non-employee directors will receive an annual base retainer of $65,500 (an increase from $63,600 in 2019) and a grant of restricted stock valued at $87,500 (an increase from $80,000 in 2019)

- ►

- Chair retainers for the Audit Committee, the Organization and Compensation Committee, the Nominating/Corporate Governance Committee, Finance and Capital Investment Committee, and the Enterprise Risk Management, Safety and Security Committee will be unchanged, at $18,000, $13,500, $12,500, $10,000, and $11,000, respectively

- ►

- The vice chair retainer for the Enterprise Risk Management, Safety and Security Committee will be unchanged at $5,500

- ►

- Board and committee meeting fees for the chairman and other non-employee directors will remain unchanged for 2020

CALIFORNIA WATER SERVICE GROUP | 2020 Proxy Statement 27

- ►

- The chairman will receive a Board retainer of $65,500 and a chairman retainer of $60,000 for 2020

- ►

- The lead director will receive a $25,000 retainer (an increase from $22,000 in 2019) due to continued increased responsibilities, including stockholder engagement

The Board of Directors requires non-employee directors to maintain a certain amount of stock ownership consistent with our stock ownership requirements. Pursuant to the Group's Corporate Governance Guidelines, available on the Group's website at http://www.calwatergroup.com, beneficial ownership of an aggregate amount of shares having a value of five times the amount of the annual base retainer is required. Non-employee directors are required to achieve the relevant ownership threshold within five years following adoption of the requirements or five years after commencing service, whichever is later. The Nominating/Corporate Governance Committee will review compliance with these requirements for non-employee directors on an annual basis.