DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on May 9, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

California Water Service Group

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

STEADY AT THE HELM California Water Service Group 2023 Stockholder Outreach

2022 Performance Highlights GROUP OPERATIONS • Continued enhancement of the Group’s safety organization and programs, making safety a top priority • Closed acquisitions in Hawaii, New Mexico, Texas, and Washington, adding approximately 4,000 customers • Completed purchase agreements with three utilities serving approximately 980 customers in Hawaii, New Mexico, and Washington • Secured regulatory approval on four acquisitions in California, Hawaii, and Washington, which is expected to add approximately 2,900 customers upon closing • Named one of “America’s Most Responsible Companies” by Newsweek magazine for 2023, ranking second among water utilities and 127 th overall among all companies nationwide • Increased spending with diverse vendors to 24% in California FINANCIAL • Achieved net income of $96.0 million and diluted EPS of $ 1.77 (each determined in accordance with GAAP ) • Increased annual dividend by 8.7%, representing our 55 th consecutive annual dividend increase • Invested approximately $328 million of capital in accordance with our infrastructure improvement program • Raised net proceeds from stock sales of $106.7 million through at - the - market equity program and employee stock purchase program • Maintained Group’s strong credit rating of A+ stable and AA− for first mortgage bonds from Standard & Poor’s

2022 Performance Highlights, cont. EMPLOYEE RETENTION & DEVELOPMENT • Supported the growth of our employees by defining career maps, offering educational resources, and connecting program members with a trained mentor through our new Operations Leadership Program • Provided unconscious bias training to 95% of our employees • Increased presence in diverse recruiting channels and engaged prospective employees through multiple career fairs, including military - , disability - , and minority - focused career fairs • Received recertification as a Great Place to Work® by Great Place to Work® Institute for seventh consecutive year REGULATORY • Secured more than $10 million in grants to minimize rate impacts of critical water supply projects in disadvantaged communities • Led a coalition of diverse interests in supporting passage of legislation in California that restores water utilities’ ability to propose decoupling in future proceedings before the Commission

Highly Qualified, Diverse Director Nominees GREGORY E. ALIFF Former Vice Chairman and Senior Partner of U.S. Energy & Resources, Deloitte LLP SHELLY M. ESQUE Former Vice President and Global Director of Corporate Affairs, Intel Corporation MARTIN A. KROPELNICKI President and CEO of California Water Service Group THOMAS M. KRUMMEL, M.D. Emile Homan Professor and Chair Emeritus, Surgery Department, Stanford University School of Medicine YVONNE A. MALDONADO, M.D. Professor of Global Health and Infectious Diseases, Departments of Pediatrics and Epidemiology and Population Health, Stanford University SCOTT L. MORRIS Chairman, Avista Corporation CAROL M. POTTENGER Principal and Owner of CMP Global, LLC, and Retired U.S. Navy Vice Admiral LESTER SNOW Former Director of California Department of Water Resources PATRICIA WAGNER Former Group President, U.S. Utilities, Sempra Energy

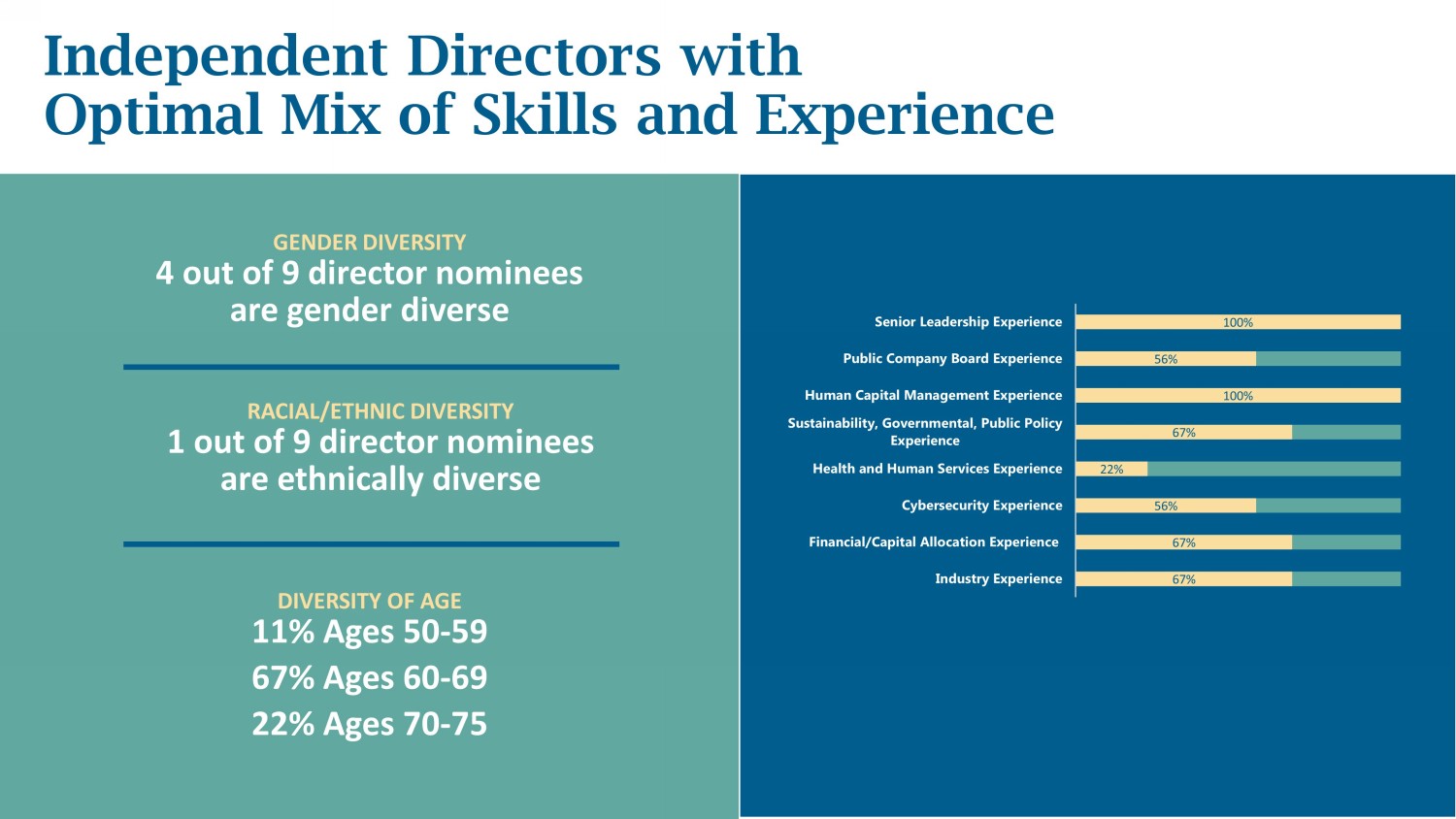

Independent Directors with Optimal Mix of Skills and Experience GENDER DIVERSITY 4 out of 9 director nominees are gender diverse RACIAL/ETHNIC DIVERSITY 1 out of 9 director nominees are ethnically diverse DIVERSITY OF AGE 11% Ages 50 - 59 67% Ages 60 - 69 22% Ages 70 - 75 67% 67% 56% 22% 67% 100% 56% 100% Industry Experience Financial/Capital Allocation Experience Cybersecurity Experience Health and Human Services Experience Sustainability, Governmental, Public Policy Experience Human Capital Management Experience Public Company Board Experience Senior Leadership Experience

Governance Practices Promote Long - Term Focus and Strengthen Accountability EFFECTIVE BOARD LEADERSHIP & INDEPENDENT OVERSIGHT • Independent Lead Director with well - defined responsibilities • Substantial majority of independent directors and all - independent committees • Executive sessions led by independent Lead Director at Board meetings • Ongoing review of Board composition and succession planning • Focus on diversity, experience, skills, and attributes that enhance our Board • Mandatory director retirement at age 75 OVERVIEW OF CORPORATE GOVERNANCE • Code of Conduct for directors, officers, and employees • Compensation clawback policy • Stock ownership guidelines for executive officers and directors • Prohibition on short sales, transactions in derivatives, and hedging and pledging of stock by directors and executive officers • Annual review of committee assignments and committee chairs • Annual committee assessments • Integrated active risk management with strong Board oversight, including ESG oversight by Nominating/Corporate Governance Committee • Annual, anonymous board self - assessment; outside counsel synthesizes responses which are shared with the Nominating/Corporate Governance Committee and Board STOCKHOLDER RIGHTS • No dual - class common stock structure • Annual election of all directors • Majority voting for directors in uncontested elections • No supermajority voting requirements in governing documents • Stockholder right at 10% threshold to call a special meeting • Annual advisory vote for say - on - pay

Environmental, Social, and Governance HIGHLIGHTS Annual framework - aligned reporting on material ESG topics* * Full ESG reports and data downloads may be accessed at https://www.calwatergroup.com/esg/reports - documents . ESG PROGRAM HIGHLIGHTS ESG - related metrics integrated into long - term at - risk compensation program Top - to - bottom ESG governance framework and policies Comprehensive greenhouse gas disclosures and climate change strategy Short and long - term ESG goals integrated into strategic planning process PROGRESS SINCE 2022 IN KEY ESG FOCUS AREAS • Completed an updated inventory of our greenhouse gas emissions in accordance with the Greenhouse Gas Protocol and committed to setting absolute, science - based Scope 1 and Scope 2 emissions reduction targets in 2024. • Invested approximately $328 million in infrastructure to improve resiliency, water quality, and sustainability. • Developed and refined contingency plans for operating our water treatment plants impacted by climate change - driven events, including fires, floods, and droughts. • Invested more than $6.1 million in water conservation rebates and programs for customers, helping them save about 180 million gallons of water. • Hosted 20 Emergency Operations Center training engagements in collaboration with communities across our service areas, better preparing us and our communities for enhanced coordination and resilience during emergency events. • Contributed more than $1.58 million to charitable organizations working to enhance the quality of life in our communities. • Hosted seven events in our communities to help low - income customers take advantage of our rate assistance and other programs. • Provided unconscious bias training to 95% of our employees. • Conducted surveys and focus groups to measure employee engagement, and developed a more formal and robust employee communication strategy.

Management of Cybersecurity Risk COLLABORATION Partnering with: • Cybersecurity & Infrastructure Security Agency (CISA ) • DHS • FBI • USEPA • Fusion Centers • WaterISAC • Various state Office of Emergency Services …for information sharing and incident response support COMPLIANCE Adopted and following cyber frameworks from: • National Institute of Standards and Technology (NIST ) • Payment Card Industry Data Security Standard • California Privacy Rights Act (CPRA • Defense Federal Acquisition Regulation Supplement (DFARS) GOVERNANCE Quarterly updates to the Board of Directors and Audit Committee is a major part of Group’s emergency risk management program and risk interdependency analysis TACTICS, TECHNIQUES, AND PROCEDURE Employing: • 24/7 network monitoring • Annual network penetration testing • Employee cybersecurity awareness program • Software patching program • Annual cyber tabletop exercises • Ongoing review and exercise of business continuity plan THE CYBERSECURITY LANDSCAPE FOR CRITICAL INFRASTRUCTURE OPERATORS, INCLUDING THE WATER AND WASTEWATER SECTOR, CONTINUES TO EVOLVE. THE GROUP RECOGNIZES THIS AND HAS CONTINUED TO INVEST IN OUR CYBER INFRASTRUCTURE

Total Compensation Philosophy for Executives GOAL: Providing compensation that attracts, retains, and motivates talented officers We believe a balance of fixed and variable compensation components, with short - and long - term compensation elements, maintains a strong link between NEOs’ compensation and overall Group’s performance while promoting interests of both customers and stockholders without incentivizing excessive risk - taking. Additionally, our executive compensation program considers the following factors: • Overall financial and operating performance of our company • Changes in market conditions, cost of living differences , market trends, and inflation • Each officer’s performance and contributions to achievement of short - and long - term financial goals and operational milestones • Each NEO’s job responsibilities, expertise, historical compensation, and years and level of experience • Our overall succession planning and importance of retaining each NEO, and each NEO’s potential to assume greater responsibilities in the future • Peer group benchmarking data and compensation analyses

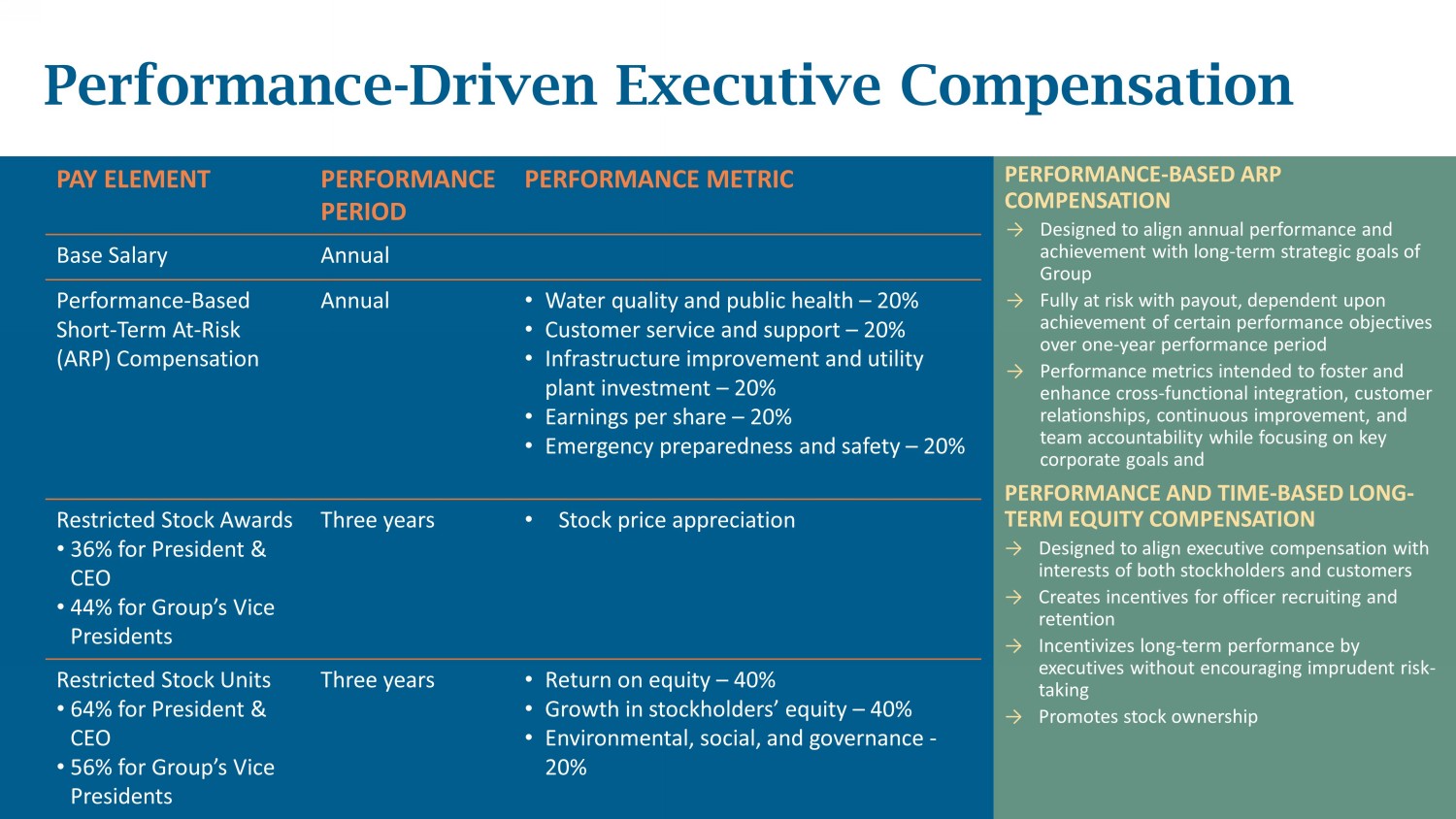

Performance - Driven Executive Compensation PERFORMANCE - BASED ARP COMPENSATION → Designed to align annual performance and achievement with long - term strategic goals of Group → Fully at risk with payout, dependent upon achievement of certain performance objectives over one - year performance period → Performance metrics intended to foster and enhance cross - functional integration, customer relationships, continuous improvement, and team accountability while focusing on key corporate goals and PERFORMANCE AND TIME - BASED LONG - TERM EQUITY COMPENSATION → Designed to align executive compensation with interests of both stockholders and customers → Creates incentives for officer recruiting and retention → Incentivizes long - term performance by executives without encouraging imprudent risk - taking → Promotes stock ownership PAY ELEMENT PERFORMANCE PERIOD PERFORMANCE METRIC Base Salary Annual Performance - Based Short - Term At - Risk (ARP) Compensation Annual • Water quality and public health – 20% • Customer service and support – 20% • Infrastructure improvement and utility plant investment – 20% • Earnings per share – 20% • Emergency preparedness and safety – 20% Restricted Stock Awards • 36% for President & CEO • 44% for Group’s Vice Presidents Three years • Stock price appreciation Restricted Stock Units • 64% for President & CEO • 56% for Group’s Vice Presidents Three years • Return on equity – 40% • Growth in stockholders’ equity – 40% • Environmental, social, and governance - 20 %

Commitment to Stockholder Engagement & Responsiveness to Feedback Recent governance and executive compensation changes include: GOVERNANCE • Formed Enterprise Risk Management, Safety, and Security Committee • Included oversight of environmental, social, and governance (ESG) items by Nominating/Corporate Governance Committee • Adopted four new policies: Environmental Sustainability; Diversity, Equality, and Inclusion; Political Engagement; and Human Rights • Published our second ESG report with disclosure aligned with Sustainability Accounting Standards Board (SASB) Water Utilities & Services Industry Standards and in reference to Global Reporting Initiate (GRI) standards • Included an ESG metric in the 2020, 2021, and 2022 long - term at - risk compensation program for the three - year performance periods 2020 - 2022 , 2021 – 2023, and 2022 – 2024 COMPENSATION • Continued emphasis on allocating long - term equity compensation to performance - based equity awards • Modified performance criteria used for short - and long - term equity compensation programs • Revised methodologies used to determine our Supplemental Executive Retirement Plan’s (SERP) actuarial assumptions and amended the plan, increasing plan’s unreduced retirement age from 60 to 65 • Conducted independent, third - party review of: • President and CEO’s compensation • Executive short - and long - term at - risk compensation programs • Proxy peer group • Updated our peer group to reflect industry changes We received 92% of the votes cast on the Say - on - Pay advisory vote taken at the 2022 Annual Meeting of Stockholders

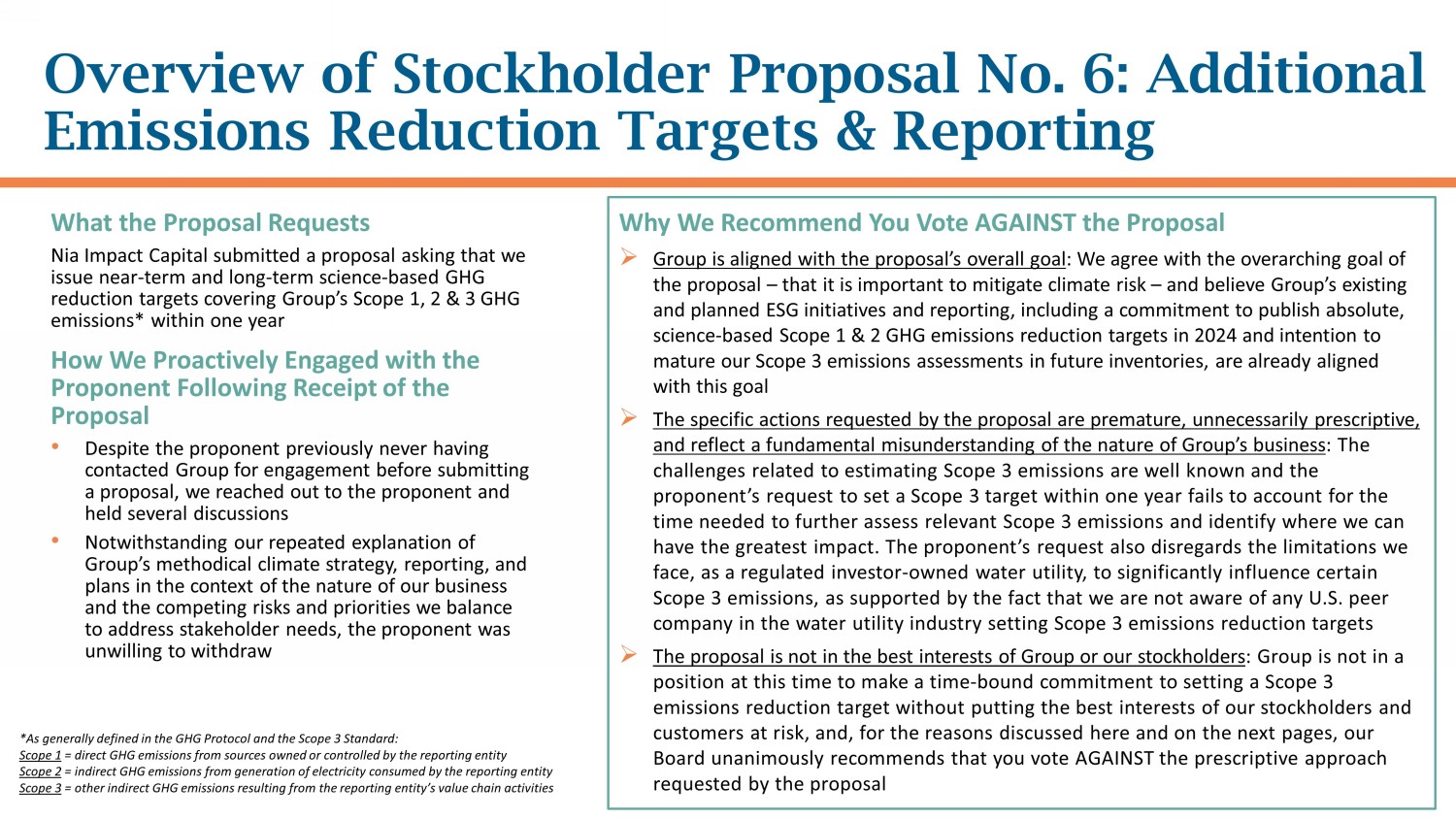

Overview of Stockholder Proposal No. 6: Additional Emissions Reduction Targets & Reporting Why We Recommend You Vote AGAINST the Proposal » Group is aligned with the proposal’s overall goal : W e agree with the overarching goal of the proposal – that it is important to mitigate climate risk – and believe Group’s existing and planned ESG initiatives and reporting, including a commitment to publish absolute, science - based Scope 1 & 2 GHG emissions reduction targets in 2024 and intention to mature our Scope 3 emissions assessments in future inventories, are already aligned with this goal » The specific actions requested by the proposal are premature, unnecessarily prescriptive, and reflect a fundamental misunderstanding of the nature of Group’s business : The challenges related to estimating Scope 3 emissions are well known and the proponent’s request to set a Scope 3 target within one year fails to account for the time needed to further assess relevant Scope 3 emissions and identify where we can have the greatest impact. The proponent’s request also disregards the limitations we face, as a regulated investor - owned water utility, to significantly influence certain Scope 3 emissions, as supported by the fact that we are not aware of any U.S. peer company in the water utility industry setting Scope 3 emissions reduction targets » The proposal is not in the best interests of Group or our stockholders : Group is not in a position at this time to make a time - bound commitment to setting a Scope 3 emissions reduction target without putting the best interests of our stockholders and customers at risk, and, for the reasons discussed here and on the next pages, our Board unanimously recommends that you vote AGAINST the prescriptive approach requested by the proposal *As generally defined in the GHG Protocol and the Scope 3 Standard: Scope 1 = direct GHG emissions from sources owned or controlled by the reporting entity Scope 2 = indirect GHG emissions from generation of electricity consumed by the reporting entity Scope 3 = other indirect GHG emissions resulting from the reporting entity’s value chain activities What the Proposal Requests Nia Impact Capital submitted a proposal asking that we issue near - term and long - term science - based GHG reduction targets covering Group’s Scope 1, 2 & 3 GHG emissions* within one year How We Proactively Engaged with the Proponent Following Receipt of the Proposal • Despite the proponent previously never having contacted Group for engagement before submitting a proposal, we reached out to the proponent and held several discussions • Notwithstanding our repeated explanation of Group’s methodical climate strategy, reporting, and plans in the context of the nature of our business and the competing risks and priorities we balance to address stakeholder needs, the proponent was unwilling to withdraw

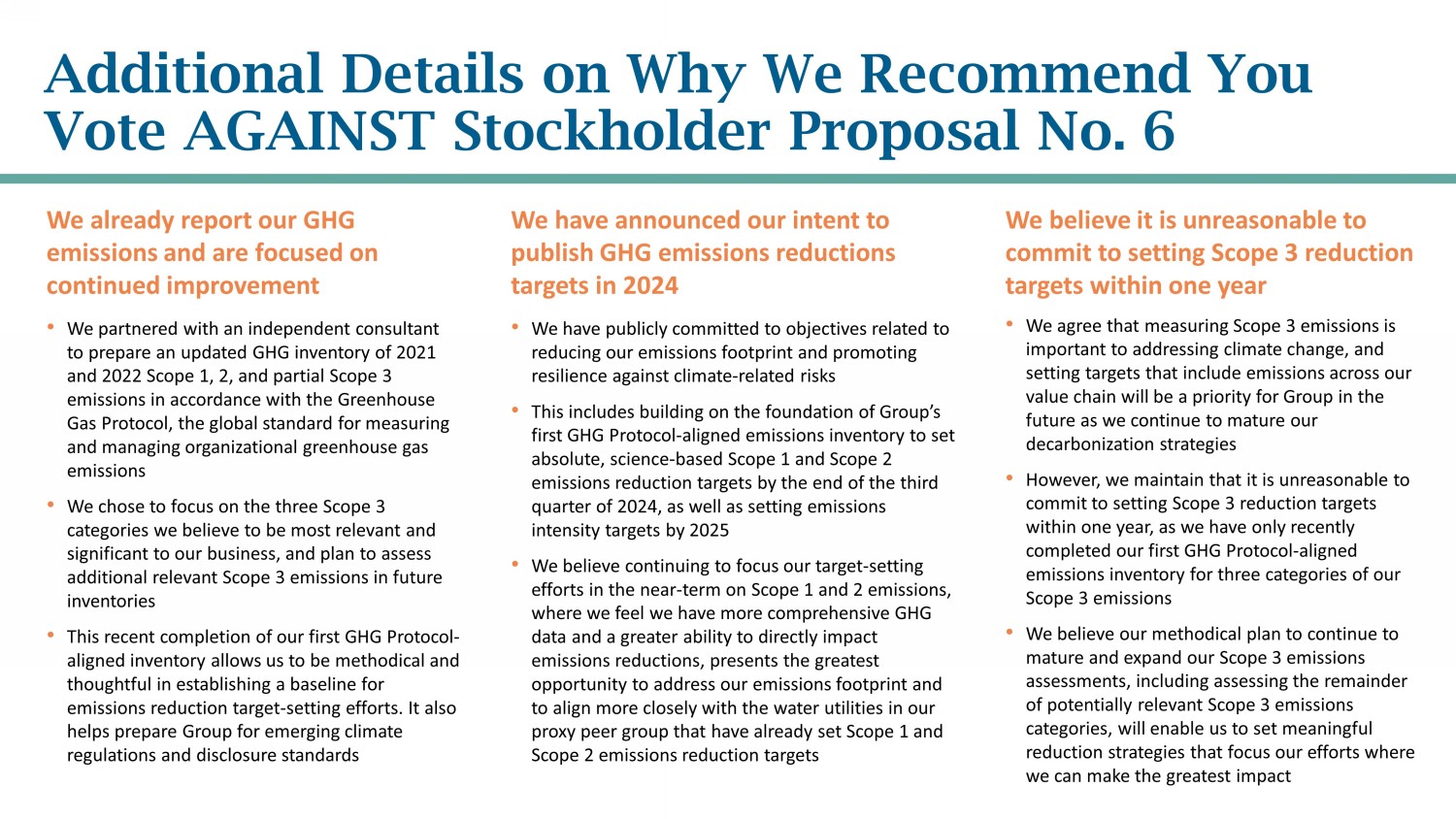

Additional Details on Why We Recommend You Vote AGAINST Stockholder Proposal No. 6 We already report our GHG emissions and are focused on continued improvement • We partnered with an independent consultant to prepare an updated GHG inventory of 2021 and 2022 Scope 1, 2, and partial Scope 3 emissions in accordance with the Greenhouse Gas Protocol, the global standard for measuring and managing organizational greenhouse gas emissions • We chose to focus on the three Scope 3 categories we believe to be most relevant and significant to our business, and plan to assess additional relevant Scope 3 emissions in future inventories • This recent completion of our first GHG Protocol - aligned inventory allows us to be methodical and thoughtful in establishing a baseline for emissions reduction target - setting efforts. It also helps prepare Group for emerging climate regulations and disclosure standards We have announced our intent to publish GHG emissions reductions targets in 2024 • We have publicly committed to objectives related to reducing our emissions footprint and promoting resilience against climate - related risks • This includes building on the foundation of Group’s first GHG Protocol - aligned emissions inventory to set absolute, science - based Scope 1 and Scope 2 emissions reduction targets by the end of the third quarter of 2024, as well as setting emissions intensity targets by 2025 • We believe continuing to focus our target - setting efforts in the near - term on Scope 1 and 2 emissions, where we feel we have more comprehensive GHG data and a greater ability to directly impact emissions reductions, presents the greatest opportunity to address our emissions footprint and to align more closely with the water utilities in our proxy peer group that have already set Scope 1 and Scope 2 emissions reduction targets We believe it is unreasonable to commit to setting Scope 3 reduction targets within one year • We agree that measuring Scope 3 emissions is important to addressing climate change, and setting targets that include emissions across our value chain will be a priority for Group in the future as we continue to mature our decarbonization strategies • However, we maintain that it is unreasonable to commit to setting Scope 3 reduction targets within one year, as we have only recently completed our first GHG Protocol - aligned emissions inventory for three categories of our Scope 3 emissions • We believe our methodical plan to continue to mature and expand our Scope 3 emissions assessments, including assessing the remainder of potentially relevant Scope 3 emissions categories, will enable us to set meaningful reduction strategies that focus our efforts where we can make the greatest impact LA0

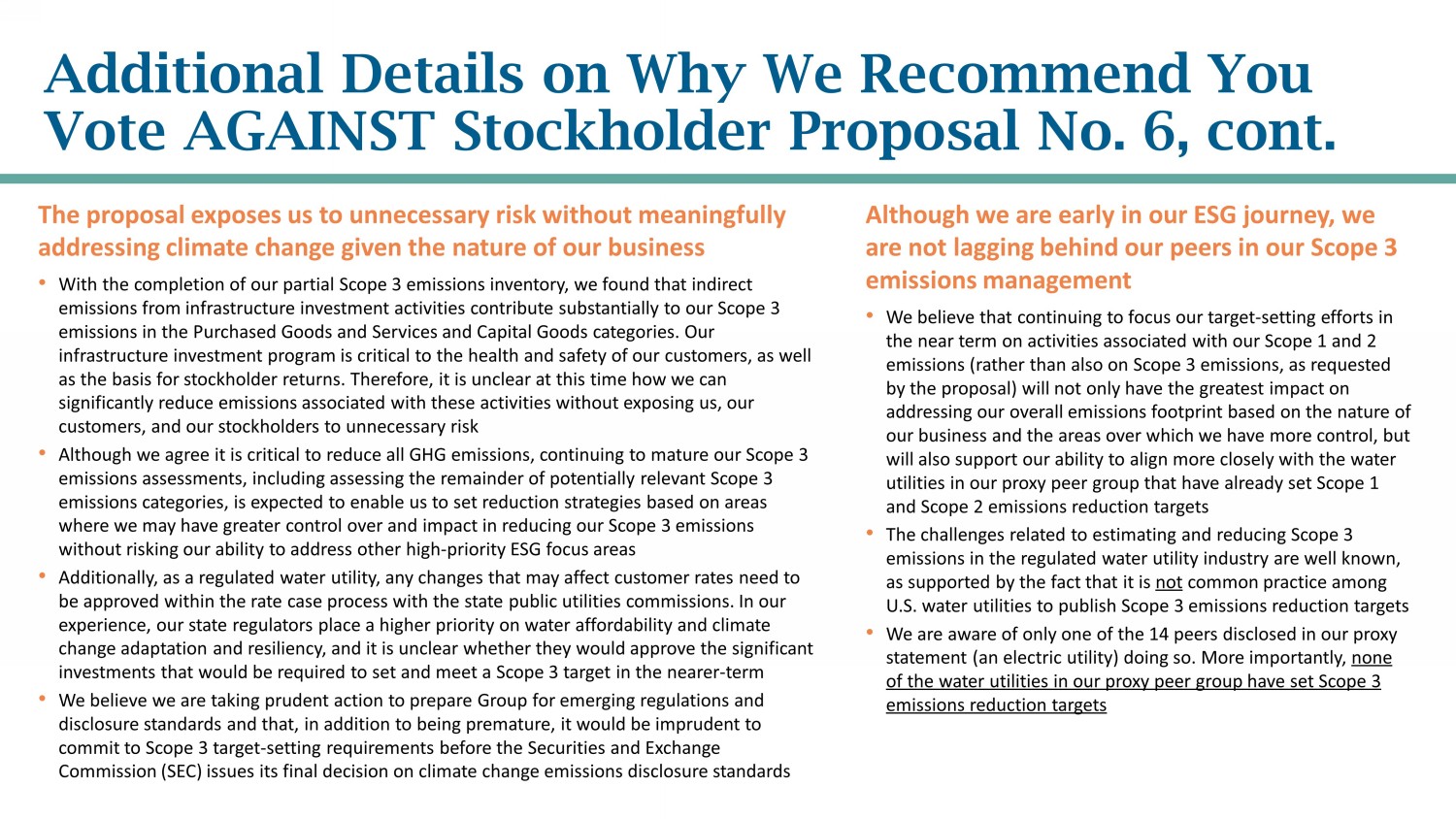

Additional Details on Why We Recommend You Vote AGAINST Stockholder Proposal No. 6, cont. The proposal exposes us to unnecessary risk without meaningfully addressing climate change given the nature of our business • With the completion of our partial Scope 3 emissions inventory, we found that indirect emissions from infrastructure investment activities contribute substantially to our Scope 3 emissions in the Purchased Goods and Services and Capital Goods categories. Our infrastructure investment program is critical to the health and safety of our customers, as well as the basis for stockholder returns. Therefore, it is unclear at this time how we can significantly reduce emissions associated with these activities without exposing us, our customers, and our stockholders to unnecessary risk • Although we agree it is critical to reduce all GHG emissions, continuing to mature our Scope 3 emissions assessments, including assessing the remainder of potentially relevant Scope 3 emissions categories, is expected to enable us to set reduction strategies based on areas where we may have greater control over and impact in reducing our Scope 3 emissions without risking our ability to address other high - priority ESG focus areas • Additionally, as a regulated water utility, any changes that may affect customer rates need to be approved within the rate case process with the state public utilities commissions. In our experience, our state regulators place a higher priority on water affordability and climate change adaptation and resiliency, and it is unclear whether they would approve the significant investments that would be required to set and meet a Scope 3 target in the nearer - term • We believe we are taking prudent action to prepare Group for emerging regulations and disclosure standards and that, in addition to being premature, it would be imprudent to commit to Scope 3 target - setting requirements before the Securities and Exchange Commission (SEC) issues its final decision on climate change emissions disclosure standards Although we are early in our ESG journey, we are not lagging behind our peers in our Scope 3 emissions management • We believe that continuing to focus our target - setting efforts in the near term on activities associated with our Scope 1 and 2 emissions (rather than also on Scope 3 emissions, as requested by the proposal) will not only have the greatest impact on addressing our overall emissions footprint based on the nature of our business and the areas over which we have more control, but will also support our ability to align more closely with the water utilities in our proxy peer group that have already set Scope 1 and Scope 2 emissions reduction targets • The challenges related to estimating and reducing Scope 3 emissions in the regulated water utility industry are well known, as supported by the fact that it is not common practice among U.S. water utilities to publish Scope 3 emissions reduction targets • We are aware of only one of the 14 peers disclosed in our proxy statement (an electric utility) doing so. More importantly, none of the water utilities in our proxy peer group have set Scope 3 emissions reduction targets

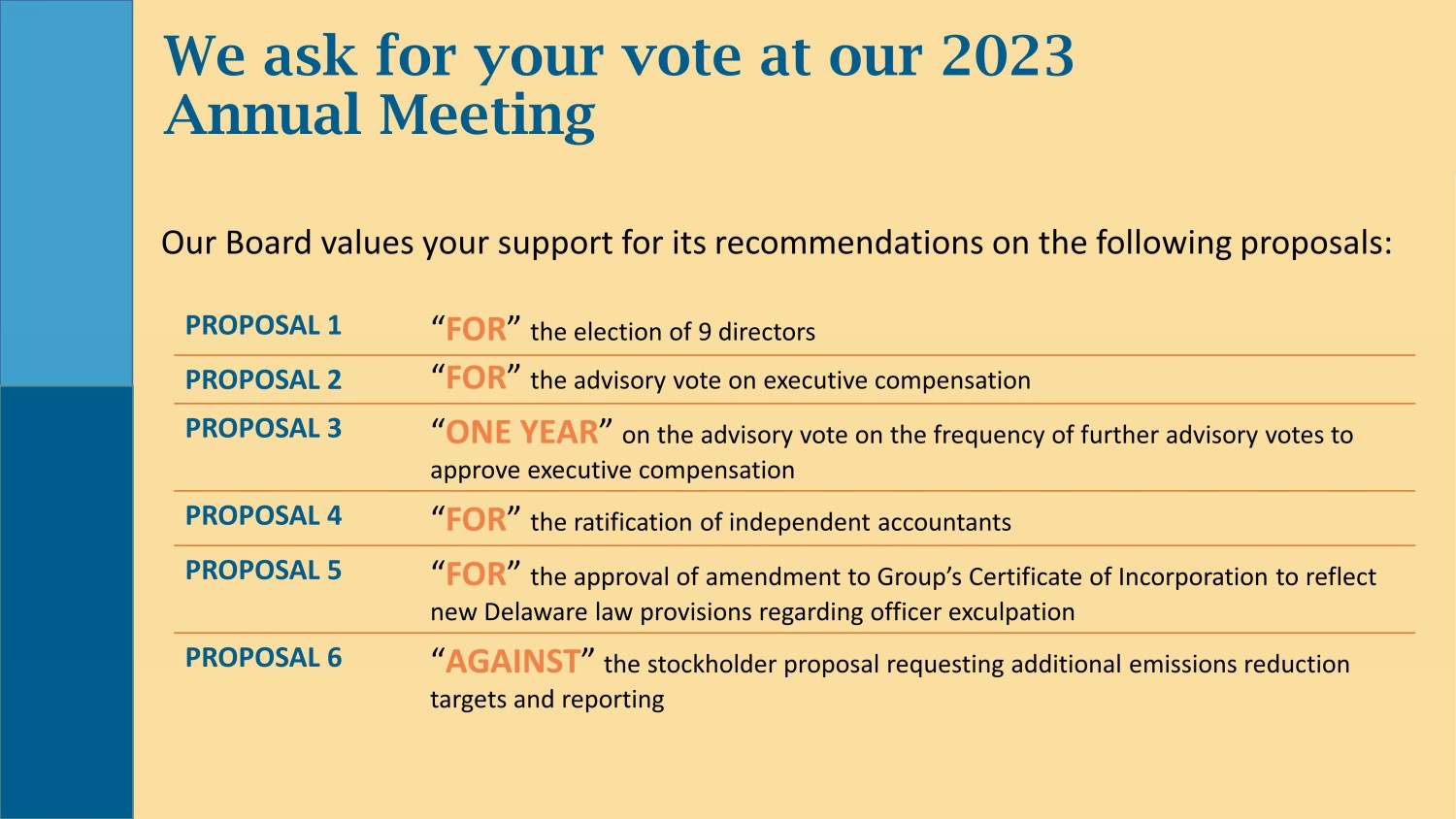

We ask for your vote at our 2023 Annual Meeting Our Board values your support for its recommendations on the following proposals: PROPOSAL 1 “ FOR ” the election of 9 directors PROPOSAL 2 “ FOR ” the advisory vote on executive compensation PROPOSAL 3 “ ONE YEAR ” on the advisory vote on the frequency of further advisory votes to approve executive compensation PROPOSAL 4 “ FOR ” the ratification of independent accountants PROPOSAL 5 “ FOR ” the approval of amendment to Group’s Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation PROPOSAL 6 “ AGAINST ” the stockholder proposal requesting additional emissions reduction targets and reporting

Forward - Looking Statements and Other Important Information This presentation and the materials referred to herein, such as the 2022 ESG Report and ESG Analyst Download ( collectively the “ESG Disclosures”), contain forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995. The forward - looking statements in this presentation and the ESG Disclosures include Group's objectives, beliefs, goals, targets, progress, or expectations with respect to ESG, sustainability, and corporate social responsibility matters, and business risks, opportunities, and plans. Because they are a spi rational and are based upon currently available information, expectations, and projections, they are subject to various risks and uncertainties, including limitations on our ab ility to make ESG investments without the support of our regulators, and actual results may differ. Because of this, Group advises all interested parties to carefully read and un der stand Group's disclosure on risks and uncertainties found in Forms 10 - K, 10 - Q, and other reports filed with the SEC. Group undertakes no obligation to update any forward - looking or other statements, whether as a result of new information, future events, or otherwise, and notwithstanding any historical practice of doing so. Group may determine to ad jus t any objectives, goals, and targets or establish new ones to reflect changes in our business. Historical, current, and forward - looking ESG - related statements and data in this presentation and the ESG Disclosures may be bas ed on standards for measuring progress that are still developing, controls and processes that continue to evolve, and assumptions that are subject to change in the future. The information included in, and any issues identified as material for purposes of, this presentation and the ESG Disclosures ma y not be considered material for SEC reporting purposes, and the use of the term “material” in the ESG Disclosures is distinct from, and should not be confused with, such t erm as defined for SEC reporting purposes. Due to the inherent uncertainty and limitations in measuring GHG emissions under the calculation methodologies used in the pr epa ration of such data, all GHG emissions or references to GHG emissions in the ESG Disclosures are estimates. There may also be differences in the manner that third part ies calculate or report GHG emissions compared to Group, which means that third party data or methodologies may not be comparable to our data or methodologies. Website references and hyperlinks throughout the ESG Disclosures are provided for convenience only, and the content on the re fer enced third - party websites is not incorporated by reference into the ESG Disclosures, nor does it constitute a part of the ESG Disclosures. Group assumes no liability for the con tent contained on the referenced third - party references.