DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on May 1, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

California Water Service Group

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

California Water Service Group 2024 Stockholder Outreach

GROUP OPERATIONS • Added more than 1,600 new customers in c losed acquisitions in California, Washington and New Mexico. • Added 1,770 equivalent dwelling units of wastewater customers through the acquisitions of HOH Utilities, LLC on the island of Kauai • Ranked highest in overall customer satisfaction among large water utilities in the western United States, in the J.D. Power 2023 Water Utility Residential Customer Satisfaction Study SM • Named one of “America’s Most Responsible Companies” and “World’s Most Trustworthy Companies” by Newsweek • Earned the U.S. Environmental Protection Agency’s 2023 WaterSense Excellence in Promoting WaterSense Labeled Products Award • Completed first Greenhouse Gas (GHG) Protocol - aligned inventory and committed to a science - aligned Scope 1 and 2 GHG emissions reduction target • Completed targeted regional Water Supply Reliability Studies • Increased spending with diverse vendors to more than 27% in California FINANCIAL • Invested a record $383.7 million of capital in accordance with our infrastructure improvement program, including $17.2 million in developer funded capital • Achieved the majority of our operational goals while keeping controllable costs within budget • Increased the Group’s 2023 annual dividend by four cents, or 4.0%, which represents our 56th consecutive annual dividend increase • Entered into unsecured revolving credit facilities for Group and its subsidiaries totaling $600 million for a five - year term 2023 Performance Highlights

REGULATORY • Secured $4.3 million in grants to reduce rate impacts of critical water supply projects in disadvantaged communities • Assisted customers in receiving more than $2 million from the state and federal Low - Income Household Water Assistance Program (LIHWAP) • Applied for and subsequently received $83 million from the California Extended Water and Wastewater Arrearage Payment Program to pay residential and commercial customer delinquent and uncollected account balances as well as the administrative expenses of the program EMPLOYEE RETENTION & DEVELOPMENT • Graduated nine employees from our new Operations Leadership Program and enrolled another 15 employees into the program, which supports the growth of our employees by defining career maps, offering educational resources, and connecting members with a trained mentor • Provided unconscious bias training to more than 95% of our employees • Invited all employees to participate in the “At - Risk Pay Program”, a program that rewards performance against the same short - term at - risk performance metrics as the executive compensation program • Further increased presence in diverse recruiting channels and engaged prospective employees through multiple career fairs, including military - , disability - , and minority - focused career fairs • Received recertification as a Great Place to Work® by the Great Place to Work® Institute for the eighth consecutive year 2023 Performance Highlights, cont.

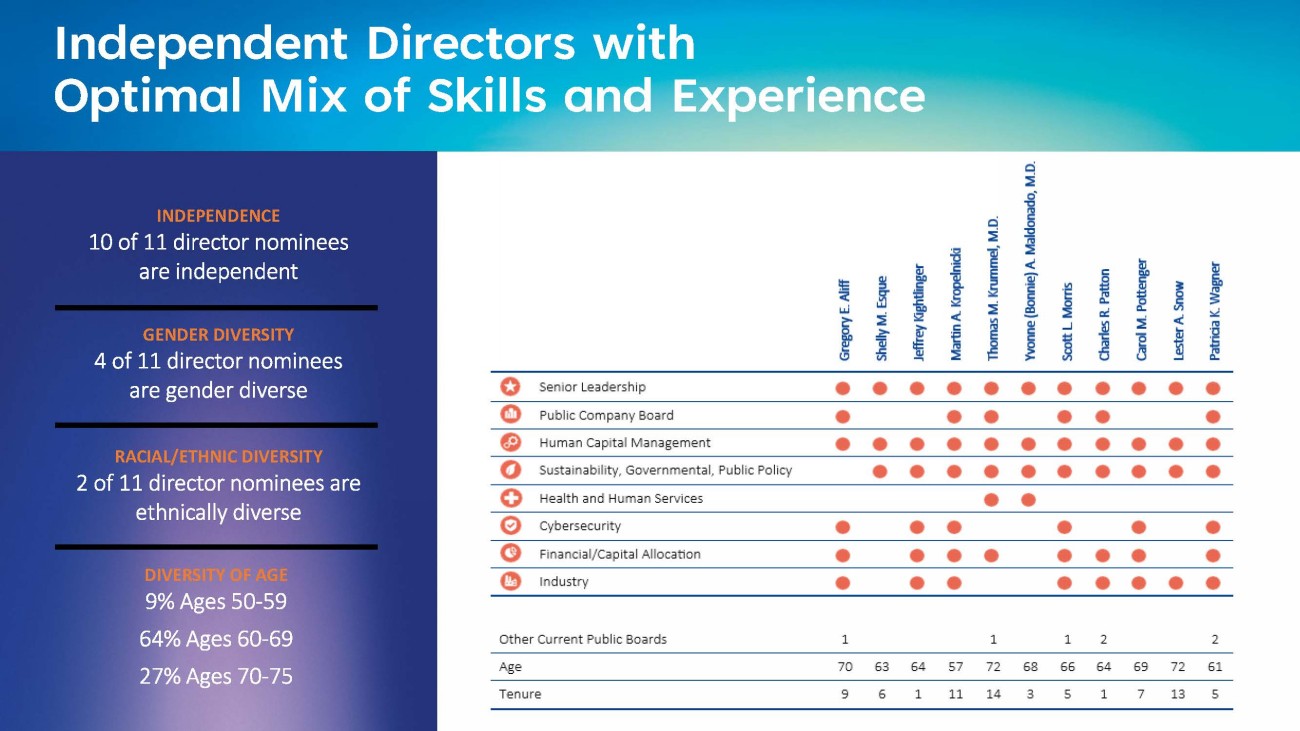

Highly Qualified, Diverse Director Nominees GREGORY E. ALIFF Former Vice Chairman and Senior Partner of U.S. Energy & Resources, Deloitte LLP SHELLY M. ESQUE Former Vice President and Global Director of Corporate Affairs, Intel Corporation MARTIN A. KROPELNICKI Chairman, President and CEO of California Water Service Group THOMAS M. KRUMMEL, M.D. Emile Homan Professor and Chair Emeritus, Surgery Department, Stanford University School of Medicine YVONNE A. MALDONADO, M.D. Professor of Global Health and Infectious Diseases, Departments of Pediatrics and Epidemiology and Population Health, Stanford University SCOTT L. MORRIS Chairman, Avista Corporation, Lead Independent Director CAROL M. POTTENGER Principal and Owner of CMP Global, LLC, and Retired U.S. Navy Vice Admiral LESTER SNOW Former Director of California Department of Water Resources PATRICIA WAGNER Former Group President, U.S. Utilities, Sempra Energy JEFFREY KIGHTLINGER Principal and Owner of Acequia Consulting, LLC, and former CEO of Metropolitan Water District of Southern California CHARLES R. PATTON Former Executive Vice President, External Affairs, American Electric Power Company, Inc.

Independent Directors with Optimal Mix of Skills and Experience GENDER DIVERSITY 4 of 11 director nominees are gender diverse RACIAL/ETHNIC DIVERSITY 2 of 11 director nominees are ethnically diverse DIVERSITY OF AGE 9% Ages 50 - 59 64% Ages 60 - 69 27% Ages 70 - 75 INDEPENDENCE 10 of 11 director nominees are independent

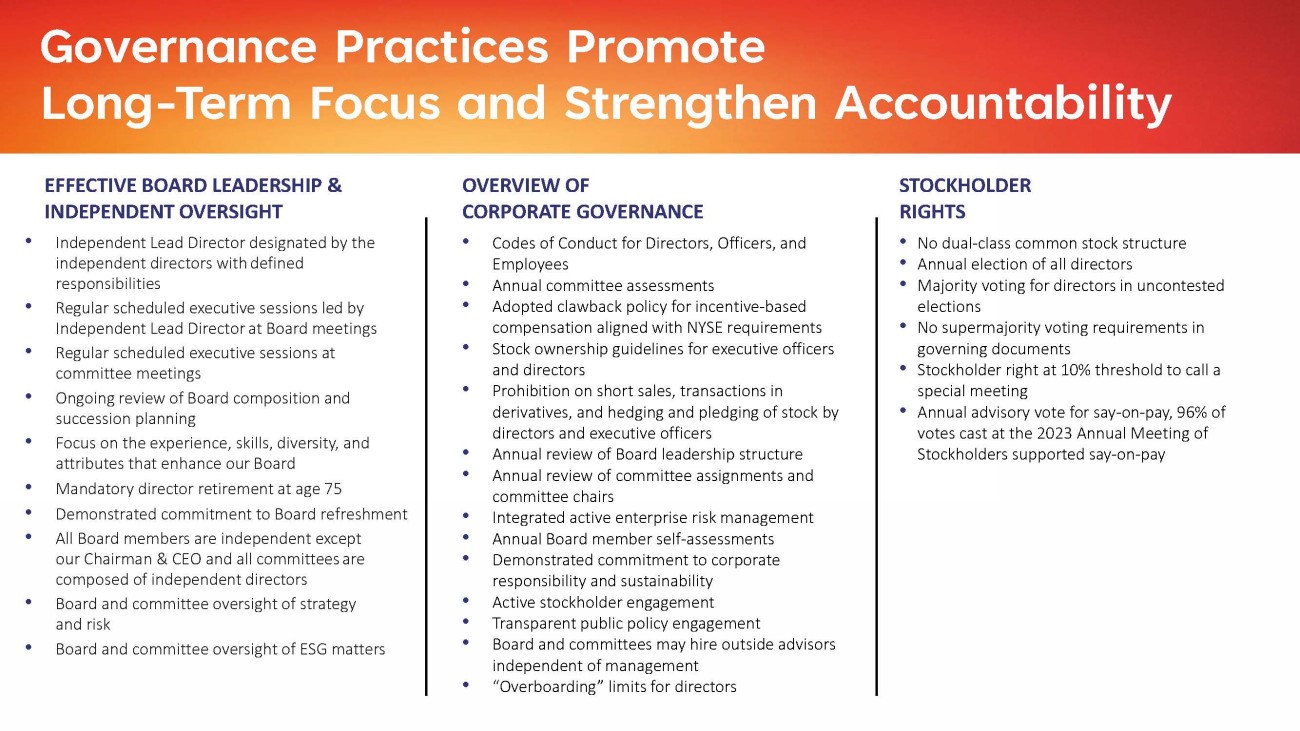

EFFECTIVE BOARD LEADERSHIP & INDEPENDENT OVERSIGHT • Independent Lead Director designated by the independent directors with defined responsibilities • Regular scheduled executive sessions led by Independent Lead Director at Board meetings • Regular scheduled executive sessions at committee meetings • Ongoing review of Board composition and succession planning • Focus on the experience, skills, diversity, and attributes that enhance our Board • Mandatory director retirement at age 75 • Demonstrated commitment to Board refreshment • All Board members are independent except our Chairman & CEO and all committees are composed of independent directors • Board and committee oversight of strategy and risk • Board and committee oversight of ESG matters OVERVIEW OF CORPORATE GOVERNANCE • Codes of Conduct for Directors, Officers, and Employees • Annual committee assessments • Adopted clawback policy for incentive - based compensation aligned with NYSE requirements • Stock ownership guidelines for executive officers and directors • Prohibition on short sales, transactions in derivatives, and hedging and pledging of stock by directors and executive officers • Annual review of Board leadership structure • Annual review of committee assignments and committee chairs • Integrated active enterprise risk management • Annual Board member self - assessments • Demonstrated commitment to corporate responsibility and sustainability • Active stockholder engagement • Transparent public policy engagement • Board and committees may hire outside advisors independent of management • “ Overboarding ” limits for directors STOCKHOLDER RIGHTS • No dual - class common stock structure • Annual election of all directors • Majority voting for directors in uncontested elections • No supermajority voting requirements in governing documents • Stockholder right at 10% threshold to call a special meeting • Annual advisory vote for say - on - pay, 96% of votes cast at the 2023 Annual Meeting of Stockholders supported say - on - pay Governance Practices Promote Long - Term Focus and Strengthen Accountability

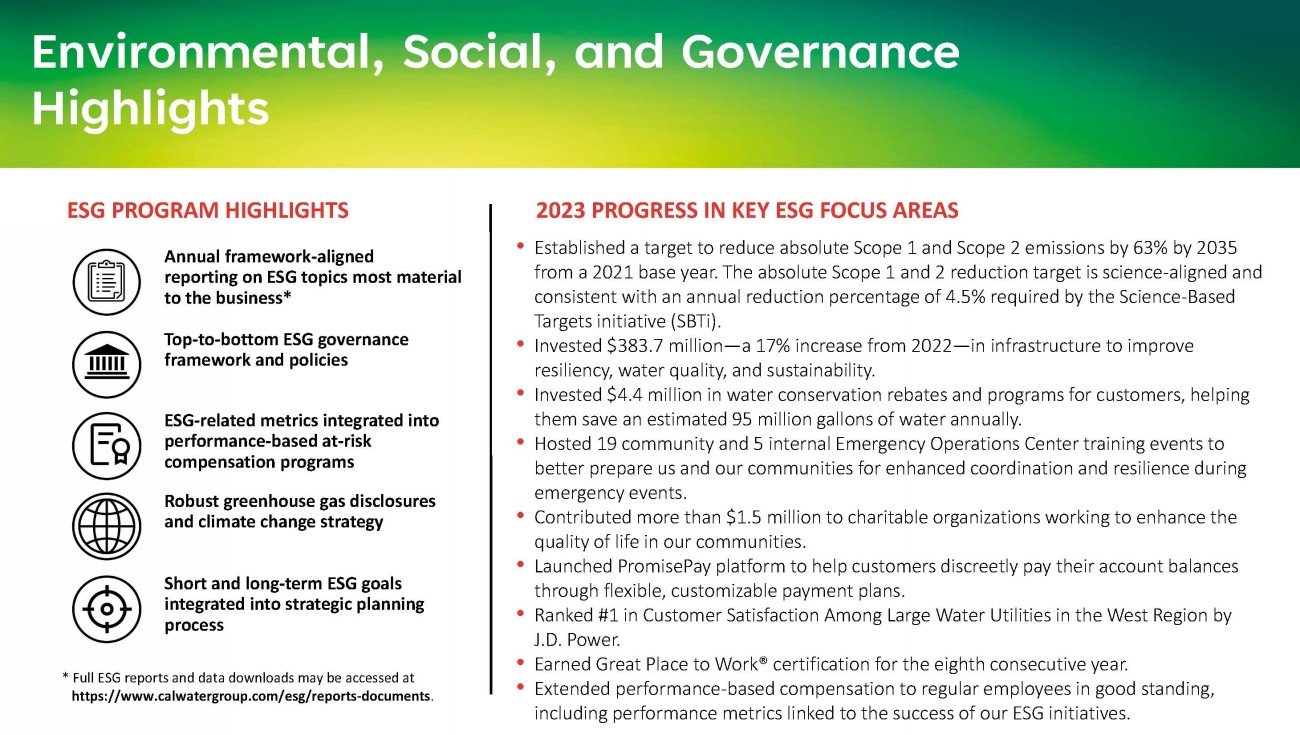

Annual framework - aligned reporting on ESG topics most material to the business* * Full ESG reports and data downloads may be accessed at https://www.calwatergroup.com/esg/reports - documents . ESG PROGRAM HIGHLIGHTS ESG - related metrics integrated into performance - based at - risk compensation programs Top - to - bottom ESG governance framework and policies Robust greenhouse gas disclosures and climate change strategy Short and long - term ESG goals integrated into strategic planning process 2023 PROGRESS IN KEY ESG FOCUS AREAS • Established a target to reduce absolute Scope 1 and Scope 2 emissions by 63% by 2035 from a 2021 base year. The absolute Scope 1 and 2 reduction target is science - aligned and consistent with an annual reduction percentage of 4.5% required by the Science - Based Targets initiative (SBTi). • Invested $383.7 million — a 17% increase from 2022 — in infrastructure to improve resiliency, water quality, and sustainability. • Invested $4.4 million in water conservation rebates and programs for customers, helping them save an estimated 95 million gallons of water annually. • Hosted 19 community and 5 internal Emergency Operations Center training events to better prepare us and our communities for enhanced coordination and resilience during emergency events. • Contributed more than $1.5 million to charitable organizations working to enhance the quality of life in our communities. • Launched PromisePay platform to help customers discreetly pay their account balances through flexible, customizable payment plans. • Ranked #1 in Customer Satisfaction Among Large Water Utilities in the West Region by J.D. Power. • Earned Great Place to Work® certification for the eighth consecutive year. • Extended performance - based compensation to regular employees in good standing, including performance metrics linked to the success of our ESG initiatives. Environmental, Social, and Governance Highlights

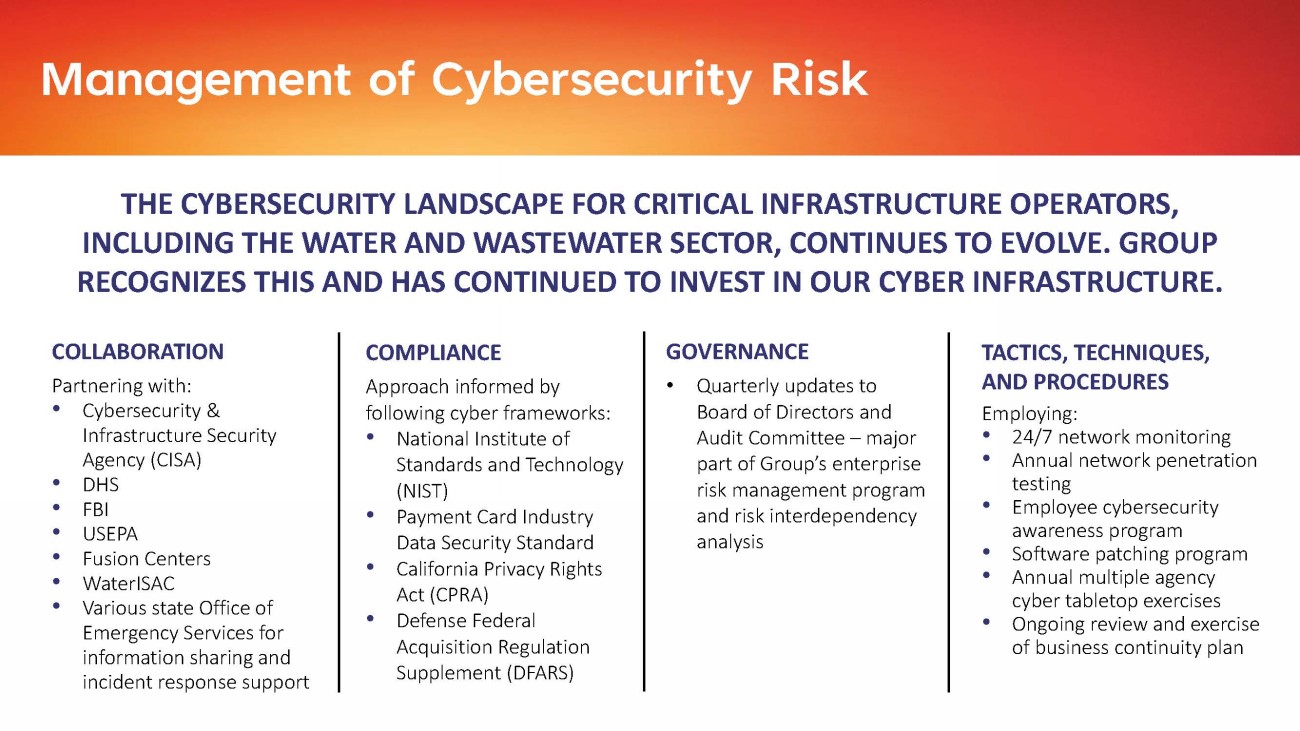

COLLABORATION Partnering with: • Cybersecurity & Infrastructure Security Agency (CISA) • DHS • FBI • USEPA • Fusion Centers • WaterISAC • Various state Office of Emergency Services for information sharing and incident response support COMPLIANCE Approach informed by following cyber frameworks: • National Institute of Standards and Technology (NIST) • Payment Card Industry Data Security Standard • California Privacy Rights Act (CPRA) • Defense Federal Acquisition Regulation Supplement (DFARS) GOVERNANCE • Quarterly updates to Board of Directors and Audit Committee – major part of Group’s enterprise risk management program and risk interdependency analysis TACTICS, TECHNIQUES, AND PROCEDURES Employing: • 24/7 network monitoring • Annual network penetration testing • Employee cybersecurity awareness program • Software patching program • Annual multiple agency cyber tabletop exercises • Ongoing review and exercise of business continuity plan THE CYBERSECURITY LANDSCAPE FOR CRITICAL INFRASTRUCTURE OPERATORS, INCLUDING THE WATER AND WASTEWATER SECTOR, CONTINUES TO EVOLVE. GROUP RECOGNIZES THIS AND HAS CONTINUED TO INVEST IN OUR CYBER INFRASTRUCTURE. Management of Cybersecurity Risk

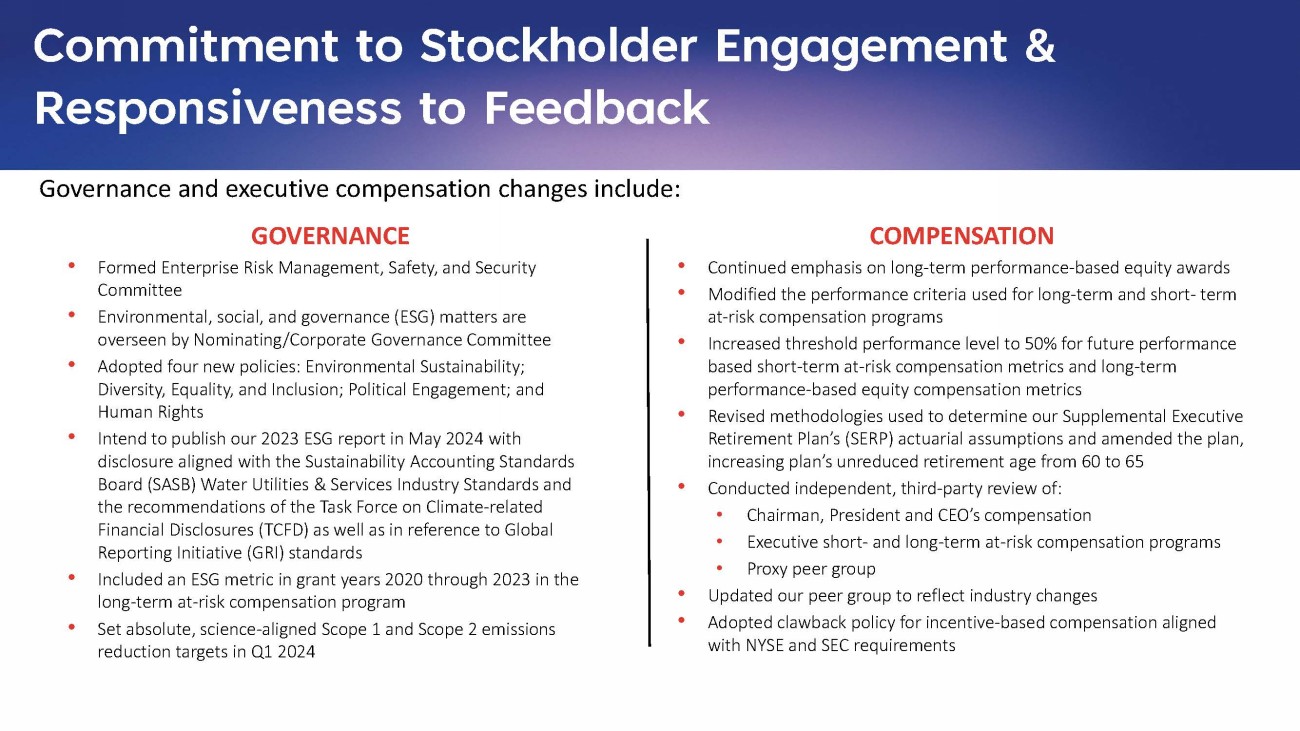

Governance and executive compensation changes include: GOVERNANCE • Formed Enterprise Risk Management, Safety, and Security Committee • Environmental, social, and governance (ESG) matters are overseen by Nominating/Corporate Governance Committee • Adopted four new policies: Environmental Sustainability; Diversity, Equality, and Inclusion; Political Engagement; and Human Rights • Intend to publish our 2023 ESG report in May 2024 with disclosure aligned with the Sustainability Accounting Standards Board (SASB) Water Utilities & Services Industry Standards and the recommendations of the Task Force on Climate - related Financial Disclosures (TCFD) as well as in reference to Global Reporting Initiative (GRI) standards • Included an ESG metric in grant years 2020 through 2023 in the long - term at - risk compensation program • Set absolute, science - aligned Scope 1 and Scope 2 emissions reduction targets in Q1 2024 COMPENSATION • Continued emphasis on long - term performance - based equity awards • Modified the performance criteria used for long - term and short - term at - risk compensation programs • Increased threshold performance level to 50% for future performance based short - term at - risk compensation metrics and long - term performance - based equity compensation metrics • Revised methodologies used to determine our Supplemental Executive Retirement Plan’s (SERP) actuarial assumptions and amended the plan, increasing plan’s unreduced retirement age from 60 to 65 • Conducted independent, third - party review of: • Chairman, President and CEO’s compensation • Executive short - and long - term at - risk compensation programs • Proxy peer group • Updated our peer group to reflect industry changes • Adopted clawback policy for incentive - based compensation aligned with NYSE and SEC requirements Commitment to Stockholder Engagement & Responsiveness to Feedback

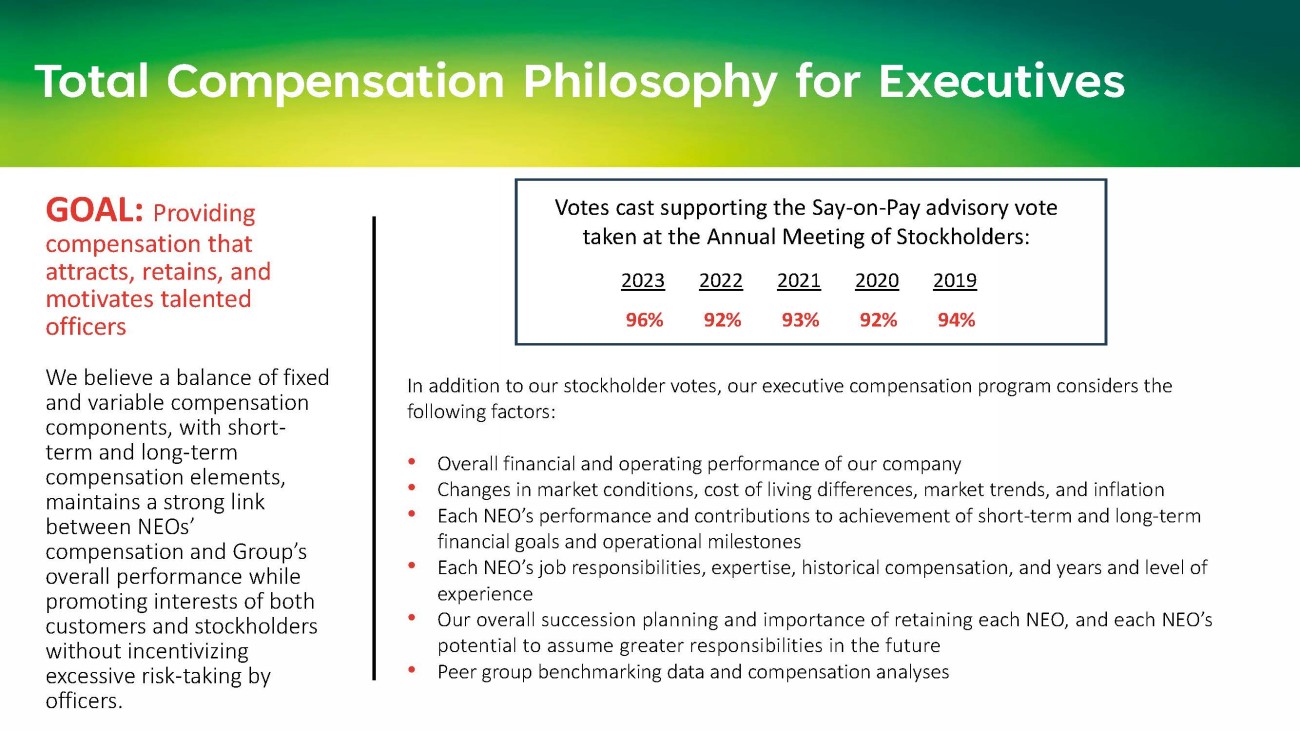

GOAL: Providing compensation that attracts, retains, and motivates talented officers We believe a balance of fixed and variable compensation components, with short - term and long - term compensation elements, maintains a strong link between NEOs’ compensation and Group’s overall performance while promoting interests of both customers and stockholders without incentivizing excessive risk - taking by officers. In addition to our stockholder votes, our executive compensation program considers the following factors: • Overall financial and operating performance of our company • Changes in market conditions, cost of living differences, market trends, and inflation • Each NEO’s performance and contributions to achievement of short - term and long - term financial goals and operational milestones • Each NEO’s job responsibilities, expertise, historical compensation, and years and level of experience • Our overall succession planning and importance of retaining each NEO, and each NEO’s potential to assume greater responsibilities in the future • Peer group benchmarking data and compensation analyses Total Compensation Philosophy for Executives Votes cast supporting the Say - on - Pay advisory vote taken at the Annual Meeting of Stockholders: 2023 2022 2021 2020 2019 96% 92% 93% 92% 94%

PAY ELEMENT PERFORMANCE PERIOD PERFORMANCE CHARACTERISTICS Base Salary Annual Individualized based upon performance of primary roles and responsibilities Performance - Based Short - Term At - Risk (ARP) Compensation Annual Five performance metrics • Water quality and public health – 20% • Customer service and support – 20% • Infrastructure improvement and utility plant investment – 20% • Budget to actual performance (EPS) – 20% • Emergency preparedness and safety – 20% Restricted Stock Awards (RSAs) Three years Stock price appreciation – value based on stock price at vesting date Restricted Stock Units (RSUs) Three years Three performance metrics • Return on equity – 40% • Growth in stockholders’ equity – 40% • Environmental, social, and governance - 20% Performance - Driven Executive Compensation Performance - Driven Executive Compensation The Organization and Compensation Committee annually reviews, evaluates, and approves all executive compensation program pay elements and performance metrics used

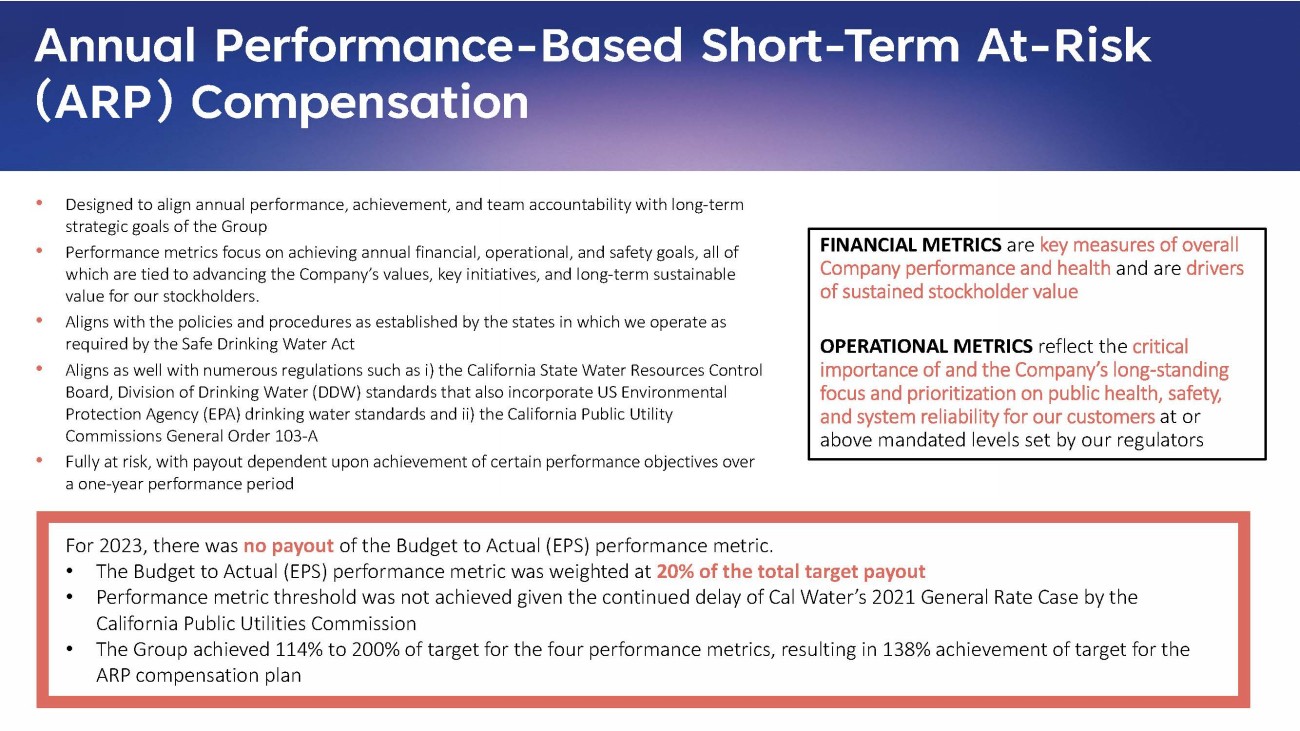

• Designed to align annual performance, achievement, and team accountability with long - term strategic goals of the Group • Performance metrics focus on achieving annual financial, operational, and safety goals, all of which are tied to advancing the Company’s values, key initiatives, and long - term sustainable value for our stockholders. • Aligns with the policies and procedures as established by the states in which we operate as required by the Safe Drinking Water Act • Aligns as well with numerous regulations such as i ) the California State Water Resources Control Board, Division of Drinking Water (DDW) standards that also incorporate US Environmental Protection Agency (EPA) drinking water standards and ii) the California Public Utility Commissions General Order 103 - A • Fully at risk, with payout dependent upon achievement of certain performance objectives over a one - year performance period For 2023, there was no payout of the Budget to Actual (EPS) performance metric. • The Budget to Actual (EPS) performance metric was weighted at 20% of the total target payout • Performance metric threshold was not achieved given the continued delay of Cal Water’s 2021 General Rate Case by the California Public Utilities Commission • The Group achieved 114% to 200% of target for the four performance metrics, resulting in 138% achievement of target for the ARP compensation plan FINANCIAL METRICS are key measures of overall Company performance and health and are drivers of sustained stockholder value OPERATIONAL METRICS reflect the critical importance of and the Company’s long - standing focus and prioritization on public health, safety, and system reliability for our customers at or above mandated levels set by our regulators Annual Performance - Based Short - Term At - Risk (ARP) Compensation

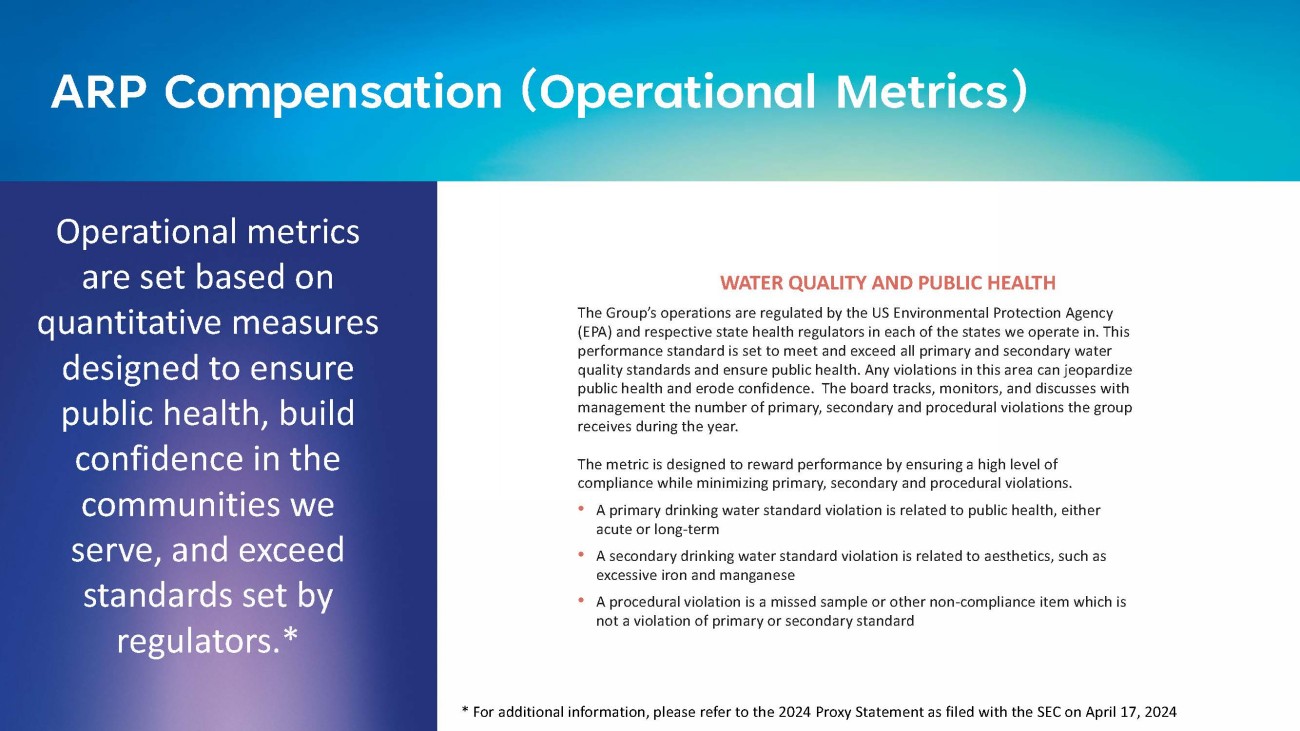

ARP Compensation (Operational Metrics) WATER QUALITY AND PUBLIC HEALTH The Group’s operations are regulated by the US Environmental Protection Agency (EPA) and respective state health regulators in each of the states we operate in. This performance standard is set to meet and exceed all primary and secondary water quality standards and ensure public health. Any violations in this area can jeopardize public health and erode confidence. The board tracks, monitors, and discusses with management the number of primary, secondary and procedural violations the group receives during the year. The metric is designed to reward performance by ensuring a high level of compliance while minimizing primary, secondary and procedural violations. • A primary drinking water standard violation is related to public health, either acute or long - term • A secondary drinking water standard violation is related to aesthetics, such as excessive iron and manganese • A procedural violation is a missed sample or other non - compliance item which is not a violation of primary or secondary standard * For additional information, please refer to the 2024 Proxy Statement as filed with the SEC on April 17, 2024 Operational metrics are set based on quantitative measures designed to ensure public health, build confidence in the communities we serve, and exceed standards set by regulators.* ARP Compensation (Operational Metrics)

ARP Compensation (Operational Metrics) CUSTOMER SERVICE AND SUPPORT Group’s customer service metrics are designed to meet and exceed all customer service requirements set by the Public Utilities Commission. The board reviews and set annual targets designed to ensure high levels of service and minimize customer complaints to our regulators. Group’s California operations is required to comply with the CPUC’S General Order 103 - A. Customer Service and Support is evaluated on a quarterly basis as follows: • The tracking of 10 service standards (nine of which are required by the CPUC to comply with General Order 103 - A) • The achievement of 99% first call satisfaction rate is measured by the tracking of the number of calls transferred to a supervisor; there is currently no CPUC standard for first call satisfaction • The answering of 80% or more of customer calls within 20 seconds and arrival at 95% of appointments within a two - hour window are both stricter than CPUC standards • The integration of our PromisePay payment plan to i ) allow customers more flexible and convenient payment arrangements and ii) to achieve an overall 20% reduction in California customer accounts receivable 90 days and over as compared to 2022 EMERGENCY PREPAREDNESS AND SAFETY Group has had a long - standing focus and prioritization on public health and safety of for our customers, employees, and communities. Emergency Preparedness and workplace safety is first and foremost about protecting employees. It is also about our preparedness to respond quickly to emergencies, to protect public health, and to coordinate with our community resources including local government, police, fire, and others. The board evaluates these metrics annually, factoring in lessons learned from key events that transpired during the prior performance period when establishing targets. Emergency Preparedness and Safety is determined by using five metrics: • Number of Community Emergency Operations Center trainings conducted • Percentage of applicable employees who attended Group’s mandated safety, wildfire preparedness, and cyber training for employees • Total Case Incident Rate (TCIR), which represents the average number of work - related injuries incurred by 100 workers during a one - year period as measured against other California companies • Number of preventable vehicle accidents incurred • The number of unannounced site safety audit and immediate onsite reviews ARP Compensation (Operational Metrics) * For additional information, please refer to the 2024 Proxy Statement as filed with the SEC on April 17, 2024

Long - Term Performance and Time - Based Equity Compensation • Designed to align executive compensation with interests of both stockholders and customers • Creates incentives for officer recruiting and retention • Encourages long - term performance by NEOs without encouraging imprudent risk - taking • Promotes stock ownership • Strengthens and rewards collaboration within the officer team as all equity awards are based on the same objectives and methodology • Performance - based equity compensation(RSUs) vests over a three - year performance period • Time - based equity compensation (RSAs) vests over a three - year period More than half of our long - term equity is in the form of RSUs subject to at - risk performance - based vesting criteria, vesting 0% to 200% based on performance of each metric (Return on equity – 40%, Growth in stockholders’ equity – 40%, Environmental, social, and governance – 20%)

Overview of Proposal No. 4: Approval of Group’s 2024 Equity Incentive Plan Key Features of the 2024 Plan The following is a summary of the principal terms of the 2024 Plan, as proposed. Because this is a summary, it may not contain all the information that may be considered important. Therefore, the Board encourages stockholders to read the full text of the 2024 Plan. » The exercise price for stock options and stock appreciation rights granted under the 2024 Plan must equal or exceed the underlying stock’s fair market value, based on the closing price per share of the Group’s common stock, at the time the stock option or stock appreciation right is granted; » The 2024 Plan expressly states that stock options and stock appreciation rights granted under the plan may not be “repriced” without stockholder approval; » 1,600,000 shares are proposed to be available for issuance under the 2024 Plan, which will comprise of i ) 349,208 that were available, but never issued under the Prior Plan at the time of its termination and (ii) 1,250,792 new shares ; » Dividends or dividend equivalent rights that relate to awards subject to vesting will be subject to the same vesting conditions as the underlying award, provided that dividends or dividend equivalents will not be made available with respect to stock options and stock appreciation rights; » Clawback policy applicable to all awards under the 2024 Plan (time - based and performance - based); » No “evergreen” provision to automatically increase the number of shares issuable under the 2024 Plan; » The 2024 Plan does not provide for tax gross - ups on excise taxes resulting from excess parachute payments; and » Stockholder approval is required for certain types of amendments to the 2024 Plan. General • On April 2, 2024, the Board approved the Group’s 2024 Equity Incentive Plan (the “2024 Plan”) subject to stockholder approval. The approval by an affirmative vote of a majority of the votes cast on this proposal (either in person or by proxy) is required for adoption. The complete text of the 2024 Plan approved by the Board is attached as Appendix A of the 2024 Proxy Statement. • The Board believes that the adoption of the 2024 Plan is desirable as it will promote and closely align the interests of employees and non - employee directors of the Group and its shareholders by providing the ability for the Group to award stock - based compensation and other performance - based compensation. • The 2024 Plan is intended to serve as the successor to the Amended and Restated California Water Service Equity Incentive Plan (the “Prior Plan”), which Prior Plan terminated in November 2023 and is no longer available for future awards. Outstanding awards granted under the Prior Plan prior to the adoption of the 2024 Plan will remain in full force and effect and will remain subject to the terms of the Prior Plan. • If the 2024 Plan is approved by our stockholders, it will become effective on May 29, 2024 (the “Effective Date”).

We ask for your vote at our 2024 Annual Meeting Our Board values your support for its recommendations on the following proposals: PROPOSAL 1 “ FOR ” the election of 11 directors PROPOSAL 2 “ FOR ” the advisory vote on executive compensation PROPOSAL 3 “ FOR ” the ratification of independent accountants PROPOSAL 4 “ FOR ” the approval of the Group’s 2024 equity incentive compensation plan

Forward - Looking Statements and Other Important Information This presentation and the materials referred to herein, such as the 2023 ESG Report and ESG Analyst Download (collectively th e “ ESG Disclosures”), contain forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995. The forward - looking statements in this presentation and the ESG Disclosures include Group's objectives, beliefs, goals, targets, progress, or expectations with respect to ESG, sustainability, and corporate social responsibility matters, and business risks, opportunities, and plans. Because they are a spi rational and are based upon currently available information, expectations, and projections, they are subject to various risks and uncertainties, including limitations on our ability to m ake ESG investments without the support of our regulators, and actual results may differ. Because of this, Group advises all interested parties to carefully read and understand Group's dis clo sure on risks and uncertainties found in Forms 10 - K, 10 - Q, and other reports filed with the SEC. Group undertakes no obligation to update any forward - looking or other statements, whether as a result of new information, future events, or otherwise, and notwithstanding any historical practice of doing so. Group may determine to adjust any objectives, goals, and ta rgets or establish new ones to reflect changes in our business. Historical, current, and forward - looking ESG - related statements and data in this presentation and the ESG Disclosures may be bas ed on standards for measuring progress that are still developing, controls and processes that continue to evolve, and assumptions that are subject to change in the future. The information included in, and any issues identified as material for purposes of, this presentation and the ESG Disclosures ma y not be considered material for SEC reporting purposes, and the use of the term “material” in the ESG Disclosures is distinct from, and should not be confused with, such term as def ine d for SEC reporting purposes. Due to the inherent uncertainty and limitations in measuring GHG emissions under the calculation methodologies used in the pr epa ration of such data, all GHG emissions or references to GHG emissions in the ESG Disclosures are estimates. There may also be differences in the manner that third parties calcula te or report GHG emissions compared to Group, which means that third party data or methodologies may not be comparable to our data or methodologies. Website references and hyperlinks are provided for convenience only, and the content on the referenced websites is not incorp ora ted by reference into, nor does it constitute a part of, this presentation.