EXHIBIT 99.2

Published on October 26, 2023

Exhibit 99.2

0 Third Quarter 2023 Results Presentation October 26, 2023

INVESTOR RELATIONS Forward - Looking Statements This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 ("PSLRA"). The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatment established by th e PSLRA. Forward - looking statements in this presentation are based on currently available information, expectations, estimates, assumptions and projections, and our management’s beli ef s, assumptions, judgments and expectations about us, the water utility industry and general economic conditions. These statements are not statements of his tor ical fact. When used in our documents, statements that are not historical in nature, including words like will, would, expects, intends, plans, believes, may, could , e stimates, assumes, anticipates, projects, progress, predicts, hopes, targets, forecasts, should, seeks or variations of these words or similar expressions are intended to identi fy forward - looking statements. Examples of forward - looking statements in this presentation include, but are not limited to, statements describing future rates, effects of DREMA, IRMA, and MWRAM, completion of pending acquisitions, estimated investments and depreciation, rate base estimates, expectations regarding the 2021 GRC filing and the regulatory process and the estimated impacts related thereto, and proposed capital expenditures. Forward - looking statements are not guarantees of future performance. They ar e based on numerous assumptions that we believe are reasonable, but they are open to a wide range of uncertainties and business risks. Consequently, actual results m ay vary materially from what is contained in a forward - looking statement. Factors that may cause actual results to be different than those expected or anticipated include, but are not limited to: the impact of the ongoing COVID - 19 pandemic and related public health measures; our ability to invest or apply the proceeds from the issuance of common st ock in an accretive manner; governmental and regulatory commissions' decisions, including decisions on proper disposition of property; consequences of eminent domain acti ons relating to our water systems; changes in regulatory commissions' policies and procedures , such as the CPUC’s decision in 2020 to preclude companies from proposing fully decoupled WRAMs in their next GRC filing (which impacted our 2021 GRC filing related to our operations commencing in 2023) ; the outcome and timeliness of regulatory commissions' actions concerning rate relief and other matters, including with respect to our 2021 GRC filing; increased risk of inverse condemnation losses as a result of cl ima te change and drought; our ability to renew leases to operate water systems owned by others on beneficial terms; changes in California State Water Resources Control Board water qu ality standards; changes in environmental compliance and water quality requirements; electric power interruptions, especially as a result of Public Safety Power Shutof f ( PSPS) programs; housing and customer growth; the impact of opposition to rate increases; our ability to recover costs; availability of water supplies; issues with the impleme nta tion, maintenance or security of our information technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate physical and cy ber security risks and threats; the ability of our enterprise risk management processes to identify or address risks adequately; labor relations matters as we negotiate with the unions; c han ges in customer water use patterns and the effects of conservation, including as a result of drought conditions; our ability to complete, in a timely manner or at all, suc cessfully integrate and achieve anticipated benefits from announced acquisitions; the impact of weather, climate change, natural disasters, and actual or threatened public health em ergencies, including disease outbreaks, on our operations, water quality, water availability, water sales and operating results and the adequacy of our emergency preparedne ss; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; risks associated with expanding our business and operations geographically; the impact of stagnating or worsening business and economic conditions, in cluding inflationary pressures, general economic slowdown or a recession, increasing interest rates, and changes in monetary policy; the impact of market conditions and volatility on unrealized gains or losses on our non - qualified benefit plan investments and our operating results; the impact of weather and timing of meter reads on our accrued unbilled revenue; and other risks and unforeseen events described in our SEC filings. When considering forward - looking statements, you should keep in mind the caution ary statements included in this paragraph, as well as the Annual 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the Securities and Exchange Commission ( SEC). We are not under any obligation, and we expressly disclaim any obligation to update or alter any forward - looking statements, whether as a result of new information, fut ure events or otherwise. 1

INVESTOR RELATIONS David Healey Vice President, CFO & Treasurer Greg Milleman Vice President, Rates & Regulatory Affairs Marty Kropelnicki Chairman & CEO Today’s Participants 2

INVESTOR RELATIONS Presentation Overview • Our Values and Priorities • Third Quarter Financial Results and Unrecorded Regulatory Mechanisms • Year - to - Date Financial Results and Unrecorded Regulatory Mechanisms • California Regulatory Update • PFAS Regulation Update • CapEx and Rate Base Tables • In Summary 3

4 BOARD UPDATE 4 BOARD UPDATE INVESTOR RELATIONS 4

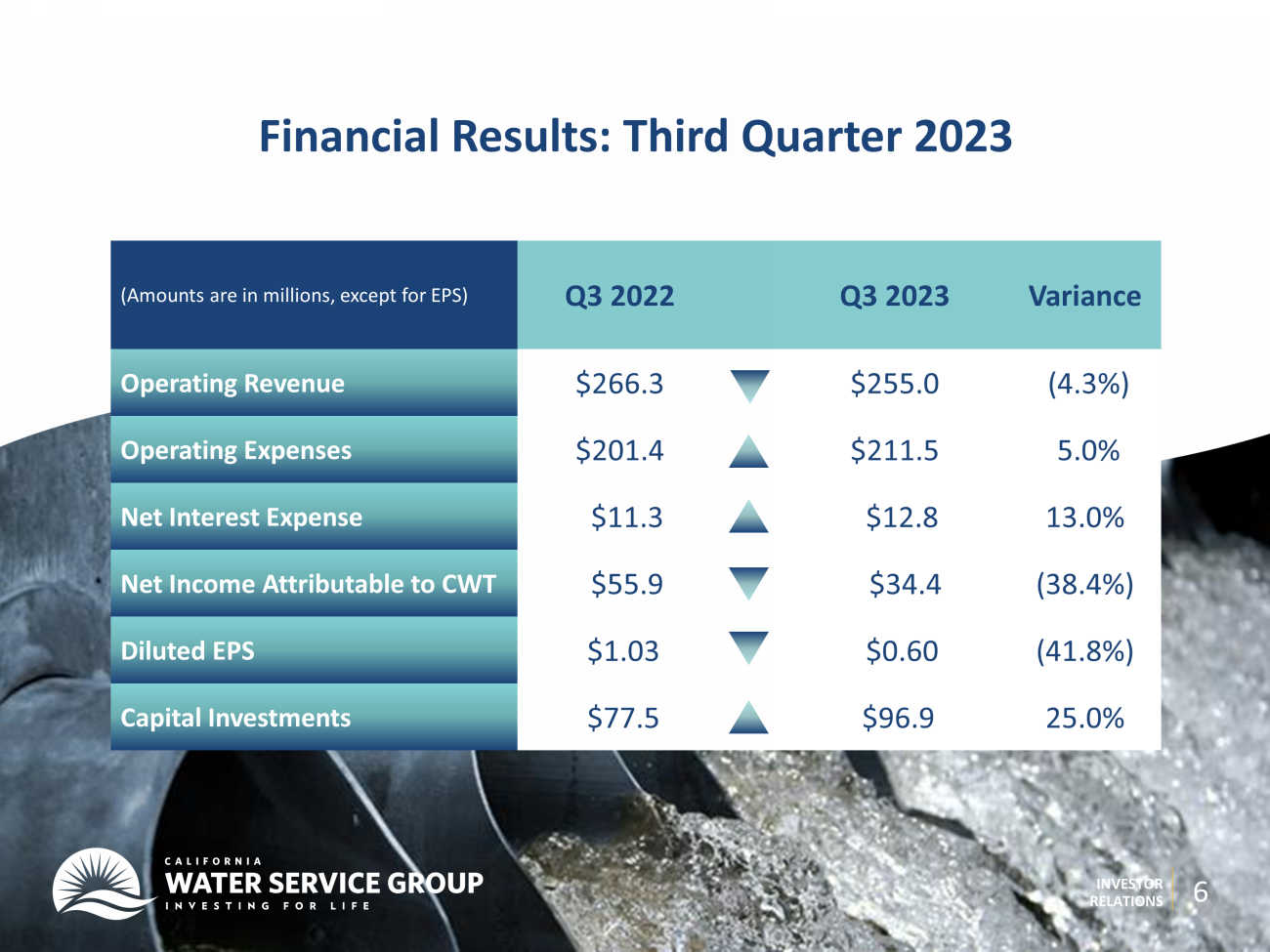

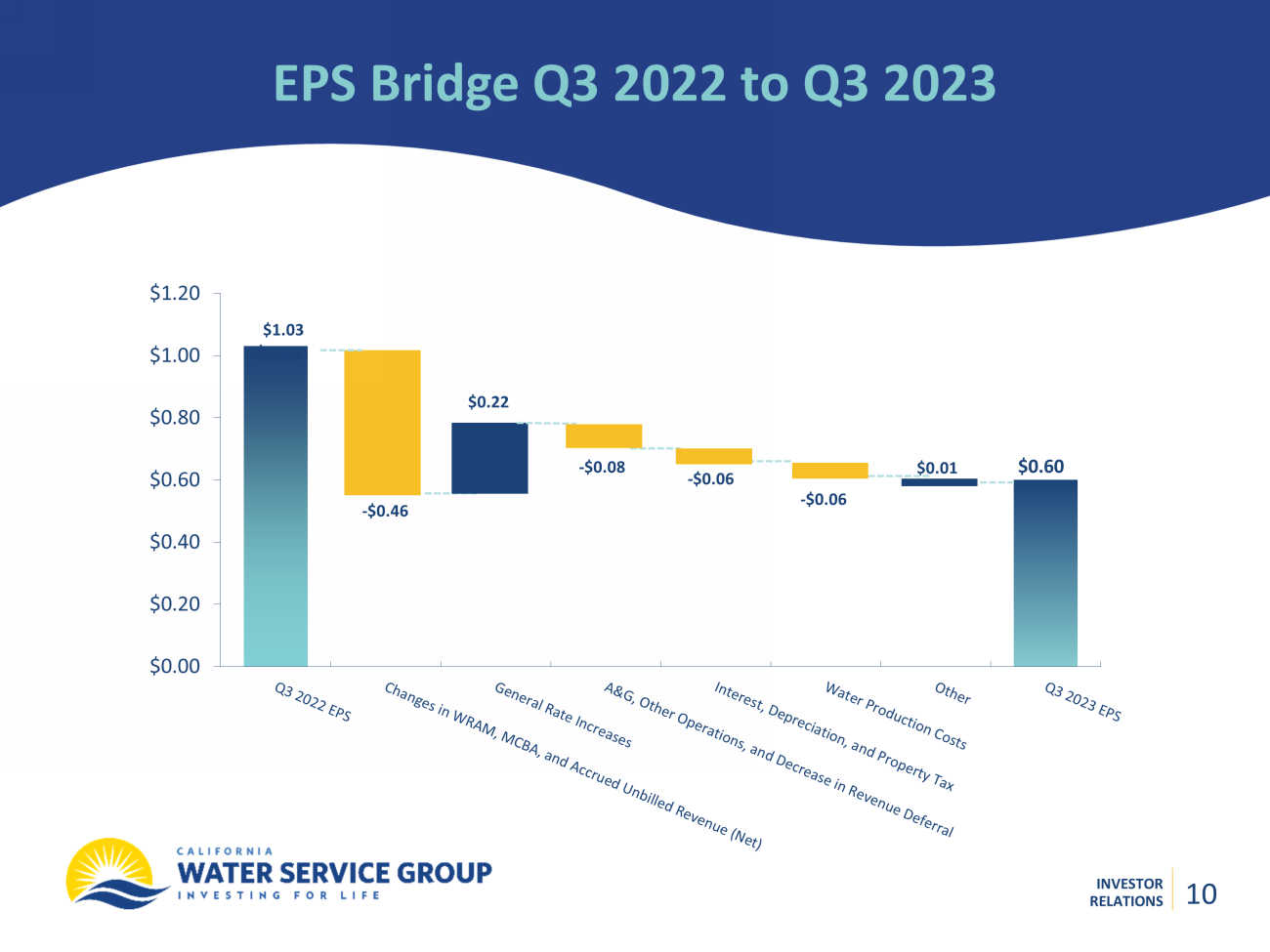

INVESTOR RELATIONS Third Quarter Financial Highlights 5 Operating revenue decreased $11.3M • $29.6M decrease in WRAM and MCBA revenue as the mechanisms concluded on December 31, 2022. • Partially offset by $13.7M in general rate increases and $1.8M from reduction in revenue deferral. Total operating expenses increased $10.1M • $3.6M increase in water production costs. • $2.0M increase in bad debt expense. • $1.5M increase in costs from reduction in revenue deferral. • $1.4M increase in labor costs. • $1.1M increase in depreciation and amortization.

INVESTOR RELATIONS (Amounts are in millions, except for EPS) Q3 2022 Q3 2023 Variance Operating Revenue $266.3 $255.0 (4.3%) Operating Expenses $201.4 $211.5 5.0% Net Interest Expense $11.3 $12.8 13.0% Net In come Attributable to CWT $55.9 $34.4 (38.4%) Diluted EPS $1.03 $0.60 (41.8%) Capital Investments $77.5 $96.9 25.0% Financial Results: Third Quarter 2023 6

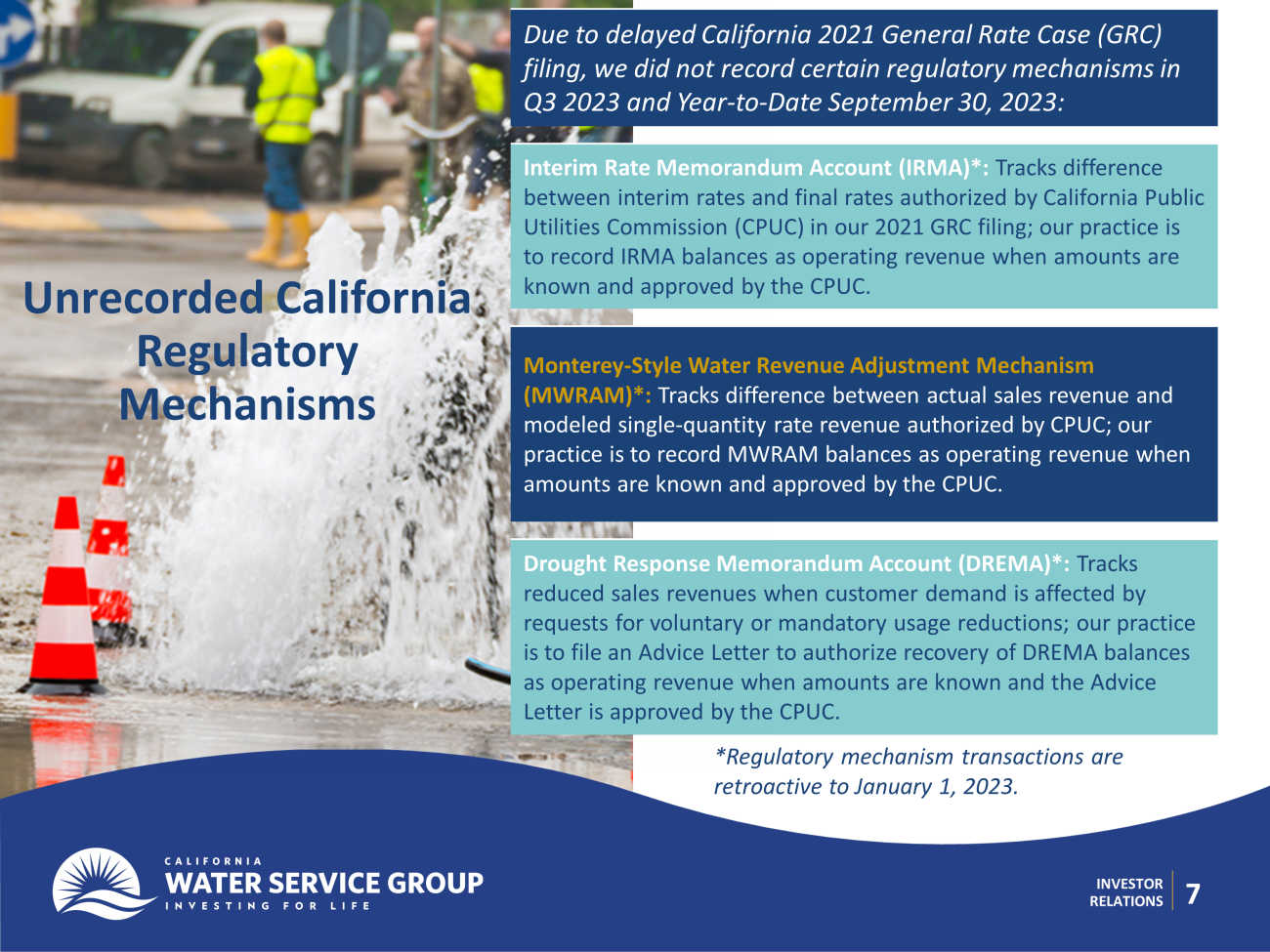

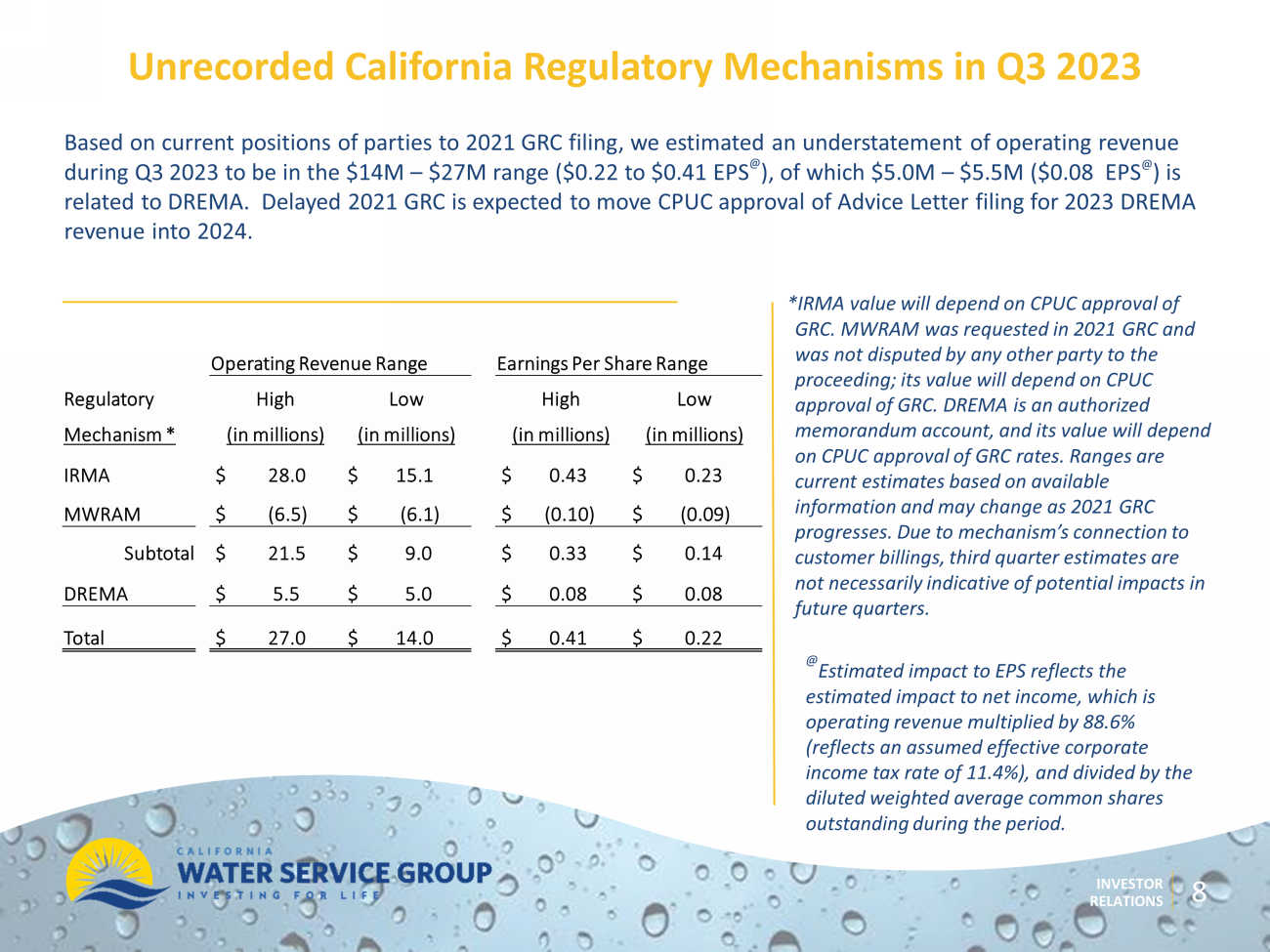

7 INVESTOR RELATIONS Unrecorded California Regulatory Mechanisms Due to delayed California 2021 General Rate Case (GRC) filing, we did not record certain regulatory mechanisms in Q3 2023 and Year - to - Date September 30, 2023: Interim Rate Memorandum Account (IRMA)*: Tracks difference between interim rates and final rates authorized by California Public Utilities Commission (CPUC) in our 2021 GRC filing; our practice is to record IRMA balances as operating revenue when amounts are known and approved by the CPUC. Monterey - Style Water Revenue Adjustment Mechanism ( MWRAM)*: Tracks difference between actual sales revenue and modeled single - quantity rate revenue authorized by CPUC; our practice is to record MWRAM balances as operating revenue when amounts are known and approved by the CPUC. Drought Response Memorandum Account (DREMA)*: Tracks reduced sales revenues when customer demand is affected by requests for voluntary or mandatory usage reductions; our practice is to file an Advice Letter to authorize recovery of DREMA balances as operating revenue when amounts are known and the Advice Letter is approved by the CPUC. *Regulatory mechanism transactions are retroactive to January 1, 2023.

INVESTOR RELATIONS Based on current positions of parties to 2021 GRC filing, we estimated an understatement of operating revenue during Q3 2023 to be in the $14M – $27M range ($0.22 to $0.41 EPS @ ), of which $5.0M – $5.5M ($0.08 EPS @ ) is related to DREMA. Delayed 2021 GRC is expected to move CPUC approval of Advice Letter filing for 2023 DREMA revenue into 2024. Unrecorded California Regulatory M echanisms in Q3 2023 8 *IRMA value will depend on CPUC approval of GRC. MWRAM was requested in 2021 GRC and was not disputed by any other party to the proceeding; its value will depend on CPUC approval of GRC. DREMA is an authorized memorandum account, and its value will depend on CPUC approval of GRC rates. Ranges are current estimates based on available information and may change as 2021 GRC progresses. Due to mechanism’s connection to customer billings, third quarter estimates are not necessarily indicative of potential impacts in future quarters. @ Estimated impact to EPS reflects the estimated impact to net income , which is operating revenue multiplied by 88.6% ( reflects an assumed effective corporate income tax rate of 11.4%), and divided by the diluted weighted average common shares outstanding during the period. Operating Revenue Range Earnings Per Share Range Regulatory High Low High Low Mechanism * (in millions) (in millions) (in millions) (in millions) IRMA $ 28.0 $ 15.1 $ 0.43 $ 0.23 MWRAM $ (6.5) $ (6.1) $ (0.10) $ (0.09) Subtotal $ 21.5 $ 9.0 $ 0.33 $ 0.14 DREMA $ 5.5 $ 5.0 $ 0.08 $ 0.08 Total $ 27.0 $ 14.0 $ 0.41 $ 0.22

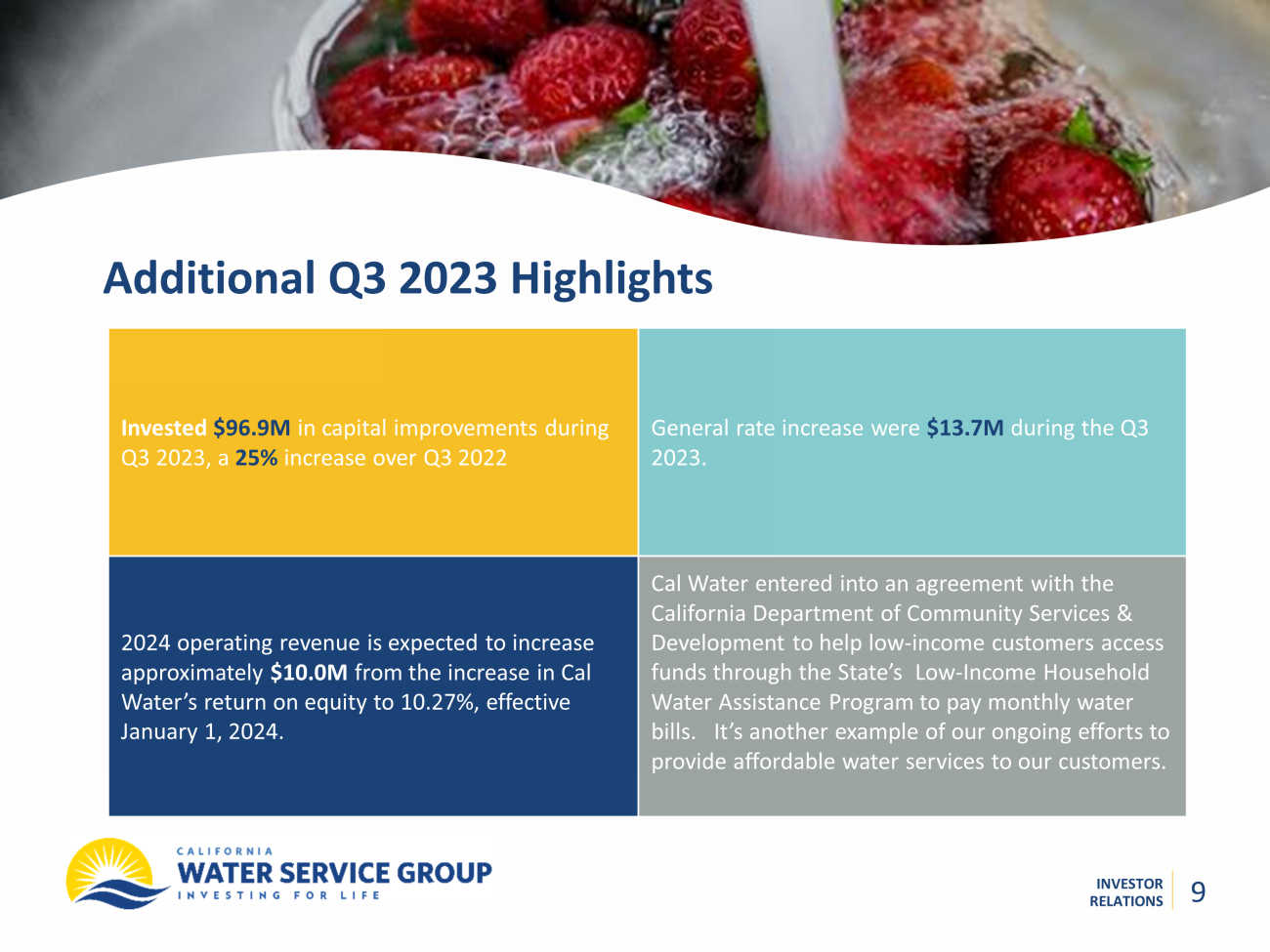

INVESTOR RELATIONS Additional Q3 2023 Highlights 9 9 Invested $96.9M in capital improvements during Q3 2023, a 25% increase over Q3 2022 General rate increase were $13.7M during the Q3 2023. 2024 operating revenue is expected to increase approximately $10.0M from the increase in Cal Water’s return on equity to 10.27%, effective January 1, 2024. Cal Water entered into an agreement with the California Department of Community Services & Development to help low - income customers access funds through the State’s Low - Income Household Water Assistance Program to pay monthly water bills. It’s another example of our ongoing efforts to provide affordable water services to our customers.

INVESTOR RELATIONS EPS Bridge Q3 2022 to Q3 2023 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $0.01 - $0.08 $ 1.03 $0.22 - $0.46 $0.60 - $0. 06 10 $ 1.03 - $0. 06

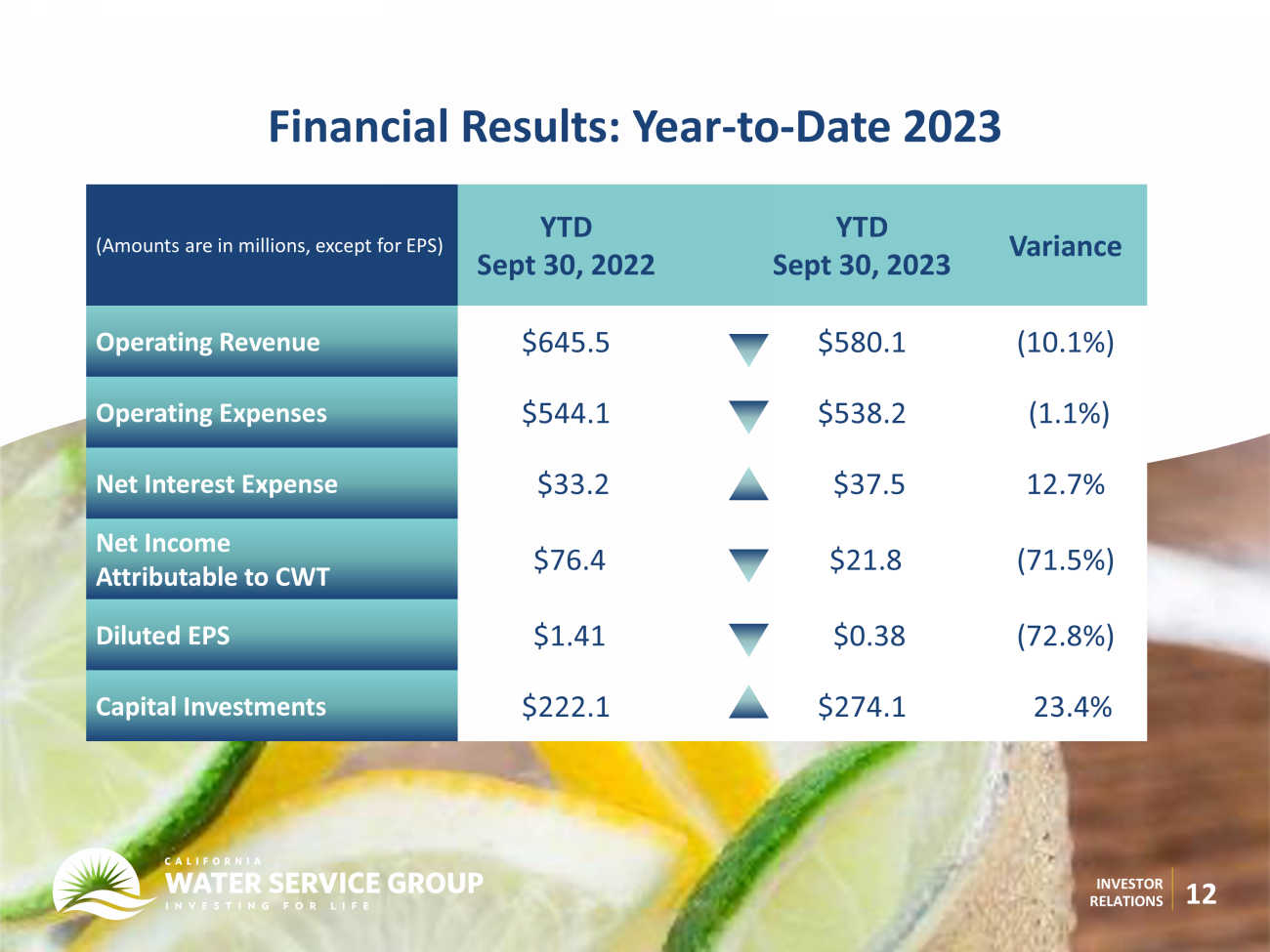

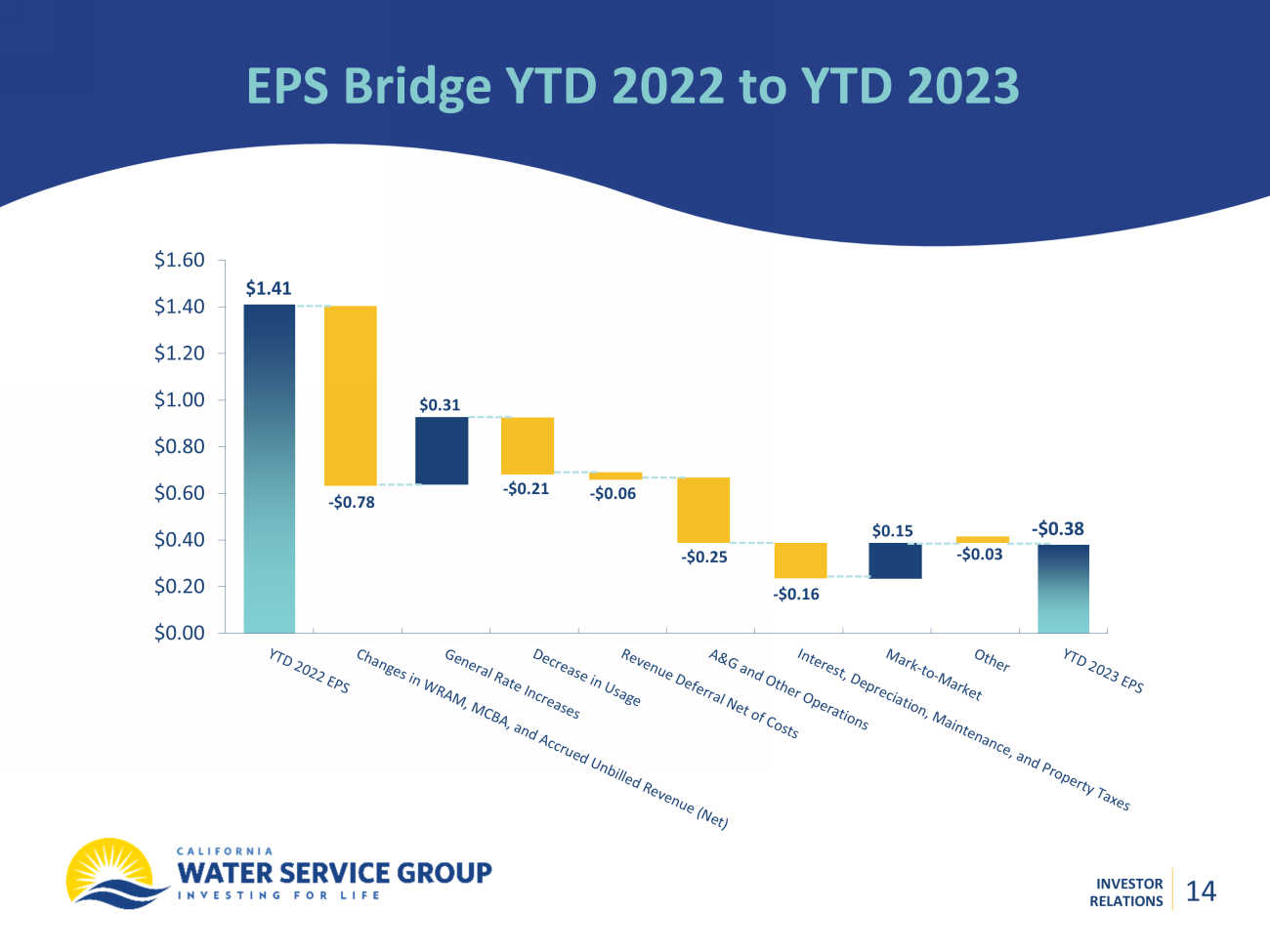

INVESTOR RELATIONS 11 Year - to - Date 2023 Financial Highlights Operating revenue decreased $65.4M • $48.8M decrease in WRAM and MCBA revenue as the mechanism concluded on December 31, 2022. • $20.0M increase in revenue deferral. • $25.3M decrease in billed metered revenue, mostly due to a 5.6% decrease in customer usage. • Partially offset by $18.9M of general rate increases, a $5.7M increase from a change in balancing accounts, and a $2.6M increase from interest on net WRAM and MCBA balances. Total operating expenses decreased $5.9M • $16.4M decrease in costs associated with revenue deferral. • $3.0M decrease in water production costs mostly due to a decrease in customer usage. • Partially offset by labor cost increases of $7.7M , depreciation and amortization increases of $3.2M , and property and other taxes increases of $1.9M .

INVESTOR RELATIONS 12 (Amounts are in millions, except for EPS) YTD Sept 30, 2022 YTD Sept 30, 2023 Variance Operating Revenue $645.5 $580.1 (10.1%) Operating Expenses $544.1 $538.2 (1.1%) Net Interest Expense $33.2 $37.5 12.7% Net In come Attributable to CWT $76.4 $21.8 (71.5%) Diluted EPS $1.41 $0.38 (72.8%) Capital Investments $222.1 $274.1 23.4% Financial Results: Year - to - Date 2023

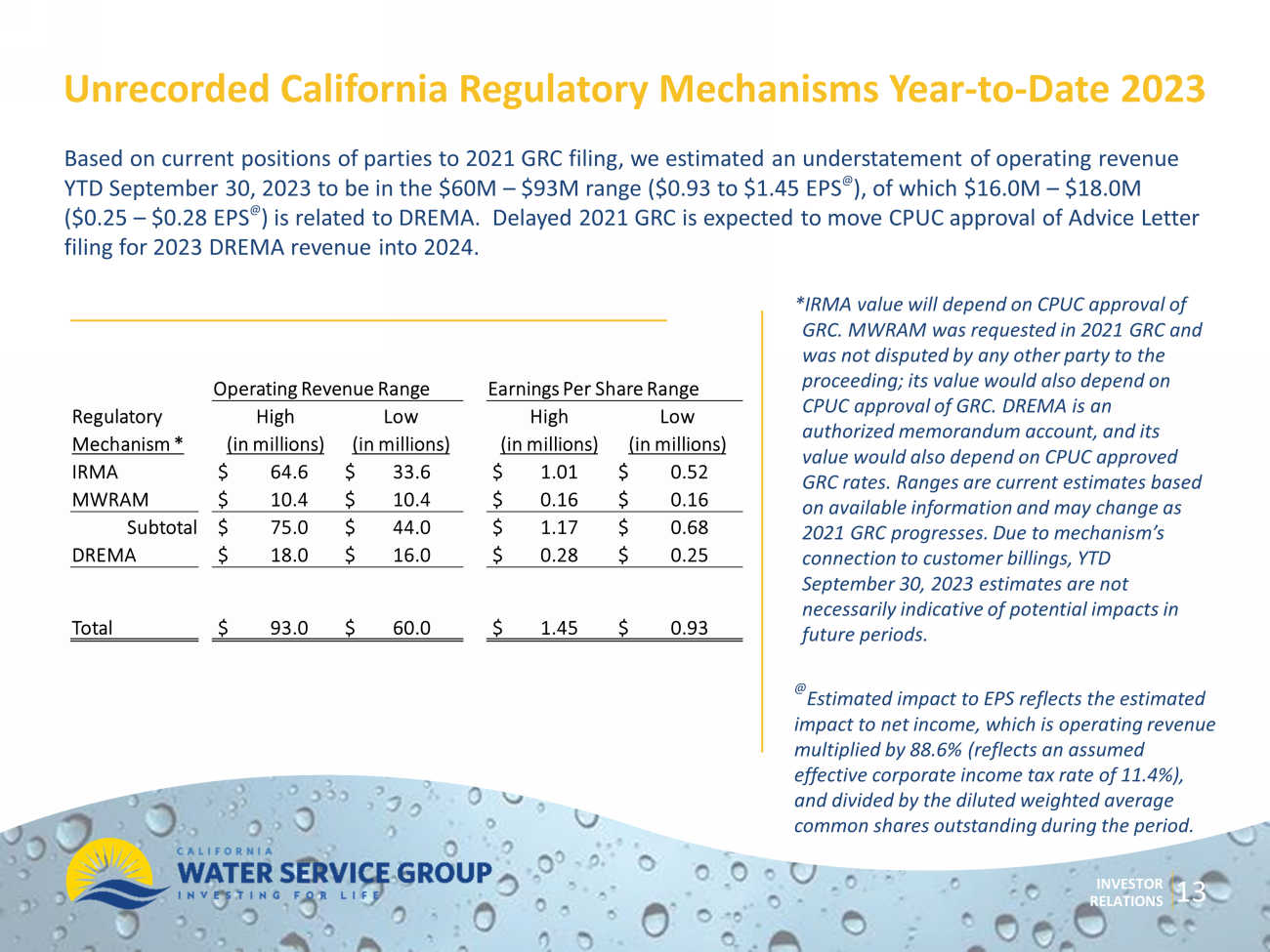

INVESTOR RELATIONS Based on current positions of parties to 2021 GRC filing, we estimated an understatement of operating revenue YTD September 30, 2023 to be in the $60M – $93M range ($0.93 to $1.45 EPS @ ), of which $16.0M – $18.0M ($0.25 – $0.28 EPS @ ) is related to DREMA. Delayed 2021 GRC is expected to move CPUC approval of Advice Letter filing for 2023 DREMA revenue into 2024. Unrecorded California Regulatory M echanisms Year - to - Date 2023 13 *IRMA value will depend on CPUC approval of GRC. MWRAM was requested in 2021 GRC and was not disputed by any other party to the proceeding; its value would also depend on CPUC approval of GRC. DREMA is an authorized memorandum account, and its value would also depend on CPUC approved GRC rates. Ranges are current estimates based on available information and may change as 2021 GRC progresses. Due to mechanism’s connection to customer billings, YTD September 30, 2023 estimates are not necessarily indicative of potential impacts in future periods. @ Estimated impact to EPS reflects the estimated impact to net income, which is operating revenue multiplied by 88.6% (reflects an assumed effective corporate income tax rate of 11.4%), and divided by the diluted weighted average common shares outstanding during the period. Operating Revenue Range Earnings Per Share Range Regulatory High Low High Low Mechanism * (in millions) (in millions) (in millions) (in millions) IRMA $ 64.6 $ 33.6 $ 1.01 $ 0.52 MWRAM $ 10.4 $ 10.4 $ 0.16 $ 0.16 Subtotal $ 75.0 $ 44.0 $ 1.17 $ 0.68 DREMA $ 18.0 $ 16.0 $ 0.28 $ 0.25 Total $ 93.0 $ 60.0 $ 1.45 $ 0.93

INVESTOR RELATIONS EPS Bridge YTD 2022 to YTD 2023 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $0.15 - $0.06 - $0.78 - $0.25 - $0.03 $ 1.41 - $0.21 $0.31 - $0.38 - $0.16 14 14

Additional Year - to - Date 2023 Highlights • Invested $274.1M in capital improvements during first nine months of 2023, 23.4% increase over same period last year. • M aintained $69.0M of cash as of September 30, 2022, of which $34.3M was classified as restricted, and had additional short - term borrowing capacity of $485.0M , subject to meeting the borrowing conditions on the line of credit facilities. • At - the - market (ATM) program increased cash and cash equivalents $112.7M during the first nine months to fund capital expenditures and general corporate purposes; our current ATM program continues through March 31, 2025. • Increased cash and cash equivalents $32.8M from collection of WRAM and MCBA December 31, 2022 receivable balances. • Net other income increased in 2023 as compared to 2022, mostly due a $9.3M unrealized loss on non - qualified benefit plan investments during the first nine months of 2022 as compared to a $0.7M increase in unrealized gains on non - qualified benefit plan investments during the first nine months of 2023. 15 INVESTOR RELATIONS

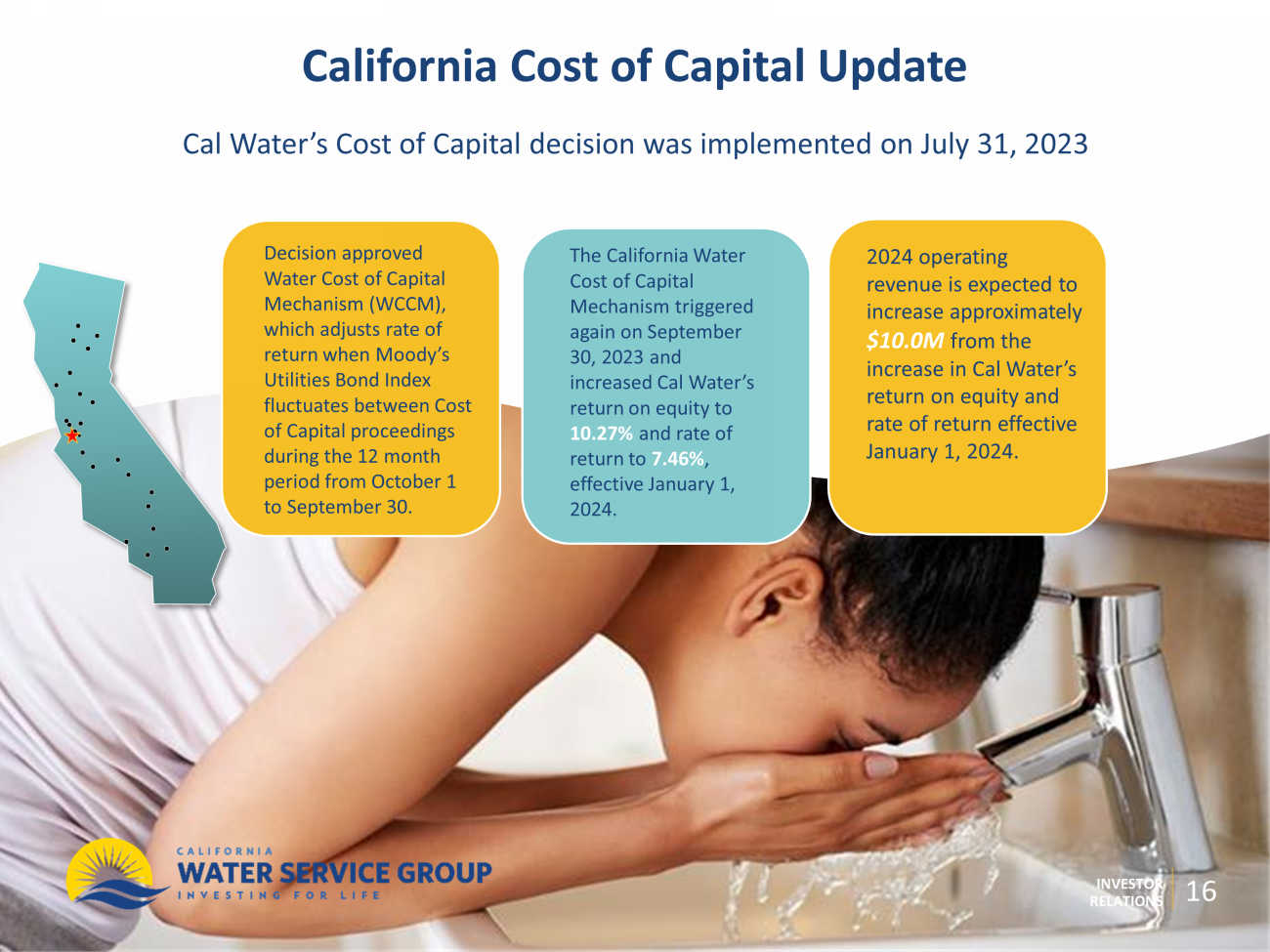

INVESTOR RELATIONS California Cost of Capital Update Decision approved Water Cost of Capital Mechanism (WCCM), which adjusts rate of return when Moody’s Utilities Bond Index fluctuates between Cost of Capital proceedings during the 12 month period from October 1 to September 30. 2024 operating revenue is expected to increase approximately $10.0M from the increase in Cal Water’s return on equity and rate of return effective January 1, 2024. The California Water Cost of Capital Mechanism triggered again on September 30, 2023 and increased Cal Water’s return on equity to 10.27% and rate of return to 7.46% , effective January 1, 2024. Cal Water’s Cost of Capital decision was implemented on July 31, 2023 16

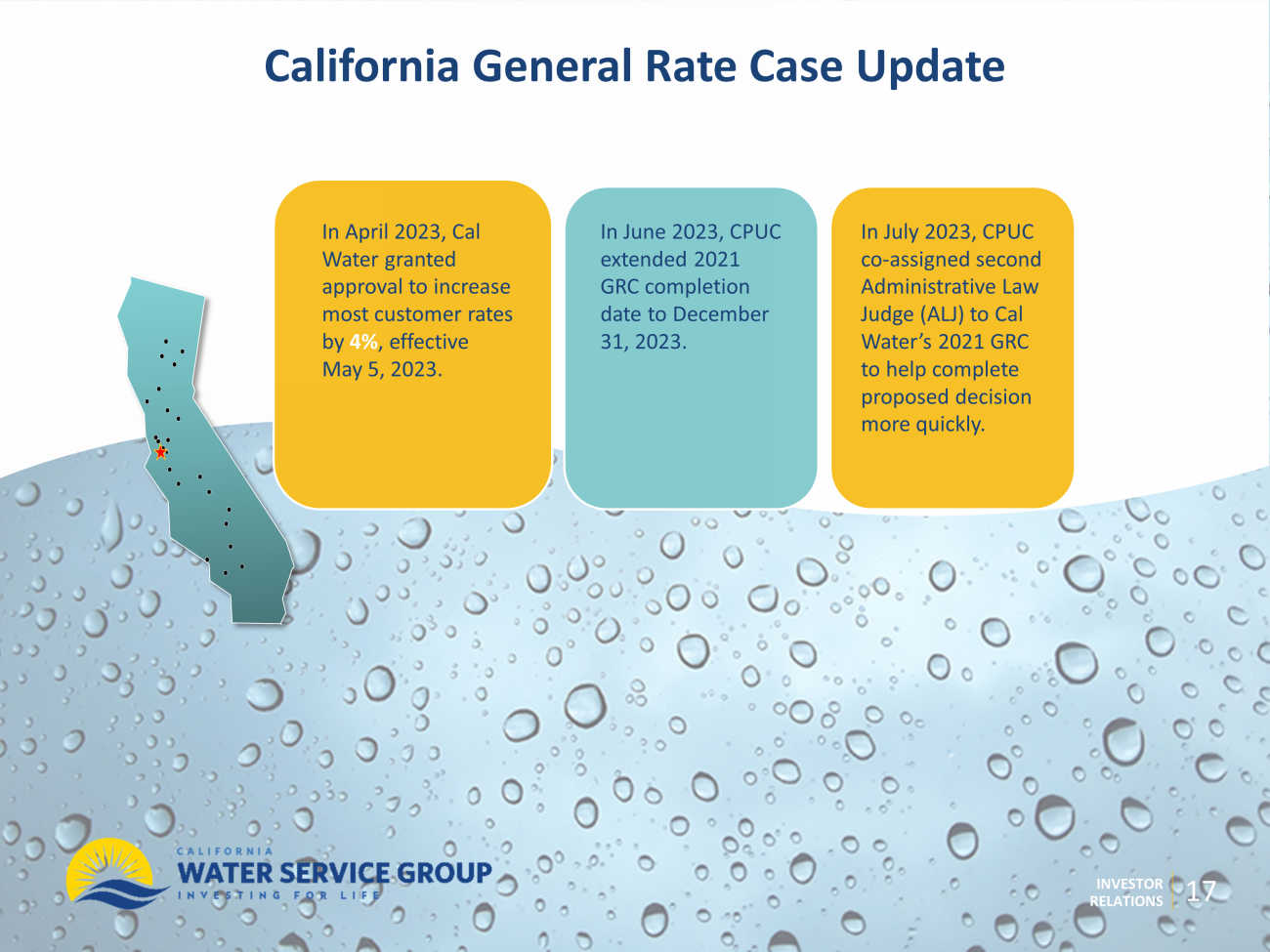

INVESTOR RELATIONS California General Rate Case Update In April 2023, Cal Water granted approval to increase most customer rates by 4% , effective May 5, 2023. In July 2023, CPUC co - assigned second Administrative Law Judge (ALJ) to Cal Water’s 2021 GRC to help complete proposed decision more quickly. In June 2023, CPUC extended 2021 GRC completion date to December 31, 2023. 17

Other Regulatory Update Other GRC’s In July 2023, the Washington Utilities and Transportation Commission approved an annual revenue increase of $2.1M , effective July 28, 2023. Drought Cost Recovery In July 2023, Cal Water requested recovery of $1.4M of drought expenses incurred in districts for the period from June 14, 2021 to December 31, 2022. 18 California Financing Application In October 2023, Cal Water filed a financing application with the CPUC to issue up to $1.3 Billion of new equity and debt securities to finance water infrastructure investments during the next three years.

INVESTOR RELATIONS 19 PFAS Regulation Update • In March, U.S. Environmental Protection Agency published draft Maximum Contaminant Levels (MCLs) for PFAS compounds. • Based on current information, if regulation is adopted in current form, we estimate capital investments of approximately $200M needed to comply. o Draft regulation, if unchanged, would require compliance by 2026 . While our regulators have strong track record of allowing recovery for water treatment investments, there are also other potential sources of funds that could offset some or all investment over time. Cal Water filed an application to include infrastructure investments as well as operating expenses in its’ existing memorandum account.

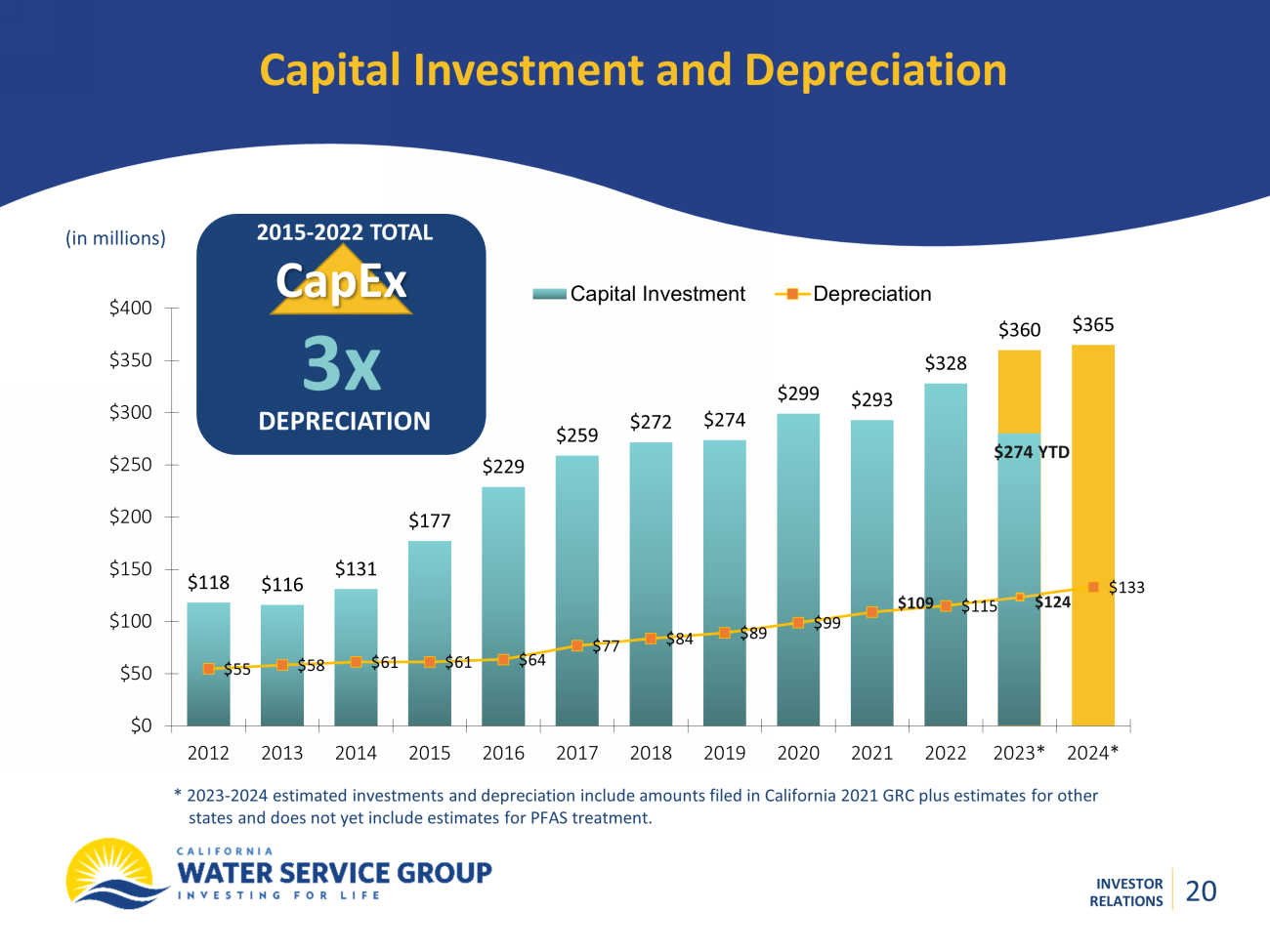

INVESTOR RELATIONS $118 $116 $131 $177 $229 $259 $272 $274 $299 $293 $328 $360 $365 $55 $58 $61 $61 $64 $77 $84 $89 $99 $115 $133 $0 $50 $100 $150 $200 $250 $300 $350 $400 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023* 2024* Capital Investment Depreciation Capital Investment and Depreciation (in millions) * 2023 - 2024 estimated investments and depreciation include amounts filed in California 2021 GRC plus estimates for other states and does not yet include estimates for PFAS treatment. 2015 - 2022 TOTAL CapEx 3x DEPRECIATION $109 20 $274 YTD $124 20

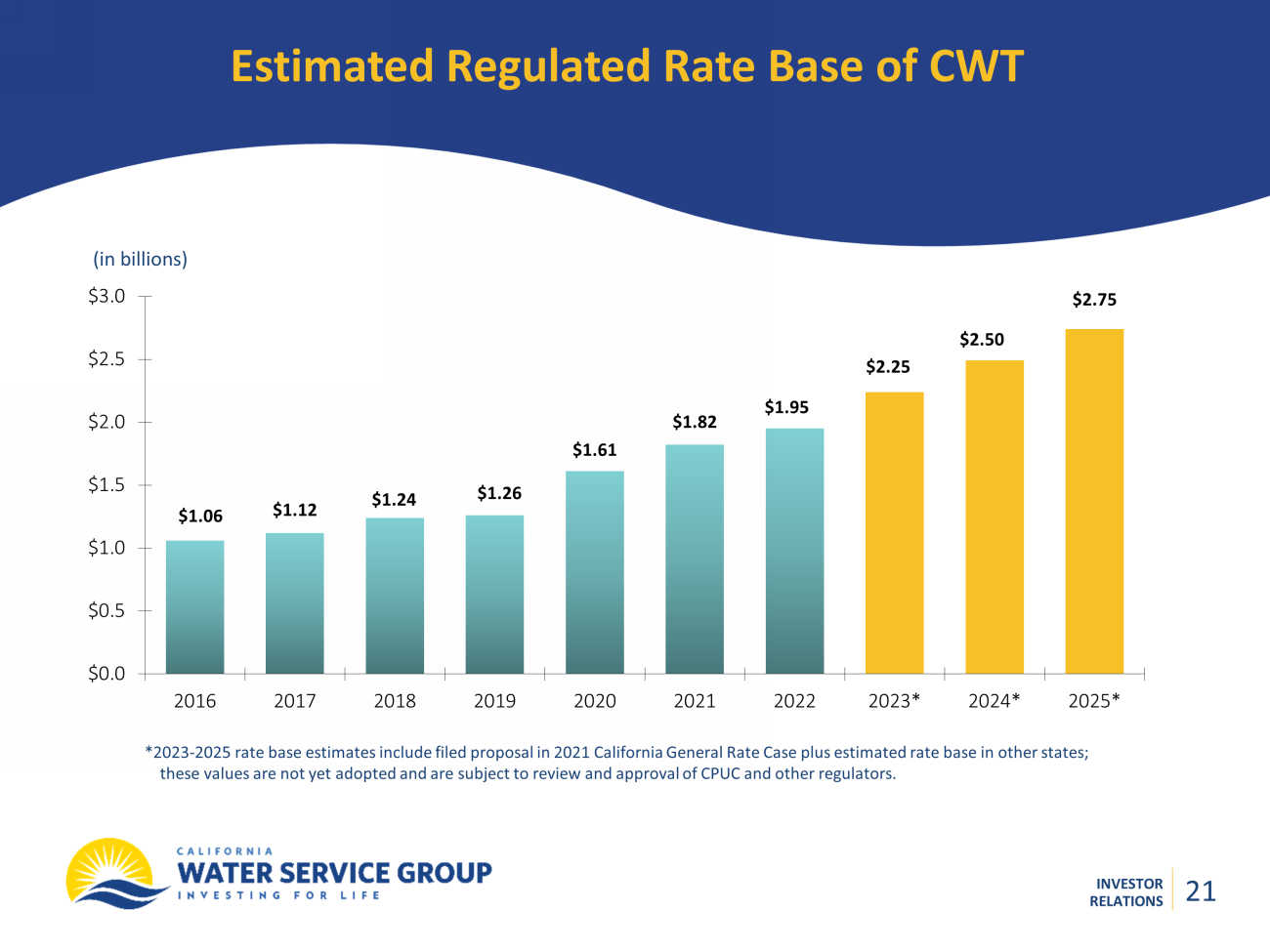

INVESTOR RELATIONS Estimated Regulated Rate Base of CWT (in billions) *2023 - 2025 rate base estimates include filed proposal in 2021 California General Rate Case plus estimated rate base in other sta tes; these values are not yet adopted and are subject to review and approval of CPUC and other regulators. $1.06 $1.12 $1.24 $1.61 $2.75 $1.26 $1.82 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2016 2017 2018 2019 2020 2021 2022 2023* 2024* 2025* $1.95 $2.25 $2.50 21 21

INVESTOR RELATIONS In Summary 22 • Results in line given delayed 2021 GRC. • Revenue shortfall in 2023 due to temporary absence of regulatory mechanisms; we anticipate potential future recognition of these mechanisms would result in additional revenue when the CPUC approves the 2021 GRC. • While we wait for regulatory decision in California, we continue to execute our business, capital, and operational plans.

DISCUSSION