EXHIBIT 99.2

Published on February 27, 2025

Exhibit 99.2

Fourth Quarter and Full Year 2024 Earnings Presentation February 27, 2025

2 Today’s Speakers Marty Kropelnicki Chairman & CEO James Lynch Sr. Vice President, CFO & Treasurer Greg Milleman Vice President, Rates & Regulatory Affairs

3 This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Reform Act of 1995 (PSLRA) . The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatment established by the PSLRA . Forward - looking statements in this presentation are based on currently available information, expectations, estimates, assumptions and projections, and our management's beliefs, assumptions, judgments and expectations about us, the water utility industry and general economic conditions . These statements are not statements of historical fact . When used in our documents, statements that are not historical in nature, including words like will, would, expects, intends, plans, believes, may, could, estimates, assumes, anticipates, projects, progress, predicts, hopes, targets, forecasts, should, seeks, commits, on schedule, indicative or variations of these words or similar expressions are intended to identify forward - looking statements . Examples of forward - looking statements in this presentation include, but are not limited to, statements describing our expectations regarding potential increases in revenue, dividends, capital investments or expenditures, depreciation, regulated rate base growth, sufficiency of cash to support capital investment and growth and authorized cost of capital and potential adjustments to the same, our plans and proposals pursuant to and timing of the 2024 California General Rate Case and our plans or strategy regarding capital allocation, balance sheet management and the year ahead . Forward - looking statements are not guarantees of future performance . They are based on numerous assumptions that we believe are reasonable but are subject to uncertainty and risks . Actual results may vary materially from what is contained in a forward - looking statement . Factors that may cause actual results to be different than those expected or anticipated include, but are not limited to : our ability to integrate business acquisitions and operate them in an effective and accretive manner ; governmental and regulatory commissions' decisions ; consequences of eminent domain actions relating to our water systems ; changes in regulatory commissions' policies and procedures ; the outcome and timeliness of regulatory commissions' actions concerning rate relief and other actions ; changes in water quality standards ; changes in environmental compliance and water quality requirements ; electric power interruptions ; the impact of opposition to rate increases ; our ability to recover costs ; availability of water supplies ; issues with the implementation, maintenance or security of our information technology systems ; civil disturbances or terrorist threats or acts ; the adequacy of our efforts to mitigate physical and cyber security risks and threats ; the ability of our enterprise risk management processes to identify or address risks adequately ; changes in customer water use patterns and the effects of conservation ; the impact of weather, climate change, natural disasters, and actual or threatened public health emergencies ; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends ; the impact of market conditions and volatility on unrealized gains or losses on our operating results ; risks associated with expanding our business and operations geographically ; and other risks and unforeseen events described in our Annual Report on Form 10 - K and other reports filed from time to time with the SEC . In light of these risks, uncertainties and assumptions, investors are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date of this presentation . We are not under any obligation, and we expressly disclaim any obligation to update or alter any forward - looking statements, whether as a result of new information, future events or otherwise . Nothing in this presentation constitutes an offer to sell, or a solicitation of an offer to buy, any securities or should be treated or relied upon as a recommendation or advice . A credit rating is not a recommendation to buy, sell or hold any securities, may be changed at any time by the applicable ratings agency and should be evaluated independently of any other information . Forward - Looking Statements and Other Important Information

4 Recent Highlights Strong 2024 results with and without the 2023 interim rate relief impacts from 2021 General Rate Case (GRC) decision Invested record level of capital investments totaling $471 million Ongoing and proactive emergency preparedness and response; not impacted by 2025 LA wildfires 1 2 3 4 Authorization from the CPUC granting a one - year extension in our Cost of Capital Application to May 1, 2026 Progress on the 2024 California GRC filing; Remains on schedule 5

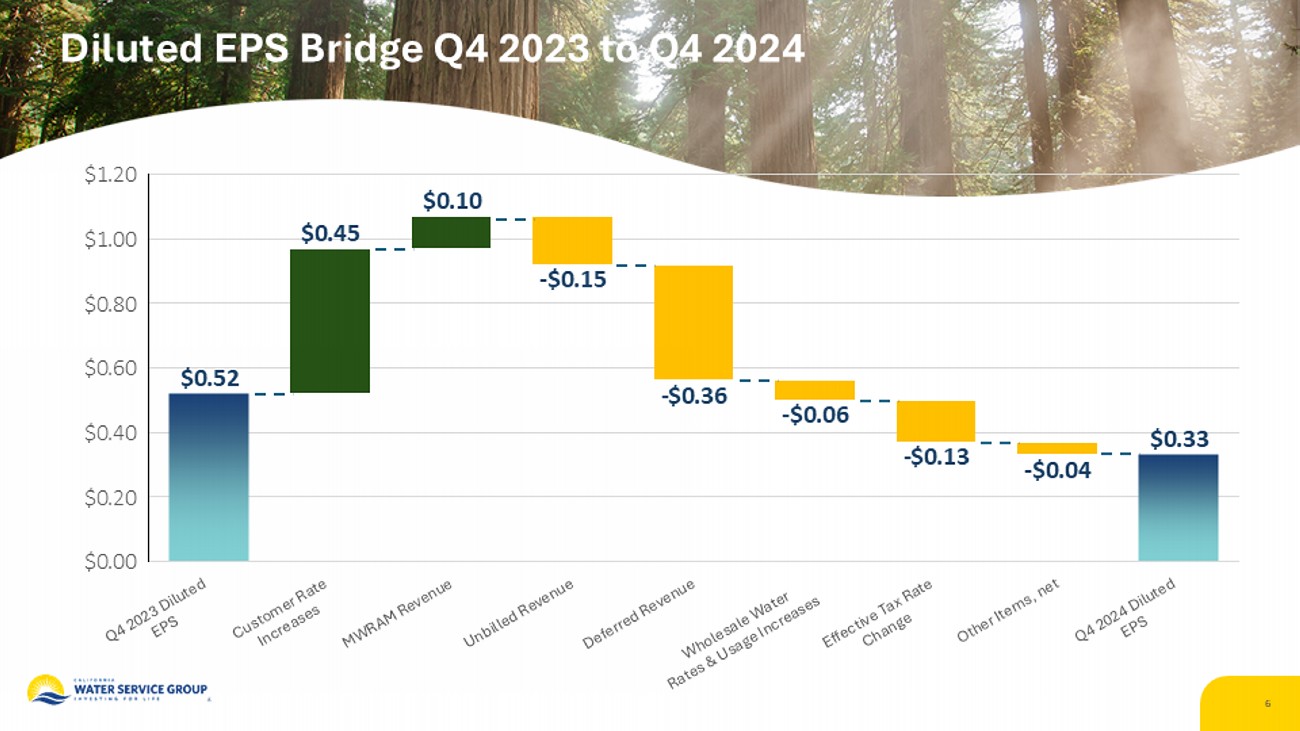

5 Fourth Quarter 2024 Financials % Change $ Variance Q4 2023 Q4 2024 (in millions except EPS amounts and percentages) 3.6% $7.7 $214.5 $222.2 Operating Revenue 5.9% $10.6 $179.3 $189.9 Operating Expenses 20.6% $2.6 $12.3 $14.9 Net Interest Expense 34.7% $10.5 $30.1 $19.7 Net Income Attributable to CWT 36.5% $0.19 $0.52 $0.33 Diluted Earnings per Share Note: Due to adoption of the 2021 CA GRC, Q1 2024 revenue and net income included interim rate relief totaling $87.5M and $64 .0M , respectively, attributable to 2023. This included $20.2M revenue and $13.6M net income, respectively, attributable to Q4 2023.

$0.52 $0.45 $0.10 - $0.15 - $0.36 - $0.06 - $0.13 - $0.04 $0.33 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 Diluted EPS Bridge Q4 2023 to Q4 2024 6

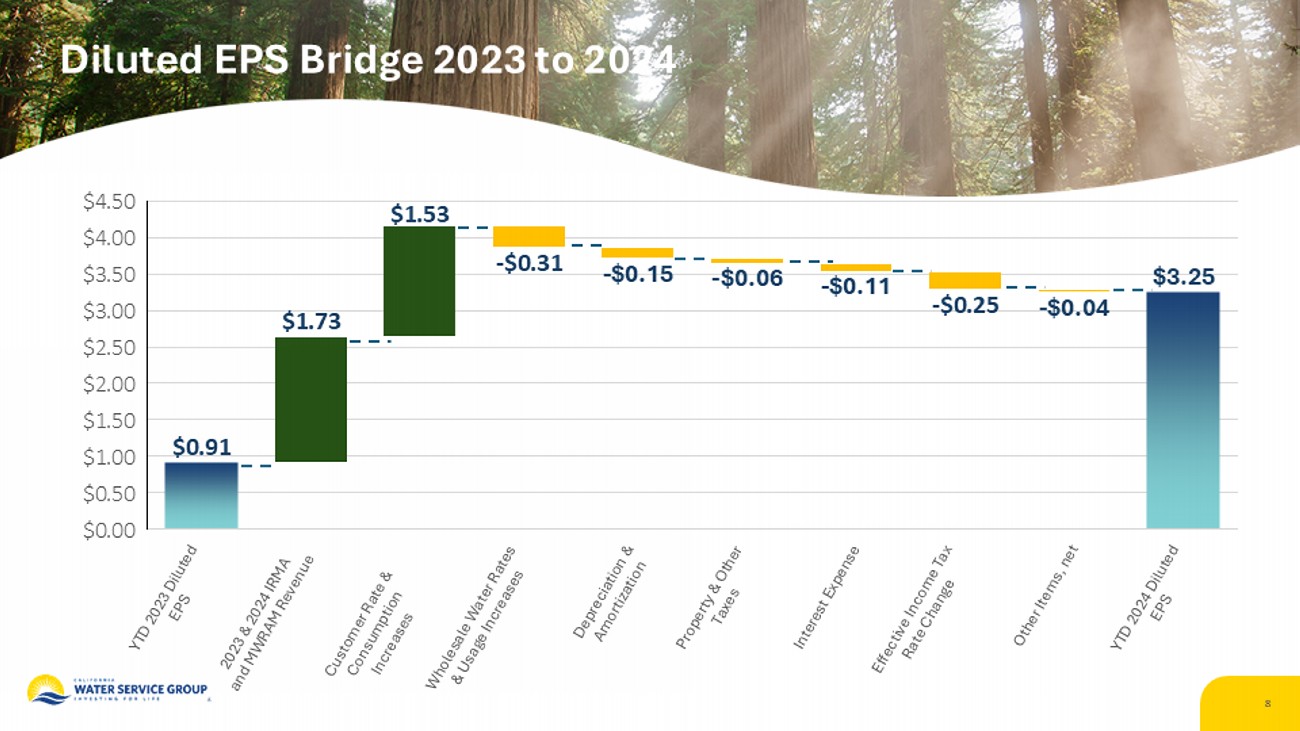

7 Full Year 2024 Financials % Change $ Variance 2023 2024 (in millions except EPS amounts and percentages) 30.5% $242.2 $794.6 $1,036.8 Operating Revenue 13.1% $94.3 $717.5 $811.8 Operating Expenses 15.5% $7.7 $49.8 $57.6 Net Interest Expense 267.6% $138.9 $51.9 $190.8 Net Income Attributable to CWT 257.1% $2.34 $0.91 $3.25 Diluted Earnings per Share Note: Due to adoption of the 2021 CA GRC, Q1 2024 revenue and net income included interim rate relief totaling $87.5M and $64 .0M , respectively , attributable to 2023.

$0.91 $1.73 $1.53 - $0.31 - $0.15 - $0.06 - $0.11 - $0.25 - $0.04 $3.25 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 Diluted EPS Bridge 2023 to 2024 8

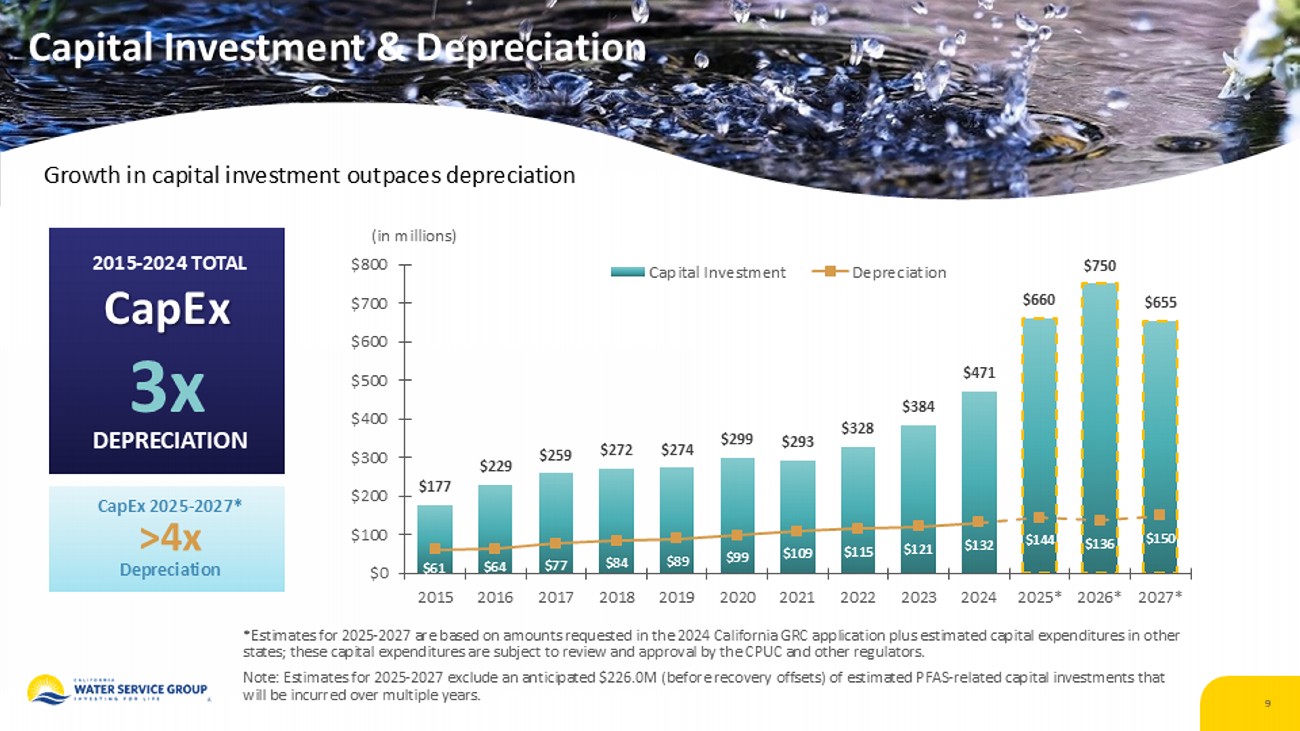

9 Growth in capital investment outpaces depreciation (in millions) 2015 - 2024 TOTAL CapEx 3x DEPRECIATION *Estimates for 2025 - 2027 are based on amounts requested in the 2024 California GRC application plus estimated capital expenditur es in other states; these capital expenditures are subject to review and approval by the CPUC and other regulators. Note: Estimates for 2025 - 2027 exclude an anticipated $226.0M (before recovery offsets) of estimated PFAS - related capital investm ents that will be incurred over multiple years. $177 $229 $259 $272 $274 $299 $293 $328 $384 $471 $660 $750 $655 $61 $64 $77 $84 $89 $99 $109 $115 $121 $132 $144 $136 $150 $0 $100 $200 $300 $400 $500 $600 $700 $800 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025* 2026* 2027* Capital Investment Depreciation Capital Investment & Depreciation CapEx 2025 - 2027* > 4x Depreciation

10 Estimated to achieve over $3.3 billion by 2027 *2025 - 2027 rate base estimates include amounts requested in the 2024 California GRC plus estimated rate base in other states; th ese values are not yet adopted and are subject to review and approval by the CPUC and other regulators. Note: Amounts presented for 2025 - 2027 exclude an anticipated $226.0M (before recovery offsets) in PFAS treatment capital investm ents that will be incurred over multiple years. Regulated Rate Base Growth $1.24 $1.26 $1.61 $1.87 $2.01 $2.20 $2.34 $2.58 $2.93 $3.35 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 2018 2019 2020 2021 2022 2023 2024 2025* 2026* 2027* (in billions)

Capital Allocation | Balance Sheet Continue to maintain financial discipline with strong balance sheet, while allocating capital in efficient manner Group announced an $0.08 increase in annual dividend; declared 320 th consecutive quarterly dividend of $0.30 per share and a one - time special dividend of $0.04 per share Group maintained at - the - market stock issuance program; used opportunistically to raise $ 86.5M during 2024 to support capital growth and business investments CPUC approved postponement of Cal Water Cost of Capital application to May 2026; authorized capital structure of 53.4% equity and 46.6% debt supports future growth Cal Water received authorization from the CPUC in August 2024 to issue up to $1.3 billion in future debt and equity securities Statistics as of December 31, 2024 11

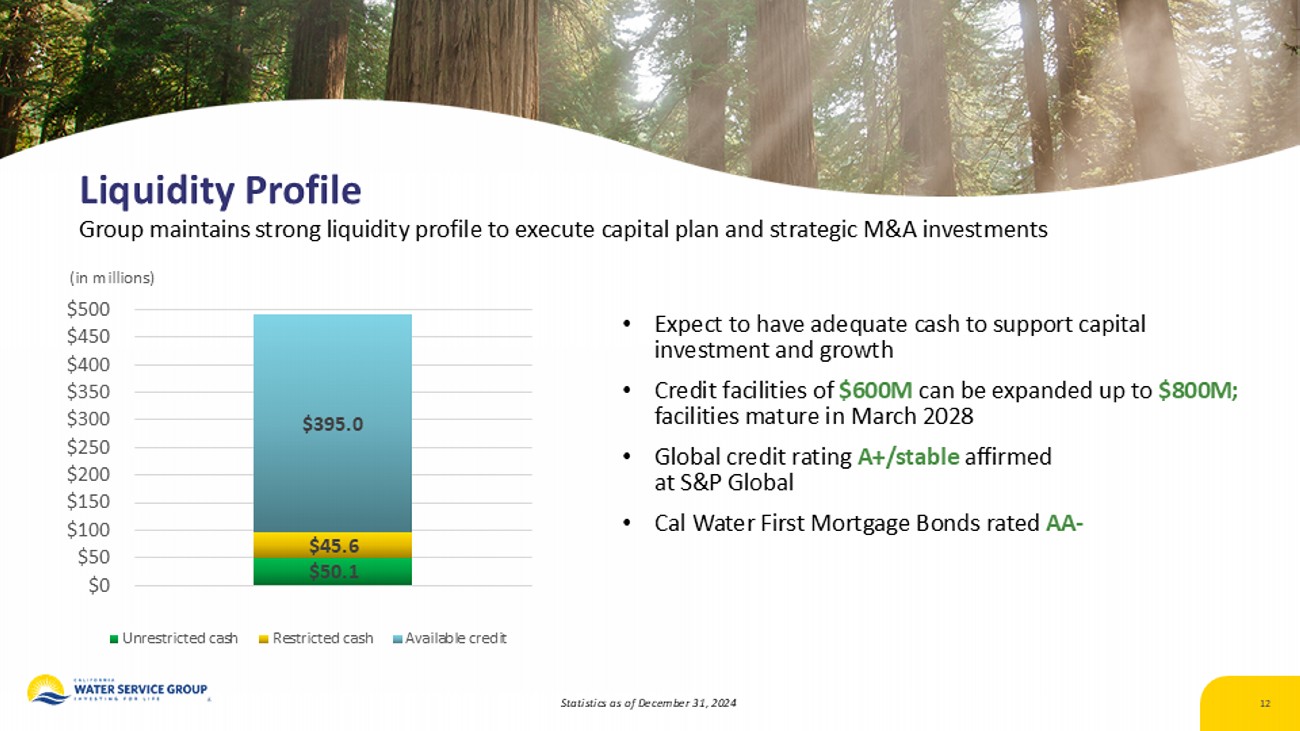

Liquidity Profile Group maintains strong liquidity profile to execute capital plan and strategic M&A investments • Expect to have adequate cash to support capital investment and growth • Credit facilities of $600M can be expanded up to $800M; facilities mature in March 2028 • Global credit rating A+/stable affirmed at S&P Global • Cal Water First Mortgage Bonds rated AA - Statistics as of December 31, 2024 12 (in millions) $50.1 $45.6 $395.0 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Unrestricted cash Restricted cash Available credit

13 Dividend Program Strong history of returning cash to shareholders 320 th $0.30 Consecutive Quarterly Dividend in Amount of 58 th $1.20 Annual Increase Expected to Yield Annual Dividend of $0.04 $1.24 One - Time Special Dividend Brings Anticipated Dividend to 10.71% Annual Increase (Reflects One - Time Special Dividend) 7.7% Five - Year Dividend CAGR $0.92 $1.00 $1.04 $1.12 $1.24 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 2021 2022 2023 2024 2025* *Anticipated annual dividend includes one - time special dividend

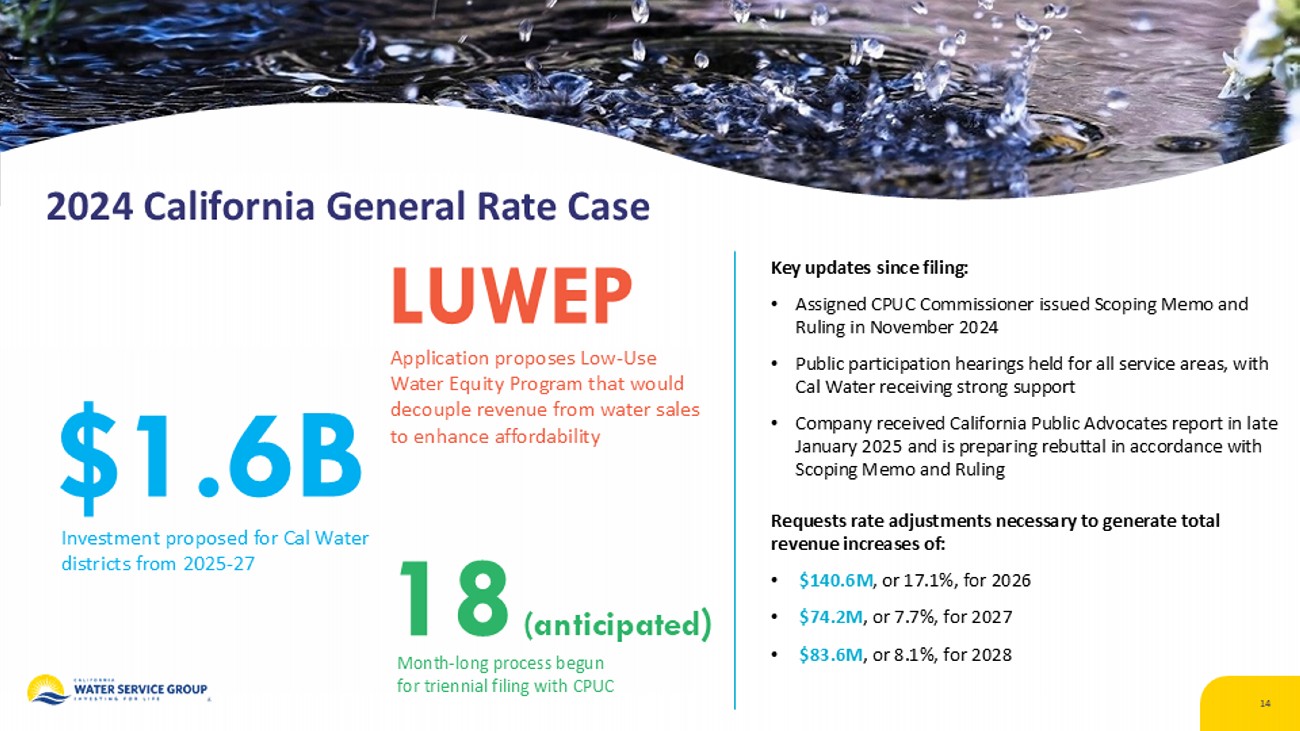

14 2024 California General Rate Case Key updates since filing : • Assigned CPUC Commissioner issued Scoping Memo and Ruling in November 2024 • Public participation hearings held for all service areas, with Cal Water receiving strong support • Company received California Public Advocates report in late January 2025 and is preparing rebuttal in accordance with Scoping Memo and Ruling Investment proposed for Cal Water districts from 2025 - 27 $1.6B Application proposes Low - Use Water Equity Program that would decouple revenue from water sales to enhance affordability LUWEP Month - long process begun for triennial filing with CPUC 18 (anticipated ) Requests rate adjustments necessary to generate total revenue increases of: • $140.6M , or 17.1%, for 2026 • $74.2M , or 7.7%, for 2027 • $83.6M , or 8.1%, for 2028

Cost of Capital & Other Regulatory Updates 15 • CPUC granted Cal Water request to postpone Cost of Capital Application to May 1 , 2026 , effectively maintaining Cal Water’s current capital structure through Dec . 31 , 2026 , including 10 . 27 % return on equity • The CPUC also reauthorized the Water Cost of Capital Mechanism (WCCM) . The WCCM automatically adjusts the rate of return when the Moody's Utilities Bond Index fluctuates between Cost of Capital applications • The ROE will remain 10 . 27 % through Dec . 31 , 2026 , unless the WCCM is triggered when next measured on Sept . 30 , 2025 . If a change in the ROE is required, it would become effective on Jan . 1 , 2026 Cost of Capital Other States • Group has initiated a more proactive approach in pursuing rate adjustments in other states • This will enable us to recover on our capital investments in a more timely manner • This approach should benefit customers by providing for smaller, incremental adjustments rather than large increases on a less frequent basis

Emergency Preparedness & Response Leadership 16 Dedicated Training Regular Community Emergency Operations Response training across service areas, including notable Hawaii Water drills (July 2024) with multi - agency participation Investment in Safety Nearly $1M of stockholder funds contributed over last five years to support local fire agencies across service areas; including $175,000 in 2024 Proactive Wildfire Mitigation Comprehensive approach including vegetation management, infrastructure upgrades, crew positioning, and backup power systems Community Support $100,000 contributed to multiple organizations to support Southern California wildfire relief efforts

The Year Ahead 17 Continue to progress 2024 California GRC and work toward a timely resolution Stay keenly focused on expense management as Cal Water enters the third year of the 2021 GRC Refresh S - 3 filing in support of renewing At - The - Market (ATM) program; expected to be completed in first half of 2025 Continue to execute our capital investment plan, which includes projects designed to protect our assets from natural disaster impacts Evaluate strategic growth areas including through targeted domestic M&A Provide our customers with best - in - class service and support

Conclusion